table of contents

Where does Aster come from? Why did CZ choose Aster as a favorite? What are the CZ effects done on Aster? What is the difference between Aster and other Perp DEXs? Are there any drawbacks?

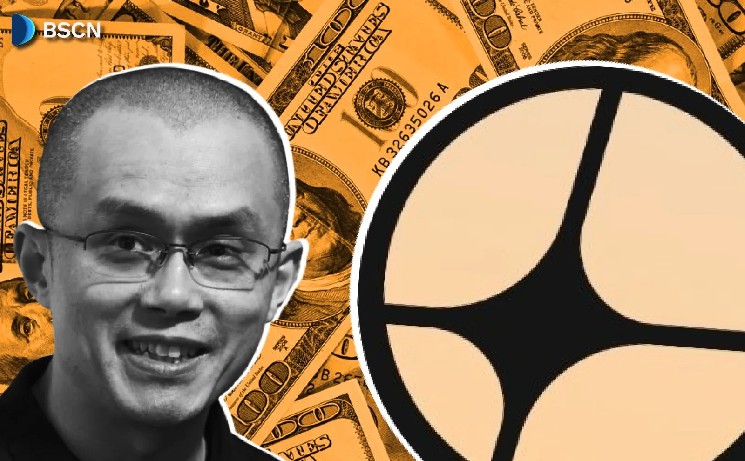

Aster is a decentralized perpetual futures exchange that Changpeng Zhao (CZ) keeps mentioning. Former Binance CEO publicly endorses and personally purchases more than $2 million $ASTER He buys tokens with his own money and maintains strategic relationships through YZi Labs. This level of support from one of the most influential figures in crypto was notable for PERP DEX, which just underwent a complete rebrand in early 2025. DeFi.

Where do aster come from?

Asters aren't exactly new. This was the result of the merger of APX Finance (formerly ApolloX) and Astherus at the end of 2024, followed by a complete rebrand on March 31, 2025. The platform currently offers non-custodial spot and perpetual trading across cryptocurrencies, forex, and even equity derivatives. Simple mode supports up to 1001x leverage on selected pairs, while Pro mode supports up to 100x. Mainly executed is BNB chain but also support Ethereum, Solanaand decision.

Why did CZ choose Aster as his favorite?

czech republic Perp DEX is loudly claiming to be the future of trading. Is his main concern the existing platform? A visible order book that exposes large positions to manipulation and front-running. On June 1, 2025, he posted on suggestion “Dark pool” style perpetual trading on decentralized exchanges argues that traders should not have real-time visibility into orders and liquidation points.

Astor ticked those boxes. The platform introduced stealth trading, MEV free execution in simple mode, and hidden orders for collateralization of yield through liquidity staking tokens such as asBNB and stablecoins such as USDF. That's directly in line with what CZ was looking for.

His support was also not very strong. CZ posted multiple times on X praising Aster's progress, writing things like, “Well done! Good start. Keep building!” While highlighting multi-chain support and hidden order functionality. On November 2, 2025, he disclosed that he had purchased $2,090,598. $ASTER Tokens with an average price of $0.91, states: “I'm not a trader. I bought it and keep it.”

Strategic investments and advice are provided through his venture arm, YZi Labs. Aster CEO Leonard In the interview, he talked about receiving direct advice from CZ.

There's a practical angle here too. Since stepping down from Binance's management following his plea deal, CZ has shifted his focus to DeFi and investing. Privacy-focused, efficient on-chain exchanges like Aster fit squarely in that new direction.

What is the CZ effect done on Aster?

The numbers say it all. After initial approval by CZ on the day of Aster's TGE on September 17, 2025; $ASTER It soared from its launch price of $0.08 to an all-time high of $2.42 within a week. His November personal purchases caused another 30%+ pump within hours.

Aster currently ranks among the top Perp DEXs by trading volume, often ranking second behind Hyperliquid. According to Dune Analytics, the platform has processed over $4 trillion in cumulative trading volume, holds $1.1 billion in TVL, and has over 8.9 million total users. $ASTER The 24-hour volume has been consistently high, trading at around $0.53. The token will be listed on Binance Spot with a seed tag, trust wallet For a permanent deal.

What is the difference between Aster and other Perp DEXs?

There are a few other notable things besides the CZ connection. The platform runs two trading modes. Simple mode allows you to run it in one click for beginners. Pro mode unlocks advanced tools like grid trading and 24/7 perpetual stocks.

In most cases, cross-chain liquidity is native and minimal bridging is required. A portion of the fee income will be allocated to token buybacks, $ASTER Holders receive discounts on trading fees. On February 4, 2026, Aster launched its service. Stage 6 Buyback Programcommit up to 80% of the protocol fee. $ASTER Redemptions and burns. Aster Chain L1, which focuses on privacy, is also in development and targeted for Q1 2026.

Are there any drawbacks?

Fair question. Some in the community question CZ's scope of influence and the true independence of the project. Aster's leadership has repeatedly addressed this, emphasizing operational separation despite ecosystem collaboration. The price movement has also been volatile, with the token rapidly correcting from a peak of $2.42 to current levels of around $0.53. CZ endorsements attract attention, but attention does not guarantee continued value.

Still, the combination of CEX-like speed, privacy tools, strong trading volume numbers, and some of the most visible backers in cryptocurrencies makes Aster hard to ignore when it comes to on-chain, perpetual trading.

check out asterasterdex.com Follow me on X @Aster_DEX.

source:

- Aster official website — Platform documentation, feature descriptions, transaction data

- CZ's X profile (@cz_binance) — with official recognition $ASTER investment statement

- YZi Good — Strategic investment and advisory details related to Aster

- Dune Analytics — Aster Overview — On-chain data of TVL, trading volume and user metrics