CME crypto products reached their peak in the fourth quarter, the exchange operator announced. This shift was driven by $ETH Both futures and new $SOL and $XRP market.

In the fourth quarter, CME experienced record activity for its crypto products, including peak engagement, trading volume, and open interest. Due to peak activity, CME has decided to offer the following services: 24 hours a day, 365 days a year It trades in the cryptocurrency market by imitating native trading.

CME completed 9 years of activity $BTC It has been one of the leading indicators of the potential direction of futures trading over the past year. $BTC. During that time, both CME and the crypto-native market have matured.

Building on its strong performance in 2025, CME has announced further products in its pipeline, including ADA, LINK and XLM contracts that will be available starting February 9th. Altcoin products are currently under regulatory review.

The market also Under preparation Created the Nasdaq CME Crypto Index and is expected to launch by the end of 2025.

CME doubled its daily trading volume

In 2025, cryptocurrency activity at CME continued to grow. The exchange inherited $3 trillion in notional futures and options trading. Over the past 12 months, average daily trading volume has more than doubled to 280,000 contracts, and average daily open interest has expanded to 313,000 contracts, or $26 billion.

Trading momentum accelerated in the fourth quarter, with open interest doubling compared to Q4 2024. The CME market's participant base is expanding, with a record high of 1,039 large open interest holders as of October 21, 2025. The exchange has seen an increase in its participant base, along with mainstream activities such as ETF trading.

$ETH Momentum drives futures trading peak

$ETH is one of the most widely traded assets and saw a spike in activity in September and October as the token remained in a relatively high range.

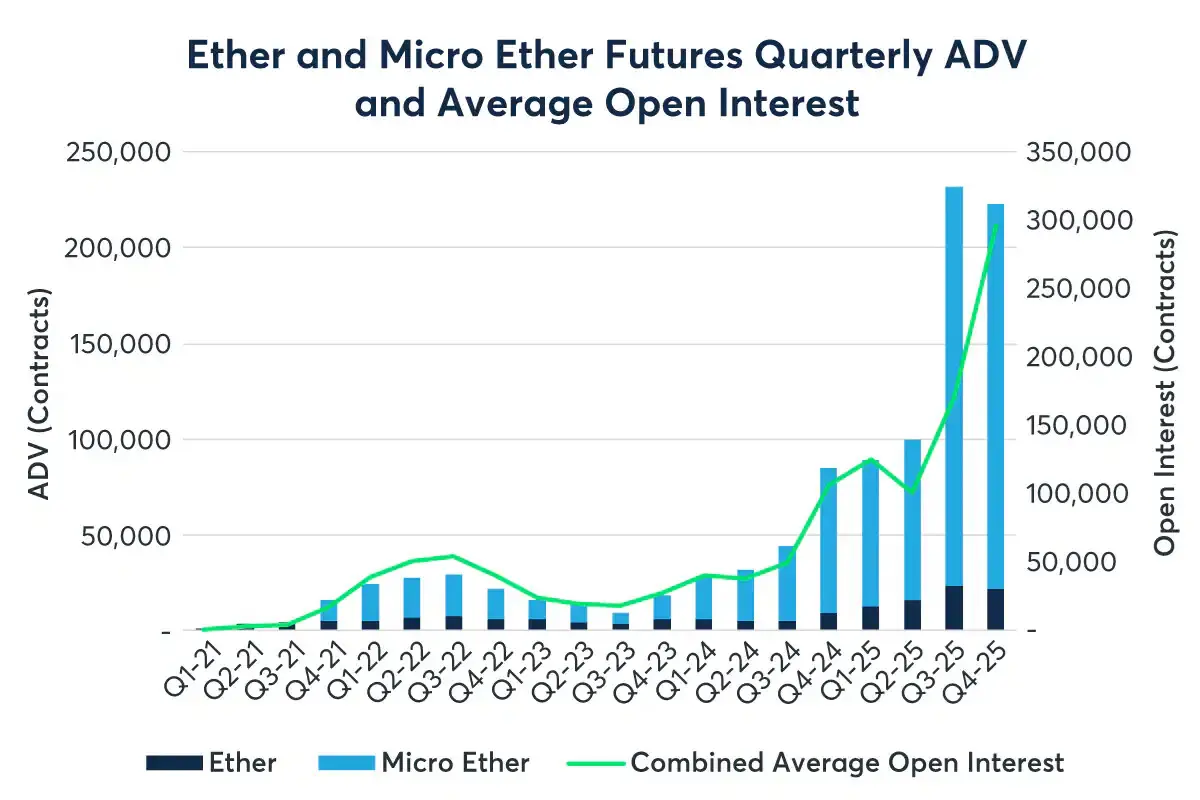

According to CME, $ETH Trading accelerated in the fourth quarter, strengthening its position as attractive to institutional investors. total open interest $ETH and MicroEther (MET) futures hit a record of 545,000 units traded on November 28th.

$ETH Futures peaked in the fourth quarter, driven by institutional demand. |Source: CME Group

Ether options took over, reaching peak open interest of 7,240 contracts on November 26th. $ETH appealed to institutions not only about Ethereum's role in decentralized finance, but also about the possibility of a recovery to a higher range.

The rest of the growth is with Solana. $XRP. Market demand for regulated exposure strengthens $SOL and $XRP product.

$SOL Futures contracts have traded $37.7 billion since inception, with peak open interest on October 29th at $2.25 billion. $XRP Open interest peaked at $1.5 billion on October 28th. In the fourth quarter, CME also launched options. $SOL and $XRP This option provided market participants with a new layer of capital efficiency.

Trading peaked in December. $BTC, $XRPand $SOL. spot indicative futures $BTC It also reached record trading volumes in the last few weeks of 2025.