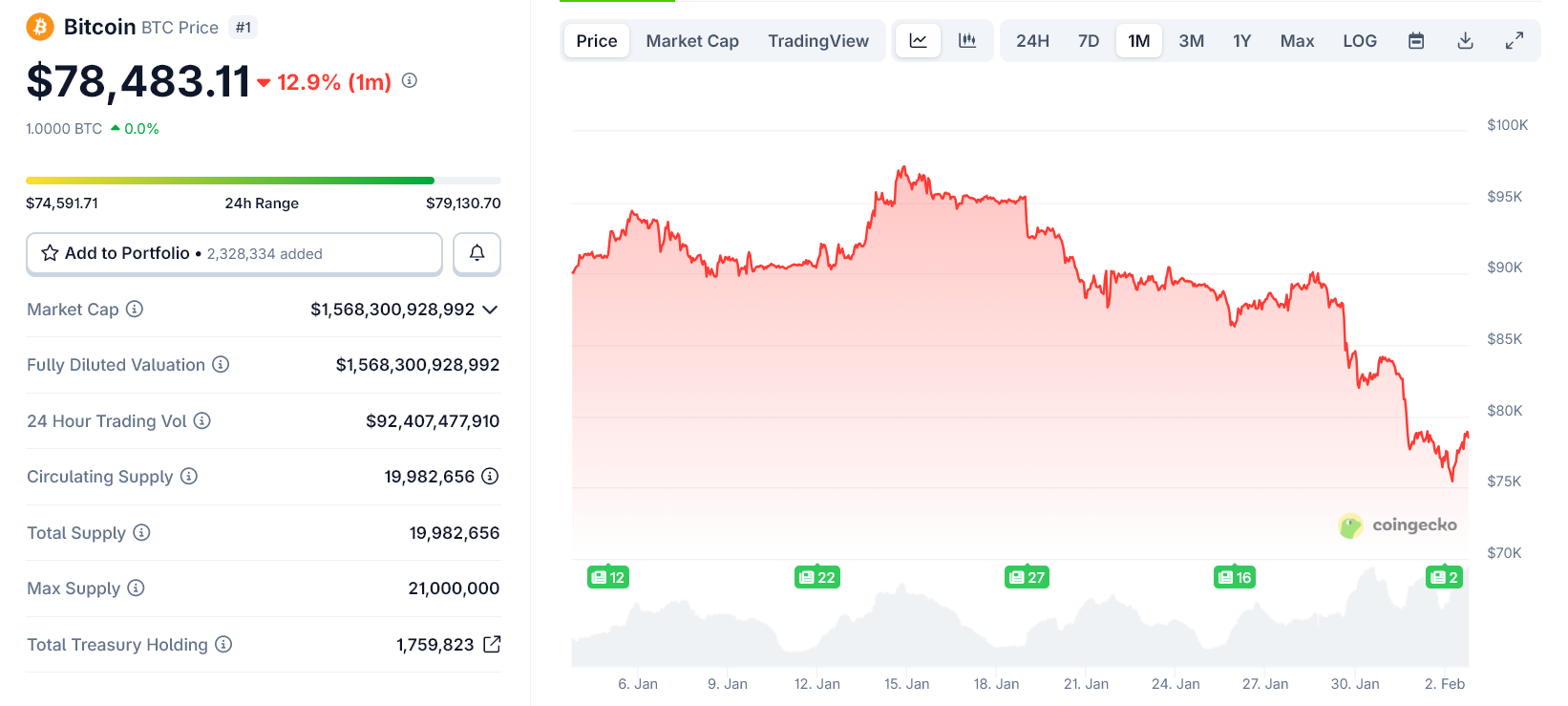

Bitcoin's recent decline is more serious than just a technical correction. It is approaching the level of directly impacting the economics of the mining industry and changing the risk profile of the market.

Around $70,000, Bitcoin transitions from a purely trader-driven market to one where network economics, miner behavior, and the risk of forced sales begin to matter. That is why this level is more important than trend lines or moving averages at the moment.

Bitcoin is entering a mining stress zone

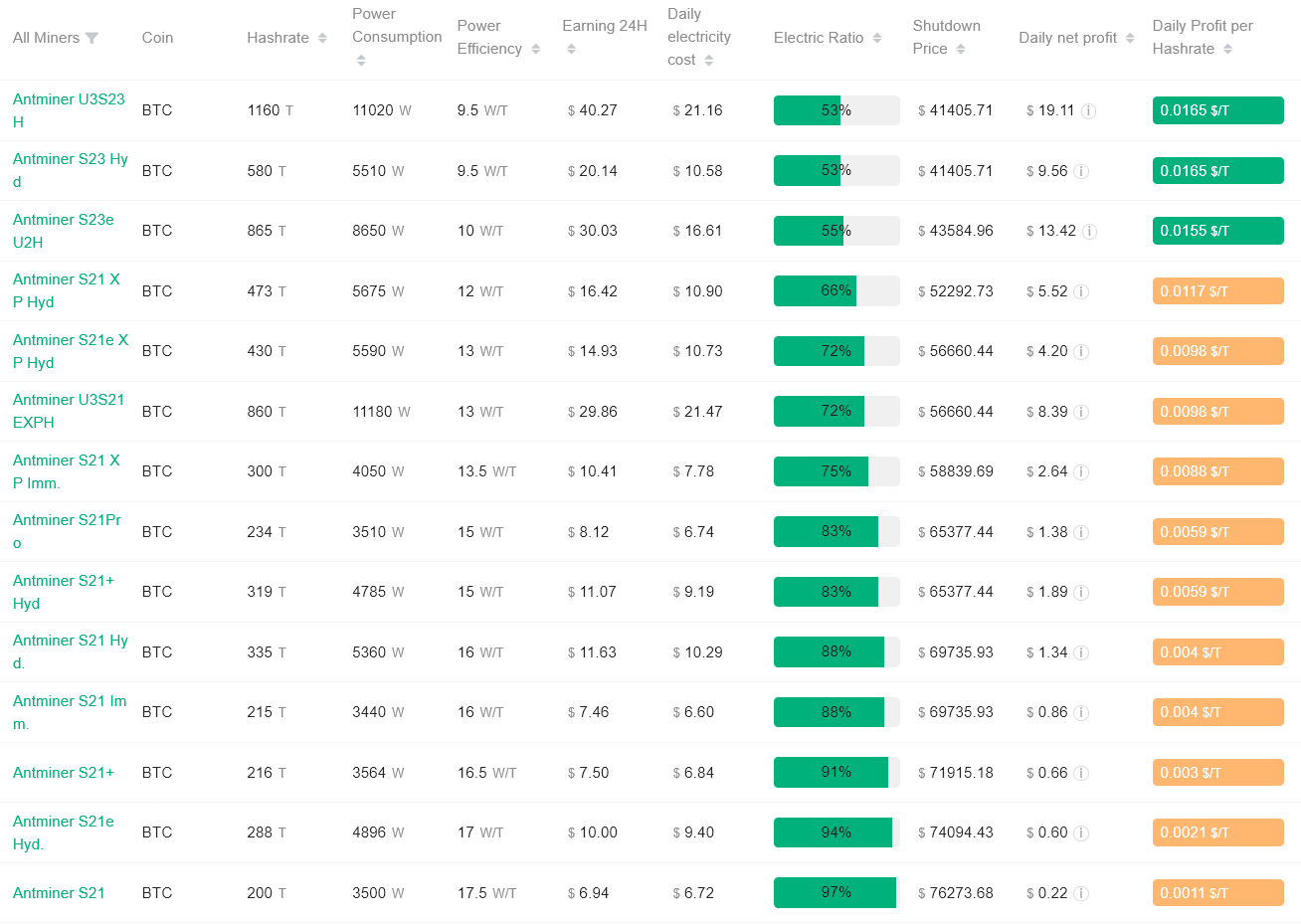

In the current network difficulties and electricity bill situation, $0.08 per kWhnew mining data shows a clear pressure zone.

Most of the Antminer S21 series machines, which account for the majority of the modern global hash rate, have shutdown prices concentrated in the following ranges: $69,000 and $74,000 around $BTC.

Simply put, below this range, Many miners stop making money just by operating.

Most Bitcoin miners have a shutdown price of less than $70,000. Source: Antpur

Bitcoin regularly moves thousands of dollars in either direction. What makes this moment different is that person feeling stressednot how quickly prices change.

Above $70,000, mining remains broadly profitable. Below that, profitability becomes selective. Therefore, only efficient miners will survive, and middle-tier operators will face losses.

This is not just about price; Cash flow, balance sheet, and behavior.

Shutdown price does not mean floor price

Accuracy is important.

The shutdown price is do not have Guaranteed support level. Miners do not control the price of Bitcoin, and the market can trade below the break-even point for mining for long periods of time.

However, the closing price will be marked Zone where behavior changesit is behavior that moves markets during times of stress.

Bitcoin price over the past month. Source: CoinGecko

What happens if Bitcoin falls below $70,000?

Even if Bitcoin briefly dips below $70,000 and recovers quickly, the impact will be limited. But if the price stay below At that level, some secondary effects start to add up.

First, weak miners may sell $BTC A reserve fund to cover electricity and hosting costs. Some miners may shut down their machines and reduce hashrate.

Most importantly, negative sentiment is amplified as headlines shift from “volatility” to “mining stress.”

None of these are fatal on their own. If they come together, the decline could be magnified.

When mining stress becomes dangerous, overlaps with liquidity stress.

Currently, Bitcoin is already grappling with issues such as:

- Global liquidity squeeze

- Decreasing risk appetite

- ETF outflows and derivatives liquidation

These factors, combined with mining stress and forced selling, could cause the market to decline faster than fundamentals alone would justify.

In this way, sharp and chaotic movements occur. It's not because Bitcoin is broken, Multiple pressures are aligned at once.

The post When Major Bitcoin Miners Face Shutdown Risk $BTC Falls Below $70,000 appeared first on BeInCrypto.