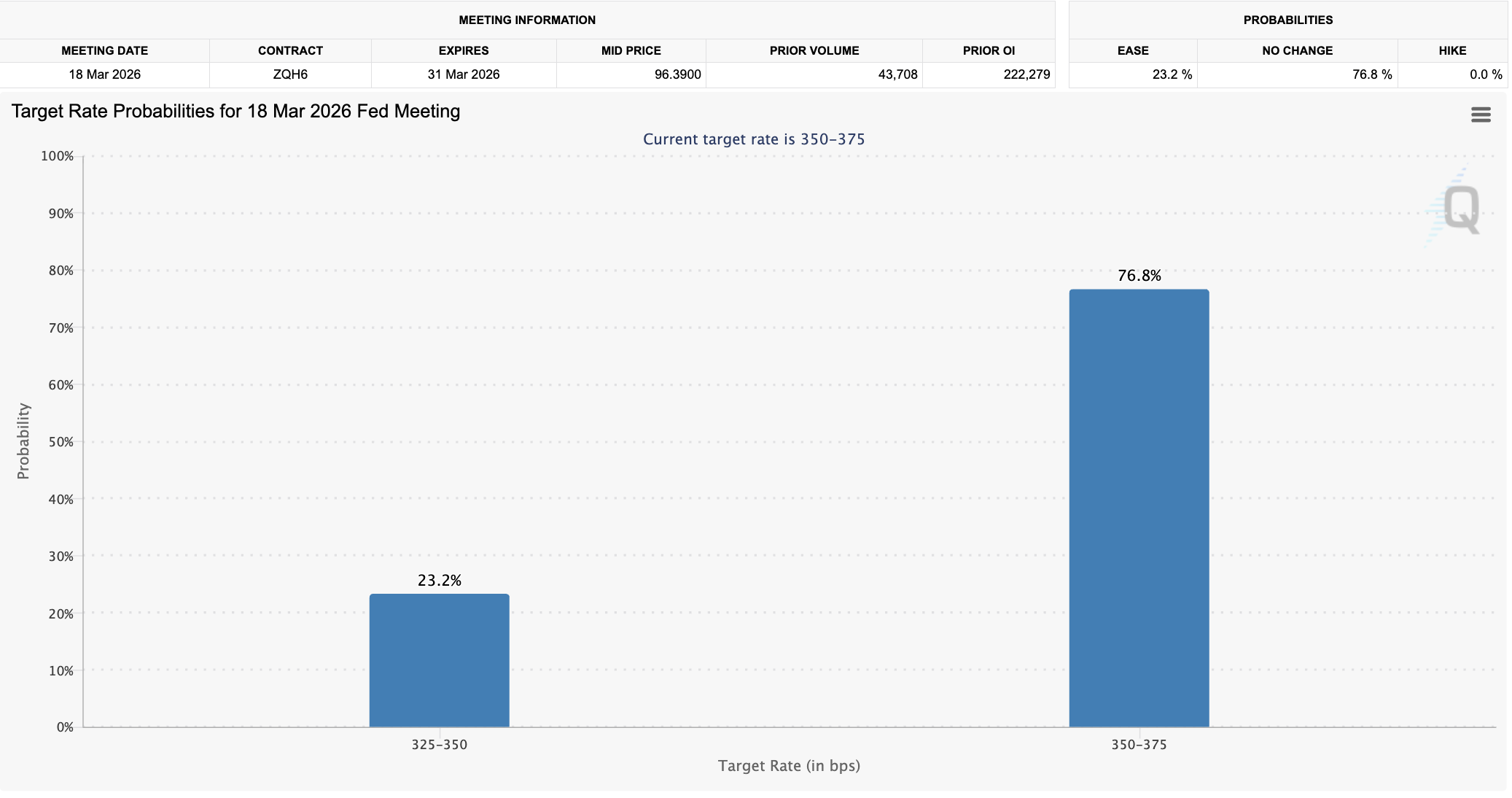

The number of traders expecting a rate cut at the Federal Open Market Committee (FOMC) meeting in March has risen to 23%, as investors worry about the hawkish stance of Kevin Warsh, President Donald Trump's nominee for Federal Reserve chairman.

The number of investors and traders expecting a rate cut has jumped nearly 5% since Friday, but only 18.4% said they expected a rate cut, according to data from the Chicago Mercantile Exchange Group.

Investors expecting a rate cut in March expected a rate cut of 25 basis points (BPS), with no investors expecting a rate cut of more than 50 basis points (BPS).

Probability of interest rate target at March 2026 FOMC meeting. sauce: CME Group

President Trump nominated Warsh in January to replace Federal Reserve Chairman Jerome Powell, whose term ends in May.

Interest rate policy can affect the price of crypto assets, with an easing of liquidity conditions seen as a positive catalyst for prices, and a tightening of liquidity conditions due to rising interest rates having a negative impact on asset prices as access to financing dries up.

Related: Bitcoin’s next bull market may not come from more accommodative policies

Markets and investors frightened by Warsh's appointment

“The nomination of Kevin Warsh as the next Federal Reserve Chairman has shaken the market to its core,” crypto market analyst Nick Pucklin said in a message shared with Cointelegraph.

Mr. Pucklin attributed the sharp decline in precious metals prices in late January and early February to investors' views on Mr. Warsh, who is seen as a more hawkish figure, in favor of keeping long-term interest rates high. he said:

“Markets are digesting Mr. Warsh's views on future Fed policy, particularly central bank balance sheets, which he has described as being “bigger than they need to be.''If Warsh adopts policies that shrink balance sheets, markets will need to consider a reduced liquidity environment.''

Thomas Perfumo, global economist at cryptocurrency exchange Kraken, told Cointelegraph that Warsh’s appointment sends a “mixed” macroeconomic signal to investors.

Warsh's appointment could signal that U.S. liquidity and credit will stabilize, rather than expand, as crypto investors had expected, Perfumo said.

magazine: If the crypto bull market is ending… it's time to buy a Ferrari: Crypto Kid