According to Adam Kobeissi, founder of Kobeissi Letter, public and exchange company funds (ETFs) have acquired tens of thousands of dollars worth of Bitcoin (BTC) in just three months.

Macro analysts told 938,700 followers of the Cobessy Letter on social media platform X that the company's demand for Bitcoin is “incredibly strong.”

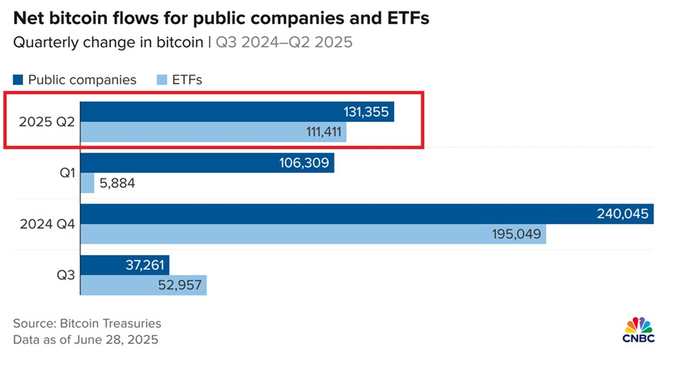

According to Kobeissi, the public company and ETF acquired a total of 242,766 BTC in the quarter ended June 30th.

“The public company purchased 131,355 Bitcoin in the second quarter of 2025, with stock holdings rising +18%, according to data from Bitcoin Treasuries.

Additionally, the ETF obtained 111,411 BTC, recording a +8% increase over the same period.

This is the third consecutive quarter in which a company has purchased more Bitcoin than an ETF.

Since the beginning of the year, public companies have purchased 237,664 bitcoins…

Currently, public companies hold ~855,000 bitcoins, or about 4% of their total supply.

The demand for Bitcoin from companies is very strong. ”

Source: Kobeissi Letter/x

As companies and ETFs swallow Bitcoin at a rapid pace, Donald, a pseudonymous crypto analyst and trader, warns investors that their accumulation of BTC is not over.

But for now, he points out that being careful about Bitcoin might be a good idea.

“To me this is very clear, right? Just as you know how this ends.

The problem is, whenever I was in the code, whenever a bubble was formed, this is actually starting to have lots of fun, right? This is when things go infinitely in a very short time. But then you have to get out really quickly too. ”

Bitcoin is trading at $108,773 at the time of writing.