Ethereum price remained under pressure in early February as selling momentum increased in both on-chain and technical indicators. The token has fallen below a major support level after the chart breakdown was confirmed, but the latest data shows that large holders and long-term investors are starting to reduce their exposure.

Vitalik Buterin for sale $ETH With accumulation slowing, the $1,800 zone is emerging as a significant near-term downside risk.

Head and shoulders breakdown matches Vitalik's symptoms $ETH sale

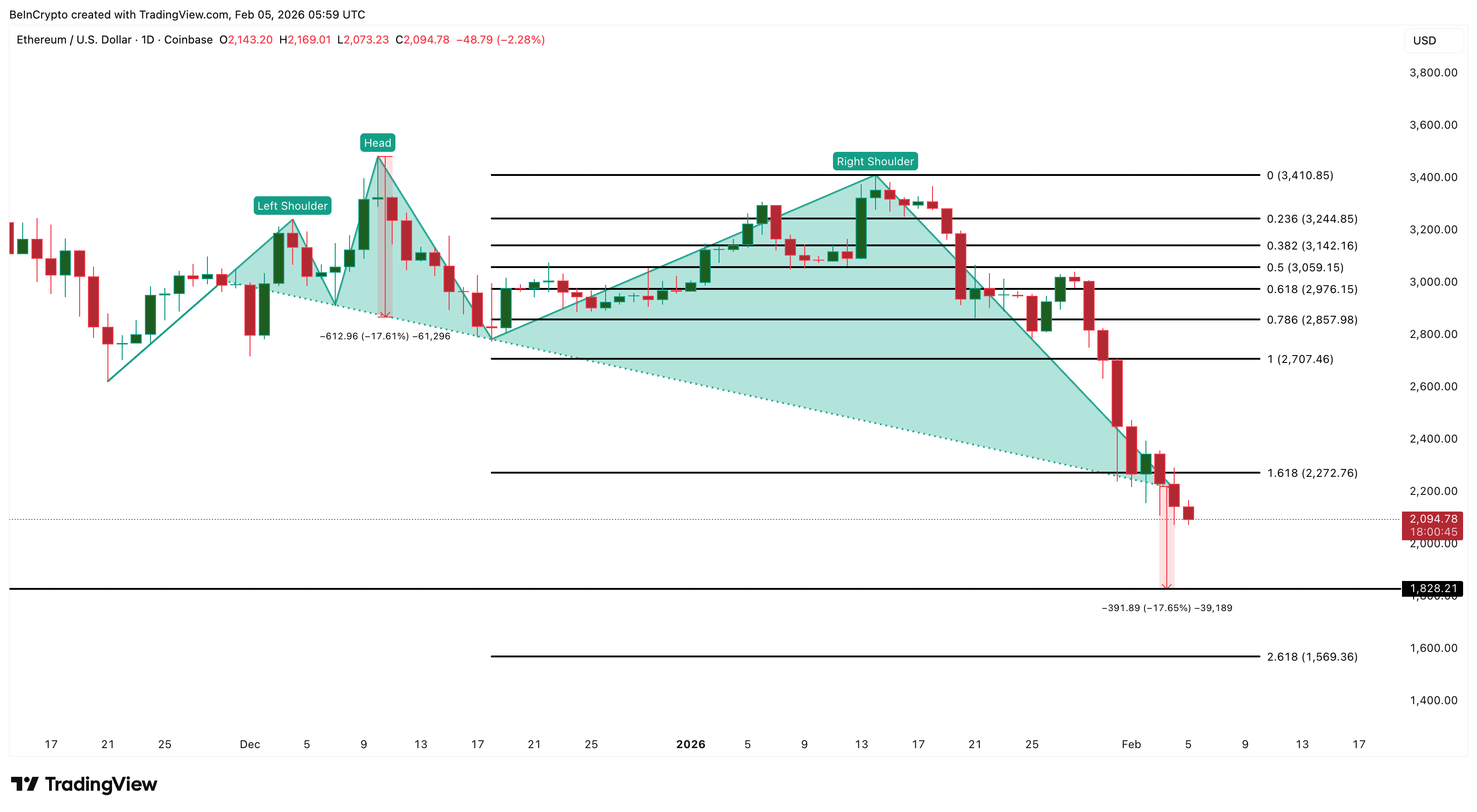

Ethereum’s recent decline accelerated after an apparent technical failure on February 3rd.

On the daily chart, $ETH He completed the head and shoulders pattern that had been forming since mid-November. time $ETH The price failed to sustain above the neckline and broke down on February 3rd, confirming a bearish pattern.

Bearish Price Structure: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

A head-and-shoulders formation usually indicates a trend reversal. The expected downside target is calculated by measuring the height of the pattern and applying it below the neckline. For Ethereum, this refers to the $1,820 zone.

Around the same time, on-chain data showed that Vitalik Buterin started selling $ETH.

Vitali. $ETH fast!

In the last 3 days, Vitalik has sold 2,961.5 pieces $ETH($6.6 million) Average price is $2,228 and sales are still going on. https://t.co/Q9G1lEsdiP pic.twitter.com/C1vBn5UimJ

— Lookonchain (@lookonchain) February 5, 2026

In the last 3 days, Vitalik has sold about 2,961 pieces $ETH The average price is about $2,228, making it worth about $6.6 million. The sell-off started when Ethereum was about to lose technical support and continued during the outage.

This timing is important. Market confidence often weakens when key ecosystem figures reduce exposure during a chart breakdown. Rather than stabilizing sentiment, Vitalik's sales reinforced bearish signals from price fluctuations.

As a result, February 3rd became a watershed moment for Ethereum due to a combination of technical failures and high-profile selloffs.

Whale and Hodler will start selling after the signal on February 3rd

After the collapse and Vitalik's sale, large long-term holders also began to change their behavior.

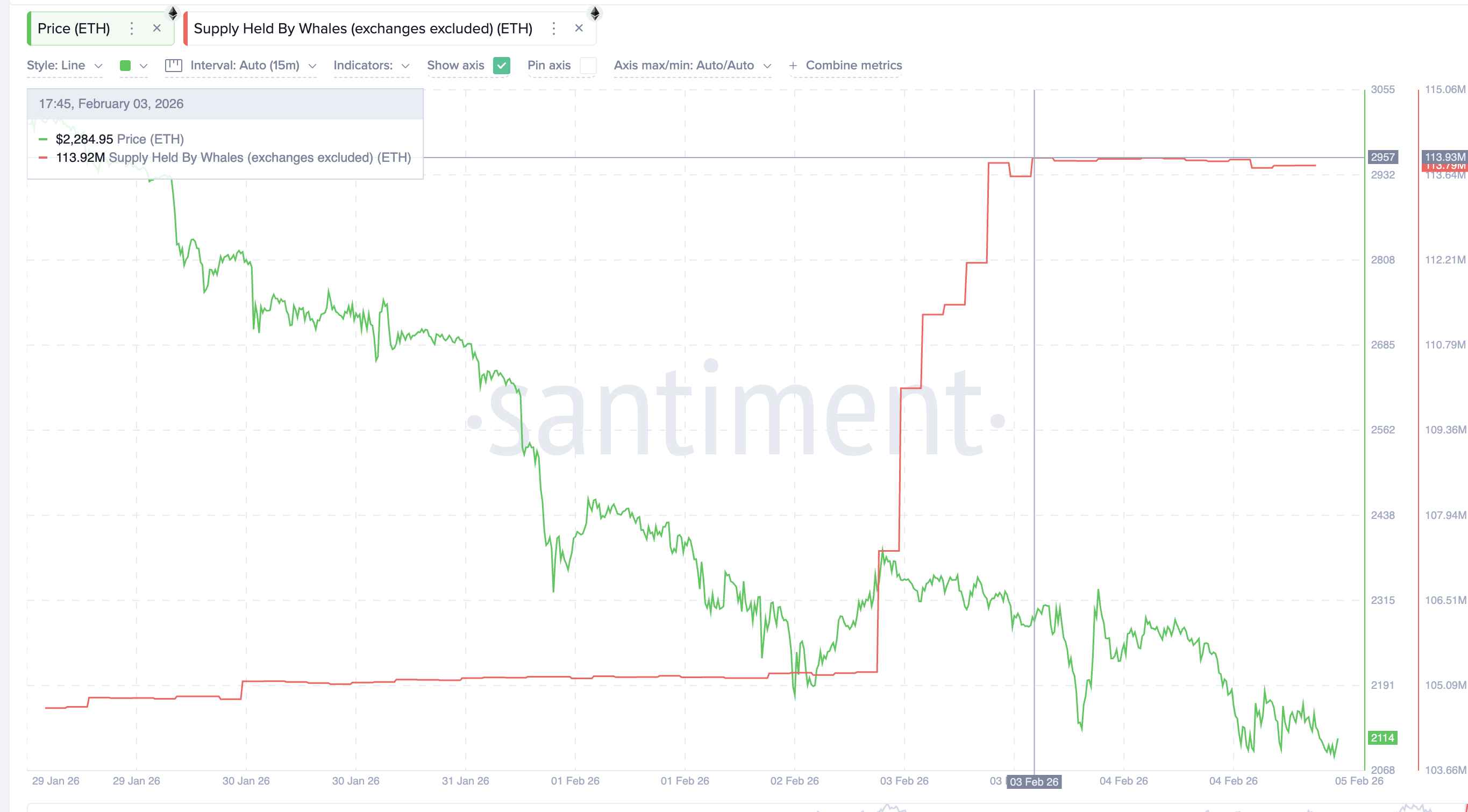

According to the data, Ethereum whales, excluding exchange wallets, significantly increased their holdings from February 2nd to February 3rd in an attempt to buy on the spur of the moment. However, that accumulation quickly reversed once prices were unable to recover.

As of February 3, the whale inventory reached nearly 13.93 million. $ETH. After that, the number decreased to approximately 13.79 million. $ETHa reduction of approximately 140,000 people $ETHworth more than $290 million. This decline suggests cautious distribution rather than confident long-term buying.

Start selling $ETH whales”>

Start selling $ETH whales”>

$ETH Whale sales start: Santiment

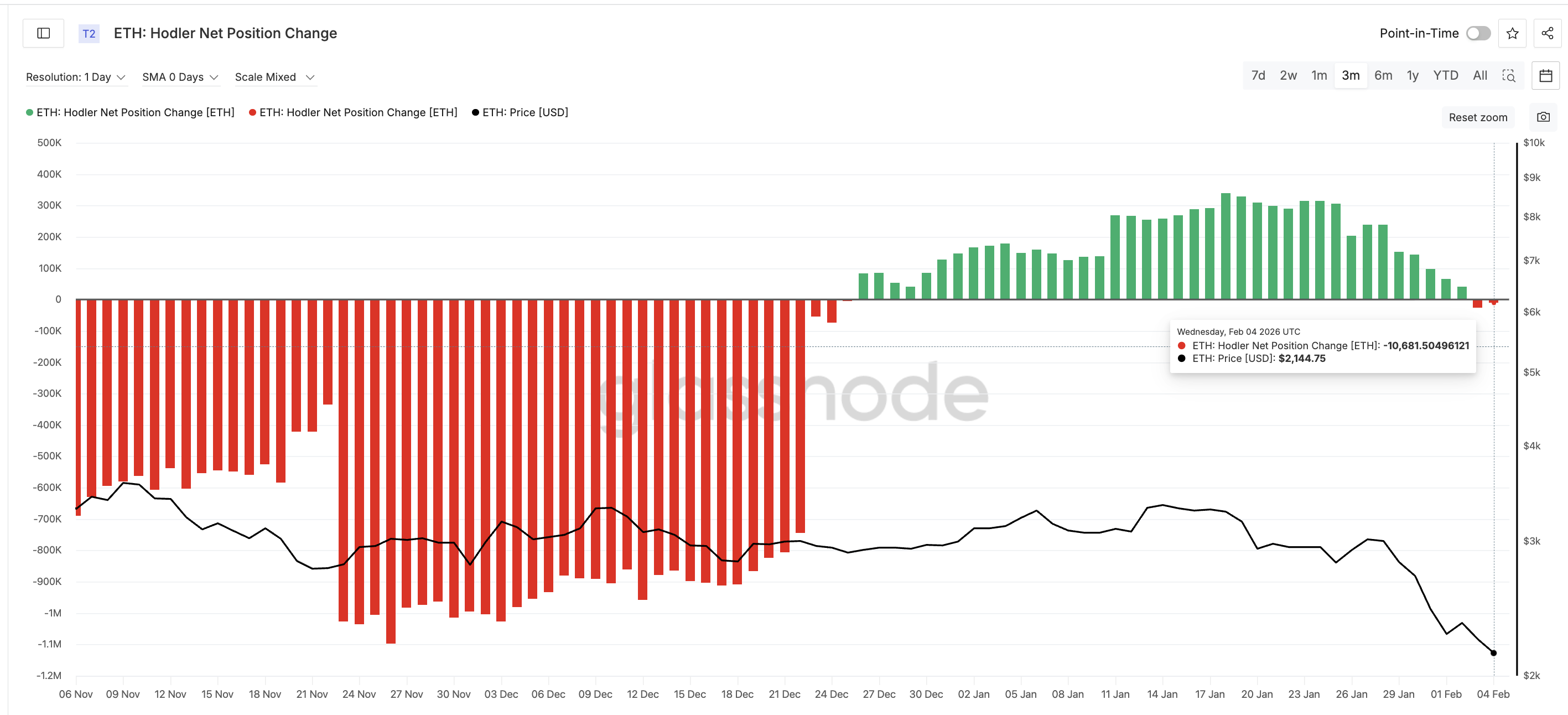

At the same time, long-term holders also started selling.

Hodler Net Position Change tracks the movement of the net. $ETH The coins are held in a wallet that has not been moved for more than 155 days. These wallets are considered long-term investors. Positive values indicate accumulation and negative values indicate net selling.

This indicator has remained positive since late December, implying that long-term holders are steadily increasing their positions. However, on February 3rd and 4th, it turned negative for the first time in several weeks.

The latest readings show around 10,681 net short positions. $ETH. This shift shows that even patient investors have begun to reduce their exposure in the wake of the collapse.

Hodlers return to dumping $ETH: Glass node

Together, these signals exhibit a distinct sequence. Vitalik reduced his holdings, the chart structure broke down, whales started selling, and long-term holders followed suit, almost simultaneously. This concerted shift suggests weakening confidence across multiple investor groups.

Downside risk typically increases when both large holders and hodlers exit at the same time.

On-chain cost cluster points to $1,800 as major Ethereum price zone

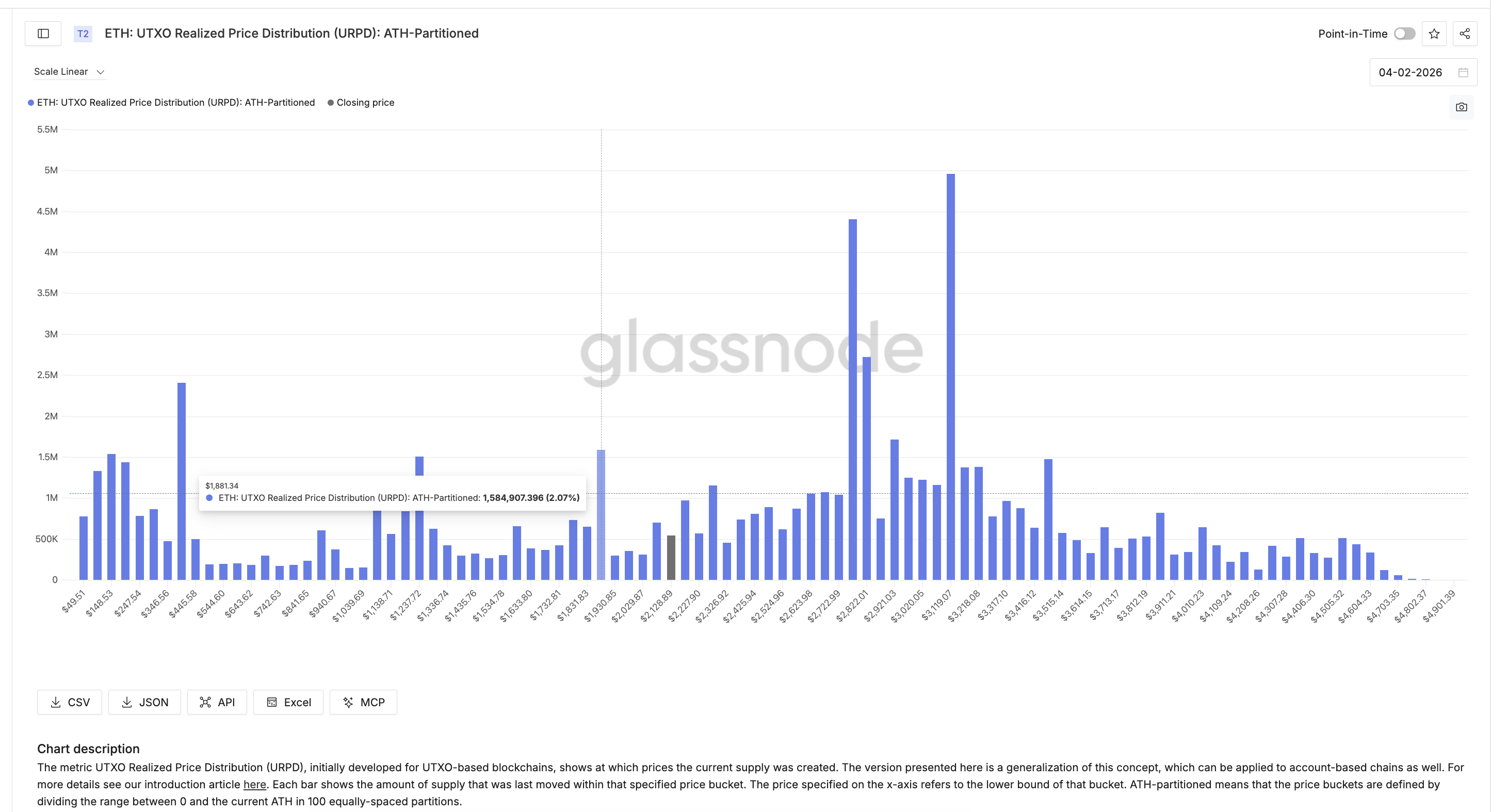

On-chain supply data helps explain where Ethereum could find its next major support.

UTXO Realized Price Distribution (URPD) shows where current supply last moved on the chain. This metric was originally designed for UTXO-based blockchains such as Bitcoin, but Glassnode has since popularized it for account-based networks such as Ethereum.

Each bar represents the amount $ETH The last person to change hands within a certain price range. Large clusters often act as support or resistance because many holders have cost bases in those zones.

Current data shows one of the strongest supply clusters around $1,880. Approximately 2% of distribution volume $ETH Finally moved within this range, it has become an important area of psychological and structural support.

Generalized cost-based cluster $ETH: Glass node

This is roughly in line with the technical prediction from the head and shoulders pattern pointing to $1,820.

Ethereum has already lost the $2,270 support level. The price is currently trading around $2,090, with the next major test between $1,880 (per on-chain cluster) and $1,820.

If this zone fails, the next zone will be $ETH The downside target appears to be around $1,560 based on the downside Fibonacci extension.

Ethereum Price Analysis: TradingView

On the upside, the bearish setup will only weaken if Ethereum reclaims $2,270 and then $2,700 and breaks above them on the daily time frame. Without that recovery, all Ethereum price gains could be subject to selling pressure.

The post Ethereum Whales And HODLers Follow Vitalik's Cue As $1,800 Risk Grows appeared first on BeInCrypto.