Temple Digital Group launches a private institutional trading platform built on the Canton Network to provide 24/7 continuous trading of digital assets using a central limit order book and non-custodial market structure.

According to an announcement shared with Cointelegraph on Thursday, the platform supports trading in cryptocurrencies and stablecoins and is designed to allow institutions to trade with approved counterparties while maintaining privacy and regulatory oversight, with participants retaining control of their assets rather than relying on a central intermediary.

The system is built around a price-time-first centralized limit order book with sub-second matching, and includes execution monitoring and transaction cost analysis tools for institutional trading desks, the company said.

The platform is live onboarding institutional users, including asset managers, market makers, and financial institutions, with support for tokenized stocks and products expected in 2026.

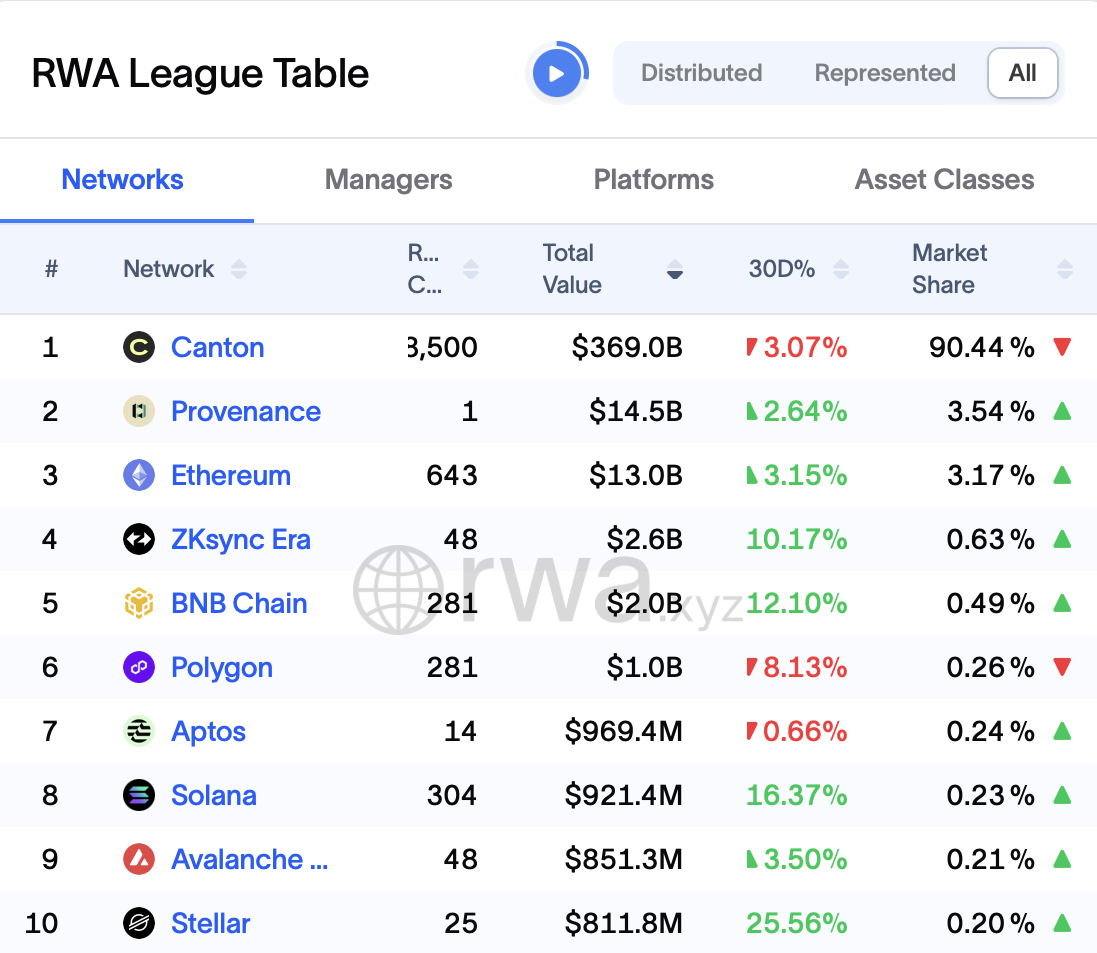

Top blockchains for tokenized real-world assets. sauce: RWA.xyz

Temple Digital Group is a New York-based digital asset infrastructure company that builds non-custodial trading infrastructure for institutional digital asset markets.

Canton Network is a permissioned blockchain created by Digital Asset that allows regulated institutions to trade and settle tokenized assets on-chain.

Related:Digital Asset raises new funding to expand deployment of Canton Network

Introduction of institutions in canton network accelerates

Canton Network gained institutional attention in late 2025 as companies announced new developments including tokenized funds, collateral, and funding infrastructure.

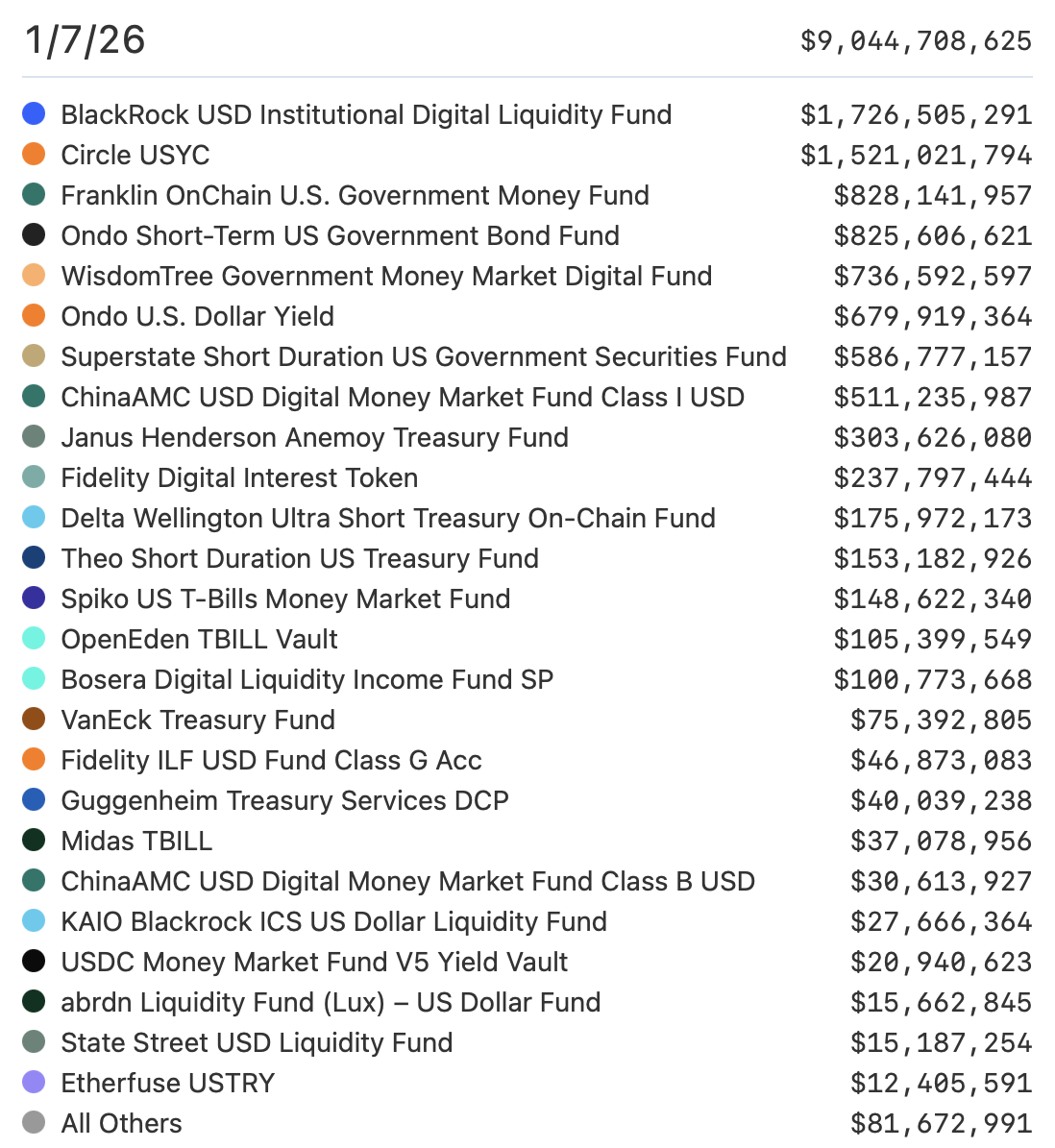

In December, Franklin Templeton expanded Benji's tokenization platform to Canton, allowing tokenized U.S. government money market funds to be used as collateral within Canton's institutional ecosystem. The fund had $828 million in assets at press time, according to industry data.

Tokenized US Treasury funds. sauce: RWA.xyz

On December 9th, Canton Network founder Digital Asset and a group of leading financial institutions completed the second round of on-chain US Treasury financing for Canton. The trial demonstrated that tokenized U.S. Treasuries can be reused as collateral in real-time, highlighting how blockchain-based infrastructure can reduce friction in traditional collateral and lending markets.

About a week later, the Depository Trust and Clearing Corporation (DTCC) announced plans to mint a portion of U.S. Treasury securities on the Canton Network and extend blockchain-based payments to its market infrastructure, which will process $37 trillion in transactions in 2024.

On Wednesday, Digital Asset and Kinexys by JPMorgan announced plans to bring JPMorgan's USD deposit token, JPM Coin, natively to the network.

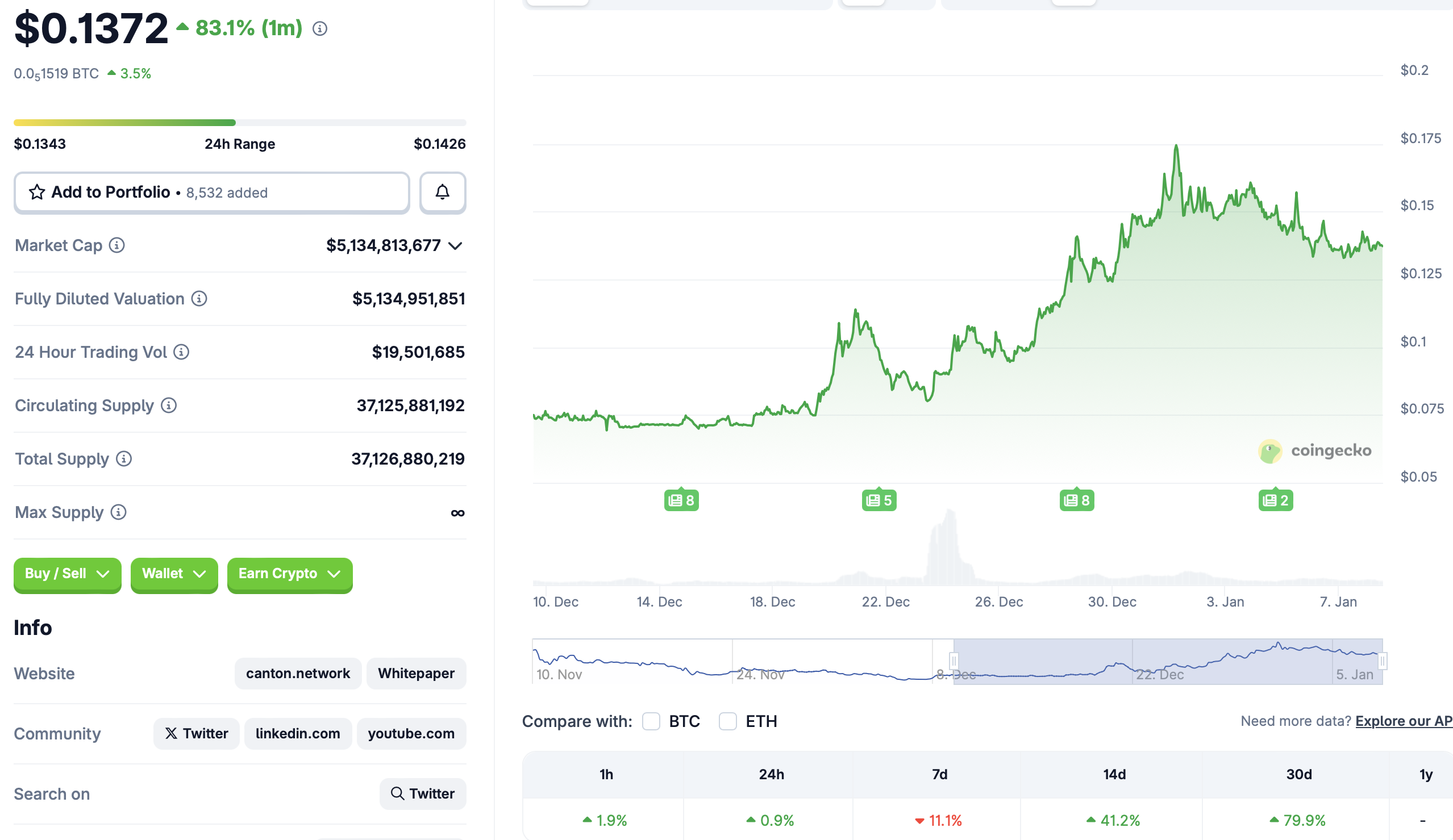

Canton Coin (CC) has been skyrocketing recently. According to CoinGecko data at the time of writing, it is up more than 40% in the past two weeks and more than 80% in the last month.

sauce: CoinGecko

magazine: Davinci Jeremie bought Bitcoin for $1…but wasn't excited about $100,000 BTC