Trend Research, an investment firm led by Liquid Capital founder Jack Yee, has sold its entire Ethereum holdings ($ETH) positions, reportedly closing in on losses of nearly $750 million.

This massive decline comes as Ethereum continues its broader decline, with the altcoin dropping more than 30% in the past month. Price performance has reignited debates such as: $ETH We are nearing the bottom of the market.

Trend Research sells Ethereum amid market volatility

BeInCrypto recently reported that Trend Research started transferring Ethereum to Binance at the beginning of the month. On-chain analytics platform Lookonchain confirmed that the company completed the sale yesterday.

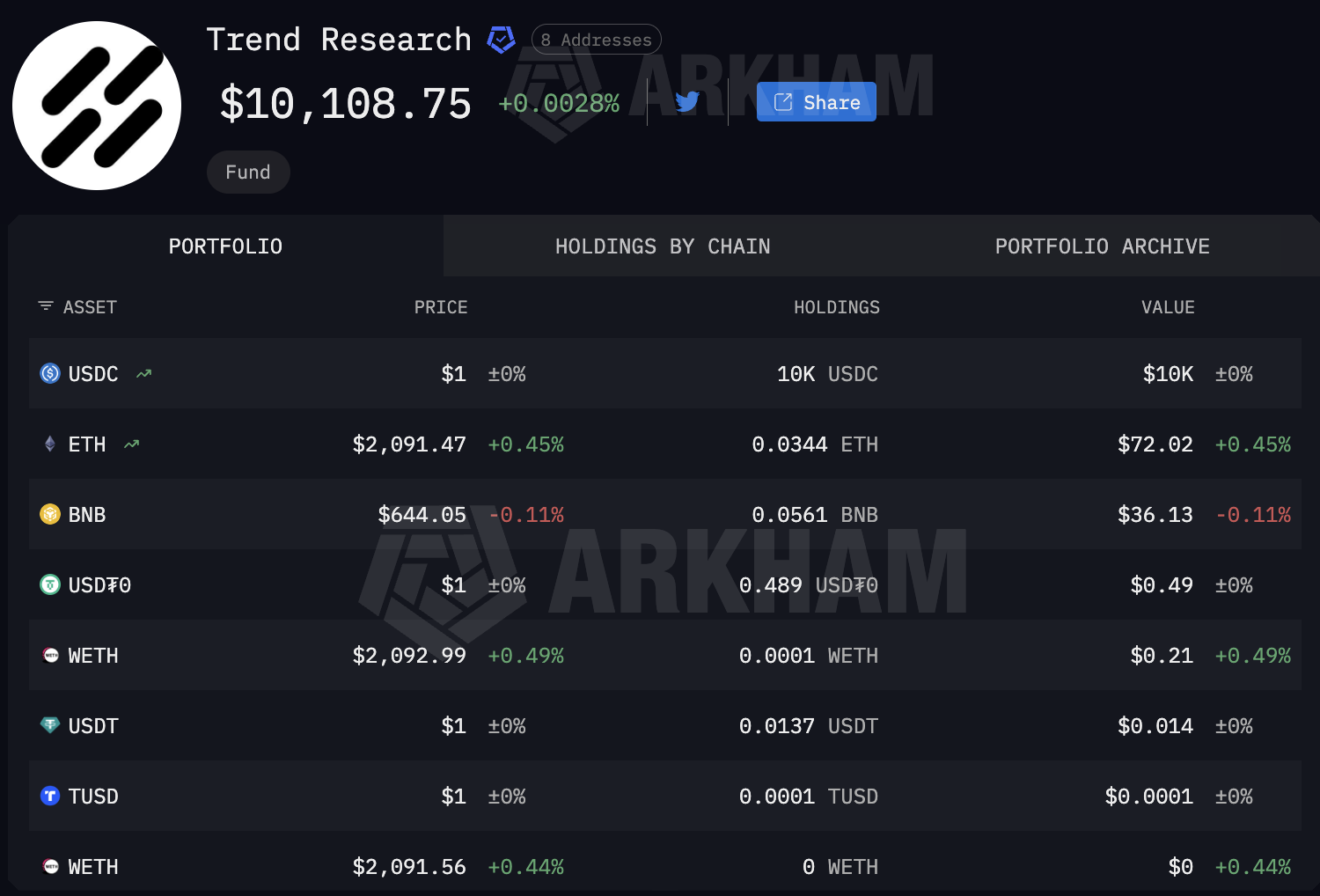

In total, Trend Research moved 651,757 $ETHapproximately $1.34 billion worth was transferred to Binance at an average price of $2,055. This transaction reduced the company's profits. $ETH Holding amount is only 0.0344 $ETHworth about $72.

Arkham Intelligence data confirms a near-complete exit, showing approximately $10,000 in USDC balances and small amounts of other tokens.

“Total losses are approximately $747 million,” Lookonchain wrote.

Selling $ETH. “>

Selling $ETH. “>

Subsequent portfolio of trend research $ETH Sold out. Source: Arkham

The exit was made following a leverage strategy built on the decentralized finance (DeFi) lending protocol Aave. Analysts Explained Trend Research was the first to buy $ETH It was deposited as collateral on a centralized exchange and deposited with Aave.

The company then borrowed stablecoins against collateral and repeatedly reinvested the borrowed funds into additional investments. $ETH The purchases created recursively leveraged positions that significantly increased both exposure and liquidation risk.

as $ETHThe price continued to fall and the position approached the liquidation threshold. Trend Research has chosen to voluntarily liquidate the entire position rather than risk liquidation.

🚨Jack E's Trend Research generated $2.6 billion in revenue $ETH Take advantage of long positions via Aave.

This month, they sold all their holdings for $1.74 billion to pay off the loan.

They lost $750 million on this deal. pic.twitter.com/00B8OYLiGC

— Ash Crypto (@AshCrypto) February 8, 2026

While Trend Research has shifted its focus to sales, Bitmine has taken the opposite approach. Despite mounting unrealized losses, the company continues to increase its exposure, recently purchasing $42 million worth of Ethereum.

What the Ethereum market bottom means for Bitmine and Trend Research

The conflicting strategies come amid heightened volatility in the Ethereum market. The second-largest cryptocurrency has fallen 32.4% over the past month, according to data from BeInCrypto Markets.

February 5th, $ETH It fell below $2,000 before recovering. At the time of writing, Ethereum was trading at $2,094.16, up about 0.98% over the past 24 hours.

$ETH) Price Performance”>

$ETH) Price Performance”>

Ethereum ($ETH) Price performance. Source: BeInCrypto Markets

Amid the economic downturn, some analysts are suggesting that Ethereum may be nearing a market bottom. One analyst described Trend Research's withdrawal as “the biggest capitulation signal.”

“These forced exits often occur around big lows,” Axel said.

Joanne Wesson, founder of Alphactal, also pointed out that Ethereum’s price bottom is likely to come several months before Bitcoin’s due to the fast liquidity cycles typically observed in altcoins.

According to Wesson, several chart indicators suggest that Q2 2026 could represent a potential price bottom. $ETH.

“Some charts already indicate that Q2 2026 could be a potential price bottom. $ETH. Capitulation has arrived and realized losses will rise sharply,” Wesson added.

$ETH Incredibly oversold.

It has been in the red for six consecutive months, and the 1 million RSI is nearing the bottom of the bear market.

Statistically, R/R is $ETH It's very expensive here.

Added $SOL. I already have a nice bag $ETH.

Now things are looking positive for these big guns.

I truly believe… pic.twitter.com/mku1VbCOP4

— Sykodelic🔪 (@Sykodelic_) February 6, 2026

Although the bottom has not yet been confirmed, this possibility could have a wide-ranging impact on institutional sentiment, especially as some companies choose to avoid risk while others continue to accumulate in the face of continued market weakness.

If Ethereum is indeed nearing a market bottom, Bitmine's continued accumulation could prove well-timed and the company stands to benefit from a future recovery.

However, if downside pressure continues, Trend Research's decision to exit the position completely may ultimately be seen as a prudent move to limit the risks associated with a leveraged strategy.

Trend Research's withdrawal from Ethereum resulted in a loss of nearly $750 million, but was it sold at the bottom price? The post appeared first on BeInCrypto.