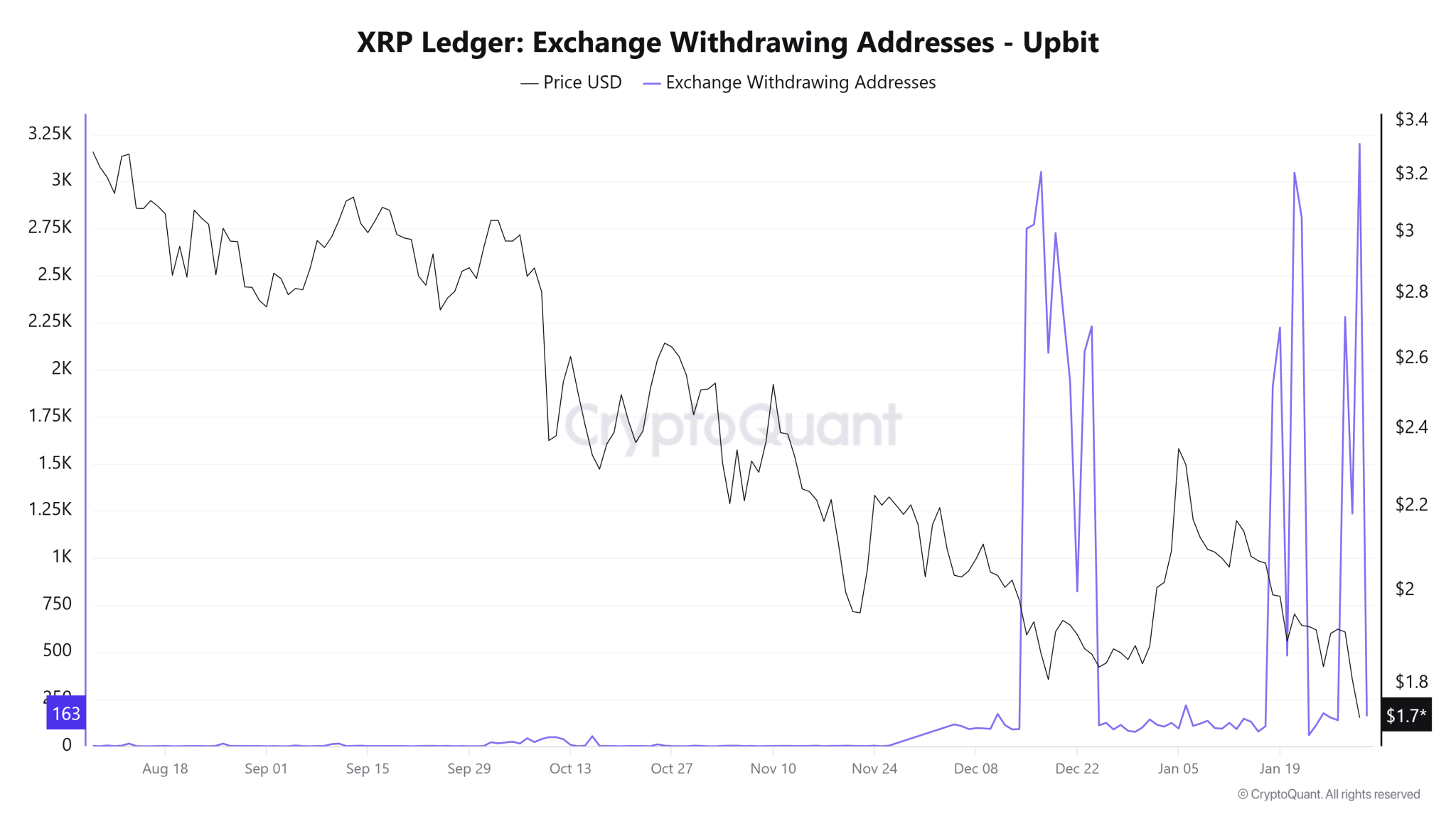

address withdraw $XRP Recently, stock prices from the Upbit exchange have skyrocketed to all-time highs, indicating that investors are withdrawing their assets from the exchange.

This recent pattern is $XRPrecent price struggle, let go $1.8 and support level within a broader market risk-off environment. For context, $XRP It has been falling ever since it hit a snag after recovering to $2.2 on January 14th. Currently trading at $1.7, $XRP It is down 22.7% from its high of $2.2.

Although the economy continues to be in a slump, Korean investors appear to be unfazed. exchange drawer. Specifically, exchange withdraw The number of addresses on Upbit, South Korea's largest exchange, recently surged to 3,200, an all-time high.

Important points

- of $XRP Prices continue to struggle January 14th It hit a high of $2.2 and is now down 22.7% to $1.7.

- Despite these struggles, Korean investors remain unfazed and continue to withdraw their tokens to cold wallets.

- Recently, the number of exchange withdrawal addresses on Upbit, South Korea's largest exchange, has increased rapidly, reaching a record high of 3,200.

- Investors typically withdraw their tokens from exchanges if they plan to HODL them for a long period of time, but this is not a definitive signal.

Upbit Exchange withdrawal addresses reach 3,200

Pseudonymous market commentator CryptoMessi warned ordinary investors to be wary of this trend in a recent article. post. Citing bullish developments, analysts “teased the possibility of something big happening” $XRP ”, pointing to the potential impact such a withdrawal would have on the world. $XRP price.

In particular, the data in the attached CryptoQuant chart shows that exchange withdrawal addresses ranged from 1 to 53 daily in Q4 2025 amid the downtrend that dominated the market at the time. Occasional spikes in address withdrawals were observed, with a daily peak of 171 during this period.

$XRP Exchange withdrawal address with Upbit | CryptoQuant

However, in December, despite the continued economic slump, withdraw Addresses from Upbit quickly proliferated. The first spike occurred on December 15, 2025, hitting a high of 2,750. By December 17th, another spike occurred, reaching a high of 3,051 cases, a new high at the time.

There was another spike in January 2026, but it remained below the peak of 3,051 cases thereafter. January 30. Specifically, on this day, we will pull out the address. up bit Despite this, the number of visitors reached a record high of 3,200. $XRP will be collapsed under $1.8 support.

What impact could this have? $XRP?

CryptoMessi called the recent trends a sign that “whales are stacking hard offline.” market watchers believe $XRP It is possible to react with a “massive” movement. He asked investors to expect the unexpected.

daily surge $XRP Withdrawals suggest that large holders and active traders continue to move tokens off exchanges despite the price struggle. Investors often withdraw their assets and store them in private wallets. point to Long-term trust and accumulation of Soaking.

Others move funds to decentralized platforms for cross-exchange staking, liquidity pools, or arbitrage opportunities. Whatever the reason, having fewer tokens sitting on an exchange reduces immediate selling pressure, which may help stabilize the price or set the stage for a rebound.

However, these withdrawals do not necessarily indicate bullish intent. Some traders will relocate $XRP Either to sell on other platforms with more liquidity or to manage risk during volatile times. Additionally, organizational restructuring may occur. wallet For security or operational reasons, we do not plan to hold it long-term.