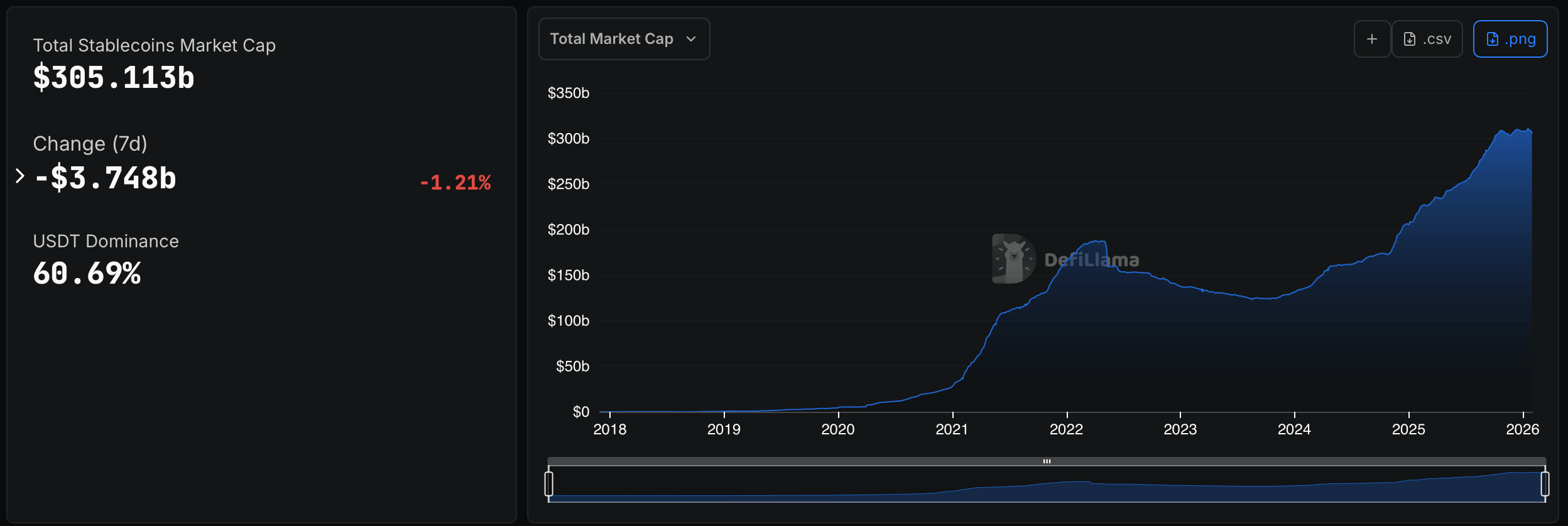

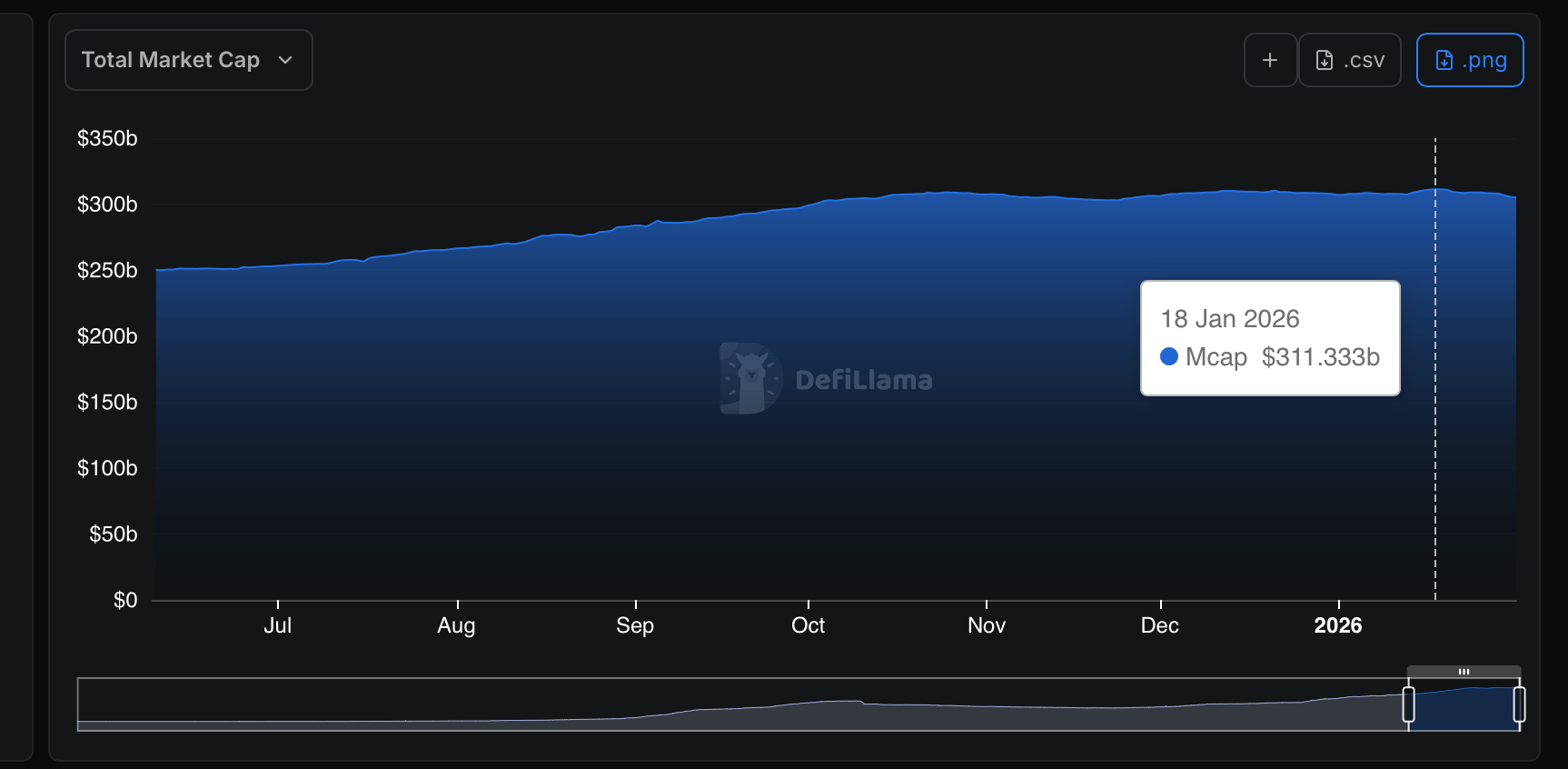

The stablecoin economy has declined by $6.22 billion in the past two weeks after hitting an all-time high of $311.33 billion. Just last week, the sector fell 1.21%, shedding another $3.748 billion.

Stablecoin sector sheds billions of dollars

Stablecoins, or token economies pegged to fiat currencies, are in the red this week, marking the second full week of declines since crossing the $311 billion mark, according to statistics from defillama.com. Of the top 12 stables, Tethers $USDT The market capitalization remains impressive at $185.18 billion, ignoring last week's slight decline of 0.81%.

Circle USDC follows at $70.07 billion, but seems more volatile, down 3.40% in 7 days. This equates to a loss of $5.05 billion during that period. Ethena's USDe remains in third place with a cap of $6.51 billion and a weekly decline of 0.92%. Sky's USDS was barely changed, increasing 0.17% to $6.22 billion.

As of this writing on February 1, 2026, the stablecoin economy has reached $305,113 million.

World Liberty Financial (WLF) stablecoin $USD1 showed the most strength, rising 7.37% to a valuation of $5.07 billion. it's the first time $USD1 We passed the $5 billion milestone. Sky's DAI fell just 0.54% to $4.6 billion. PayPal's PYUSD took a hit, dropping 3.98% to $3.6 billion.

Meanwhile, Falcon Finance's USDf fell 0.27% and now stands at $2.05 billion. Circle’s U.S. Treasury-backed stablecoin USYC fell 2.3% to $1.62 billion. The global dollar (USDG) fell by 1.22% and remained at $1.49 billion. dollar yielding ond yields $USDY During the week, the stock rose 10.10% to $1.39 billion, attracting attention. Ripple USD, with a market capitalization of $1.36 billion, fell by 4.12%, lagging behind the top 12.

14 days ago, the stablecoin economy hit an all-time high of $311.333 billion.

The backlash in the stablecoin economy comes in tandem with a broader downturn in cryptocurrencies, as leading currencies such as Bitcoin and Ethereum have seen billions of dollars wiped out of their market capitalization. Even though $3.748 billion disappeared from tokens pegged to specific fiat currencies, names like WLF $USD1 And Mr. Ondo $USDY I decided to change my mood and swim upstream.

This week, the battle for the top 12 has settled down, and as of February 1, 2026, the net value of the stablecoin economy will be $305.113 billion, accounting for 11.74% of the total valuation of the virtual currency economy of $2.6 trillion.

Also read: OSL Group raises $200 million to accelerate stablecoin and payments expansion

Over the past week, and since January 18, the numbers show that the market is catching its breath, rather than losing its nerve. Although the stablecoin economy has cooled in tandem with widespread crypto weakness, control remains concentrated and selective winners still emerge. For example, out of today's $305,113 million; $USDT It is dominant at 60.69%.

Capital is in circulation, and the $305 billion base shows persistent demand for dollar-linked liquidity even as risk appetite wanes and valuations across digital assets decline.

Frequently asked questions ❓

- What is the current size of the stablecoin market? As of February 1, 2026, the total value of the stablecoin economy reached $305,113 million, accounting for 11.74% of the broader cryptocurrency market.

- Why has the stablecoin market fallen recently? The decline reflects lower activity in the cryptocurrency market as Bitcoin and Ethereum prices fall and capital goes on the defensive.

- Which stablecoin is still dominant? tether's $USDT It leads the market with a 60.69% share and has approximately $185 billion in circulation.

- Are there stablecoins still growing despite the slowdown? yes, $USD1 and $USDY It has widened over the past week, defying a broader contraction.