Bitcoin recently experienced a sharp selloff over the past 48 hours, scaring retail investors and raising serious concerns about its future viability. Prices improved slightly on Friday, but traders are bracing for the next big drop and the possibility of it getting worse.

Fortunately for the cryptocurrency industry, this is not the first year that the future looks bleak. At times like these, history is the best reference for knowing what will happen next, which actions to avoid, and for generally assessing how bad the current situation is. Many of these answers lie in the collapse of 2022.

Situation before collapse in 2022

A lot has changed since then, but the crypto winter of 2022 provided the backdrop for most of the community to believe it was the end of the industry.

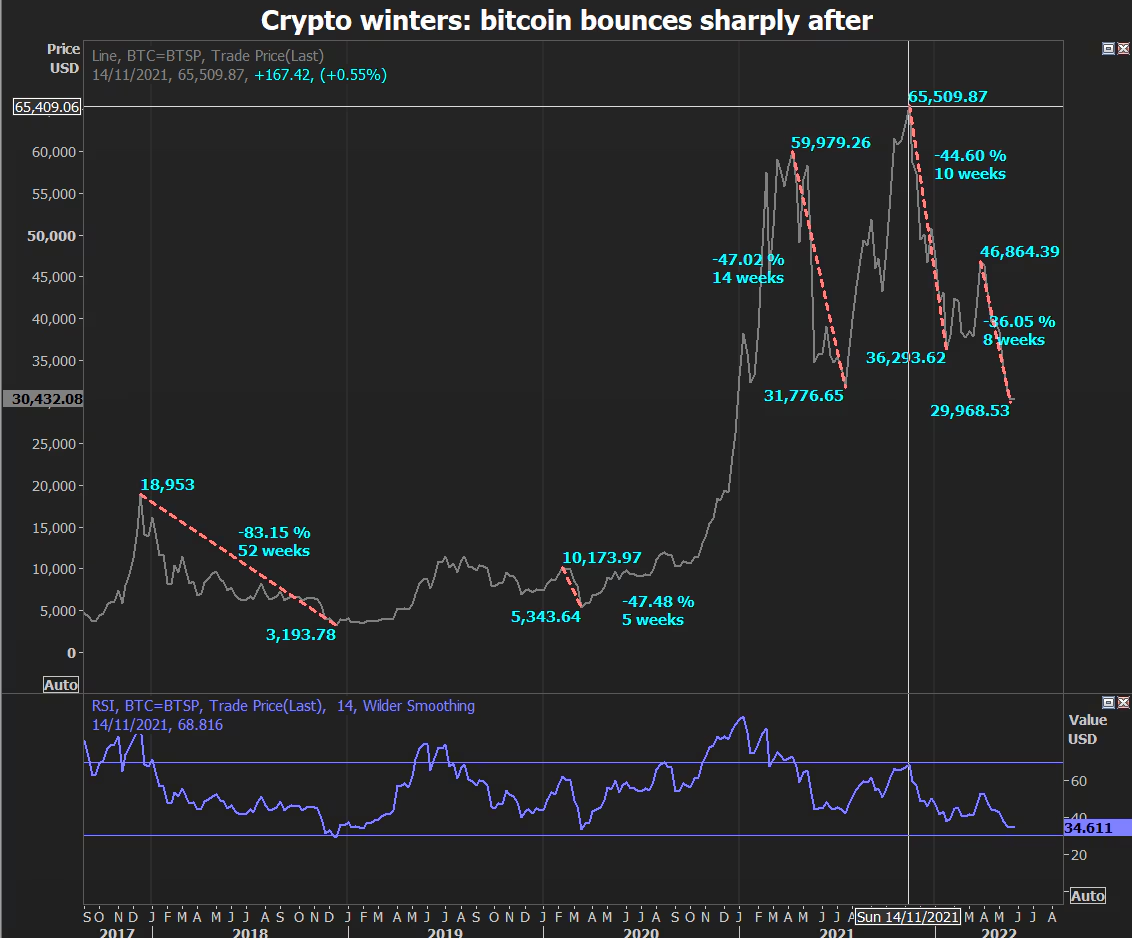

This story began in 2020, with a year of significant growth for cryptocurrencies. Money flowed into the market and prices rose sharply until reaching their peak around November 2021. Meanwhile, Bitcoin rose from about $8,300 to $64,000 in 10 months.

All the crypto winters of the past. Source: World Economic Forum

High-yield products were at the heart of the appeal offered by some of the largest cryptocurrency companies at the time. The idea of receiving generous guaranteed interest rates on purchases of things like Bitcoin and stablecoins was very appealing.

But there are also broader macroeconomic factors, and this story is beginning to unravel.

The Federal Reserve had been raising interest rates and restricting consumers' access to liquidity due to persistent inflation. Stock markets suffered a major correction following the outbreak of war in Europe.

These factors have led cryptocurrency investors to withdraw their funds from the most speculative assets.

What followed was a similar scenario to the installation installation. But as consumers rushed to withdraw their funds, larger problems began to surface, leaving investors with serious doubts about the industry.

The domino effect that followed

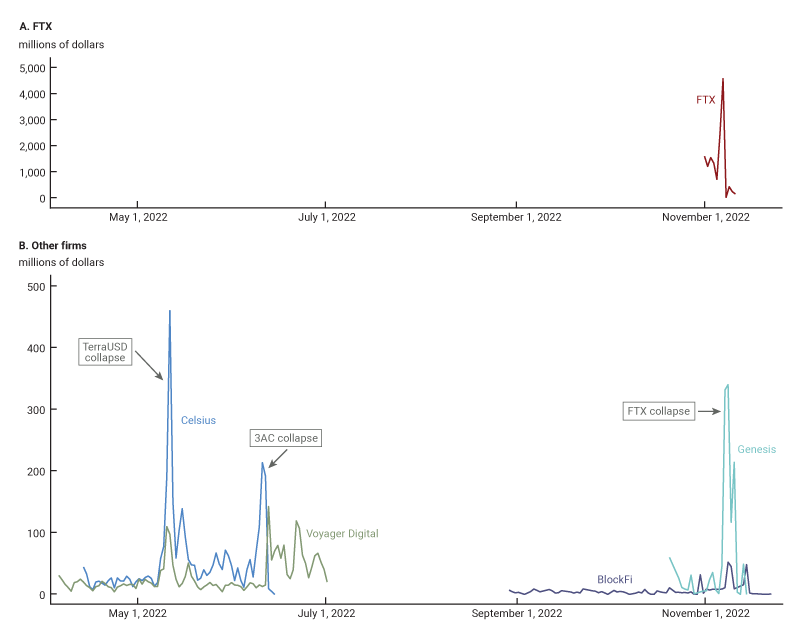

The first shock was the collapse of the TerraUSD (UST) stablecoin in May 2022, when its price plummeted over 24 hours. This event caused serious distrust in the ability to maintain the dollar peg.

According to an analysis by the Chicago Fed, then-major centralized exchanges Celsius and Voyager Digital lost 20% and 14% of customer funds, respectively, in the 11 days following the news.

Then came the bankruptcy of Three Arrows Capital (3AC). At the time, hedge funds managed about $10 billion in assets. A general plunge in cryptocurrency prices and a particularly risky trading strategy wiped out assets and forced the company to file for bankruptcy.

Withdrawal of customer funds within 90 days prior to filing for bankruptcy. Source: Federal Reserve Bank of Chicago.

Centralized exchanges were hit even harder, once again causing rapid capital outflows.

Then came the infamous FTX collapse in November 2022. The outflow amounted to 37% of customer funds, all of which were withdrawn within 48 hours. Exchanges Genesis and BlockFi withdrew about 21% and 12% of their investments, respectively, in the same month alone, according to the Chicago Fed.

In 2022, at least 15 crypto companies have ceased operations or entered bankruptcy proceedings. This failure exposed structural liquidity weaknesses in some business models, particularly their vulnerability to rapid withdrawals during market stress.

These events highlighted the increasingly important lesson that financial commitments must be consistent with underlying liquidity and that contingency plans are essential in times of stress.

Against the backdrop of today's market conditions, these lessons are once again relevant.

Why today's Bitcoin trends matter

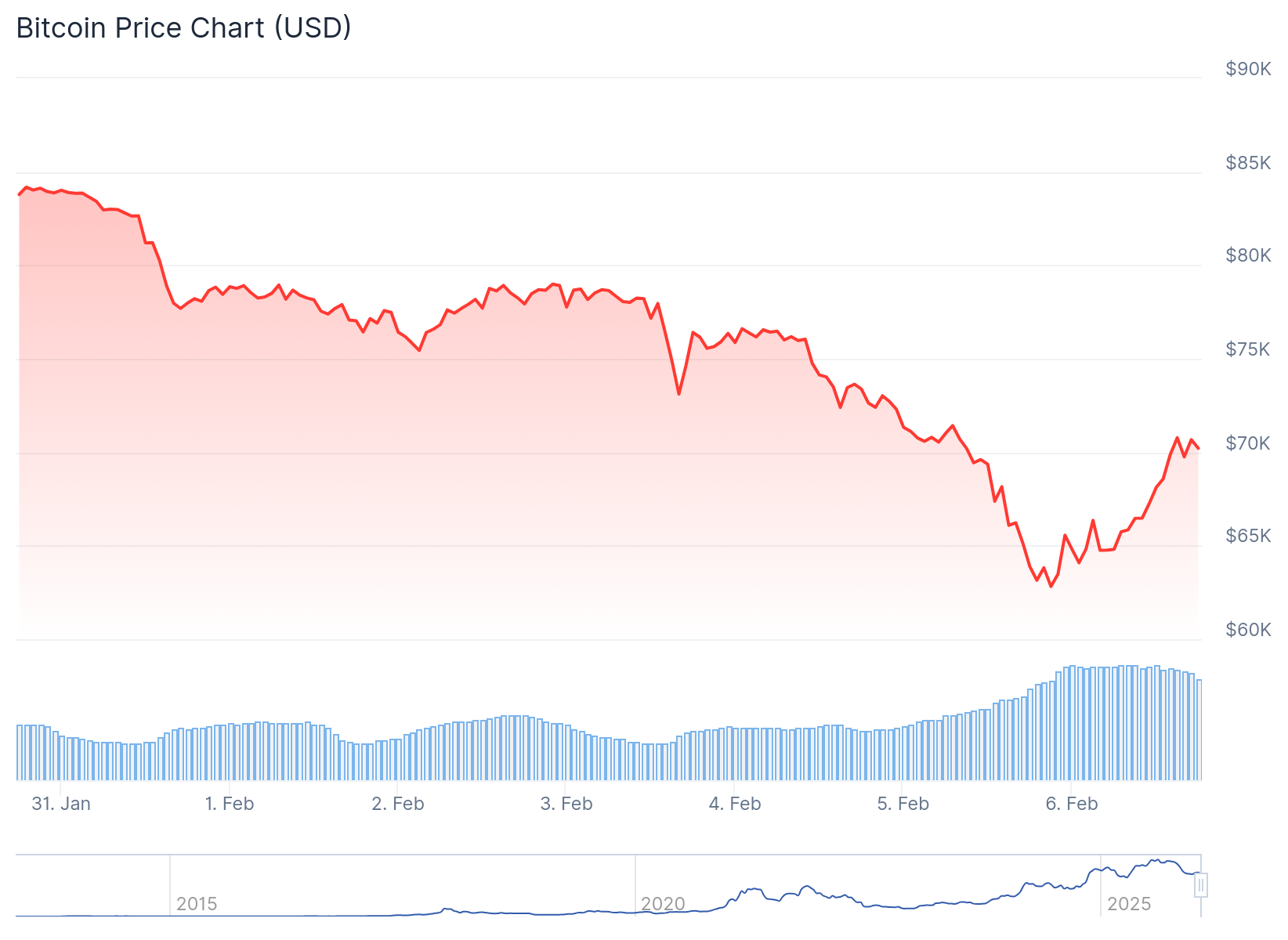

Over the past week, major cryptocurrencies Bitcoin and Ethereum have fallen nearly 30%. This decline wiped out an estimated $25 billion in unrealized value across digital asset balance sheets.

The data comes as global markets tumbled this week, hurting cryptocurrencies, stocks and even traditional safe-haven assets like gold and silver. Synchronous declines indicate broader liquidity shocks rather than asset-specific weaknesses.

As a result, traders facing margin calls first liquidated their liquid assets. In the case of cryptocurrencies, this broader backdrop indicated a market reset rather than a complete loss of confidence. Friday's strong consumer data eased near-term macro pressures, pushing Bitcoin's price up to $70,000.

Bitcoin price over the past week. Source: CoinGecko.

Nevertheless, Bitcoin's behavior suggests something more structural. We're not just reacting to the liquidity situation.

Over the past year, Bitcoin has failed to regain momentum even during relief rallies. According to previous BeInCrypto analysis, this drawdown is mainly driven by long-term holders who continuously sold their holdings.

That action sends a strong negative signal to the market. Emerging retailers are watching their movements closely, understanding that upward mobility loses credibility when held by high-conviction hodlers.

However, price fluctuations are often just the first layer of visible stress. While markets tend to price in fear quickly, financial institutions respond slower and more structurally, adjusting operations well before a full-blown crisis becomes apparent.

During periods of prolonged uncertainty, these strategic shifts can serve as early warning signs.

Educational institutions begin to quietly withdraw

Beyond price fluctuations, early signs of stress are already emerging at the institutional level.

A recent example is Gemini's decision to scale back its operations and exit certain European markets. This move does not indicate bankruptcy, nor is it likely to be directly caused by the recent price decline.

However, this reflects a strategic adjustment to a more compliant environment and shows that long-term uncertainty often prompts financial institutions to reassess regional exposures and operational efficiencies before stress materializes on balance sheets or market prices.

Meanwhile, Polygon implemented large-scale layoffs within the company last month, laying off about 30% of its staff. This is the third move in the past three years.

Bitcoin has fallen more than 20% in the past 12 months. However, in 2018, it decreased by 80% compared to the previous year, and by 2022, it decreased by 70%. pic.twitter.com/u361W9mnxR

— Robert P. Murphy (@BobMurphyEcon) February 4, 2026

Historically, similar operational setbacks emerged quietly in late 2021 and early 2022, long before widespread industry failures became visible. As liquidity tightened, companies began freezing hiring, scaling back expansion plans and cutting incentives. These moves were often framed as efficiency and regulatory adjustments rather than pain.

Attention has also returned to digital asset treasury, where prolonged drawdowns tend to expose balance sheet sensitivities. MicroStrategy has once again emerged as a leader.

MicroStrategy reveals early structural stresses

Bitcoin's largest digital asset vault faced new pressure from the market after Bitcoin fell to $60,000 this week. The incident caused the company's vast cryptocurrency assets to fall far below its average acquisition cost, reigniting concerns about balance sheet risk.

MicroStrategy's stock price plummeted as Bitcoin's decline widened, and the company's market valuation also fell below the value of its underlying Bitcoin holdings.

As prices continue to fluctuate, these balance sheets become increasingly reflexive, amplifying both confidence and vulnerability.

In fact, MicroStrategy has already moved away from its once unwavering promise of never selling. In November, Chief Executive Officer Von Leh acknowledged for the first time that the company could sell its holdings in certain crisis situations.

Today's indicators appear earlier and more subtly, so they can be more easily overlooked. But their quiet nature may be what makes them so important, offering a glimpse into how a lingering erosion of trust is beginning to reshape the industry from the inside out.