Crypto asset management firm Bitwise is backing down on expectations that Ethereum’s Fusaka upgrade will significantly boost network revenues, according to the company’s new research report released on January 28th. The findings are below a previous bullish forecast from Bitwise's own chief investment officer Matt Hogan.

In November, Hogan wrote in the However, new data released by Bitwise tells a less bullish story.

positive impact

Fusaka went live in December and added a minimum fee to “blob” data, the cheap data that layer 2 uses to post transactions back to mainnet. Although BLOB was intended to reduce costs, prices often fluctuated from near zero to sudden spikes. This upgrade puts a floor on these rates to make them more stable.

In reality, the increase in revenue that many expected has not materialized.

A Jan. 28 study by Bitwise led by senior researcher Max Shannon found that while fee floors did increase blob prices, Ethereum’s rapidly growing capacity more than offset that.

“As a result, we expect blob fees to contribute little to overall Ethereum revenue over the next 12 months,” Shannon wrote, adding that Fusaka's impact will be “more positive for user experience and L2 margins than for Ethereum revenue generation.”

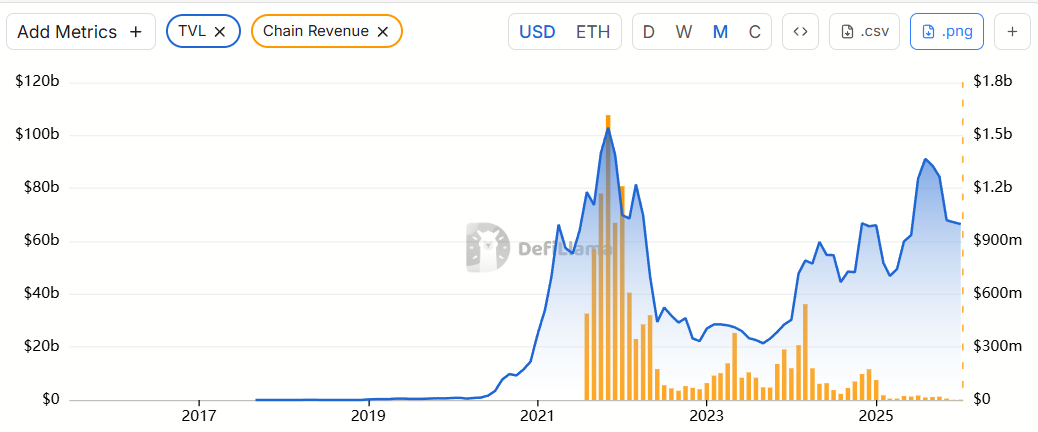

Ethereum monthly earnings. Source: Defilama

According to DefiLlama data, Ethereum's monthly revenue has fallen since its peak of around $1.6 billion in November 2021, and is down more than 99% to around $1.8 million as of December 2025. The network is looking a little better heading into January, with more than $2 million in revenue so far.

Multi-input questions

In an interview with The Defiant, Shannon clarified that the impact on Fusaka's net blob fee revenue is “always going to be a question with multiple inputs.” He explained that while minimum fees may increase revenue, increased throughput still drags down revenue, with throughput clearly winning so far.

“What we actually observed is that the throughput gains outweighed the higher base price,” he said.

Shannon believes that over a longer time frame, a fee floor should allow Ethereum to capture the value generated by layer 2 activity, but he stressed that this has not yet happened.

In a recent report, independent researcher Andrei Sergenkov claimed that Husaka set fees so low that he was able to make a profit through a particular type of fraud (address poisoning) using the network.