The market may have moved beyond the peak of uncertainty in US tariff policy, but the road ahead remains unstable, according to a new Nansen report.

Nansen emphasizes “Bescent putt” as the US eases its trade stance

In a report shared with a news on bitcoin.com, Nansen's leading research analyst Aurely Valterele argues that recent US tariff negotiations suggest a shift towards pragmatism and will alleviate investors' fears. The report highlights Treasury Secretary Becent's growing influence on trade policy, in contrast to the decline in the role of hard-line aides such as Navarro and Commerce Secretary Lutnick.

This shift, coupled with temporary tariff exemptions for semiconductor and technology products, indicates a potential de-escalation, says Nansen research analyst. But Barthere says there is a risk left. Sector tariffs and unresolved negotiations with China could extend uncertainty and impact consumer spending and business investments.

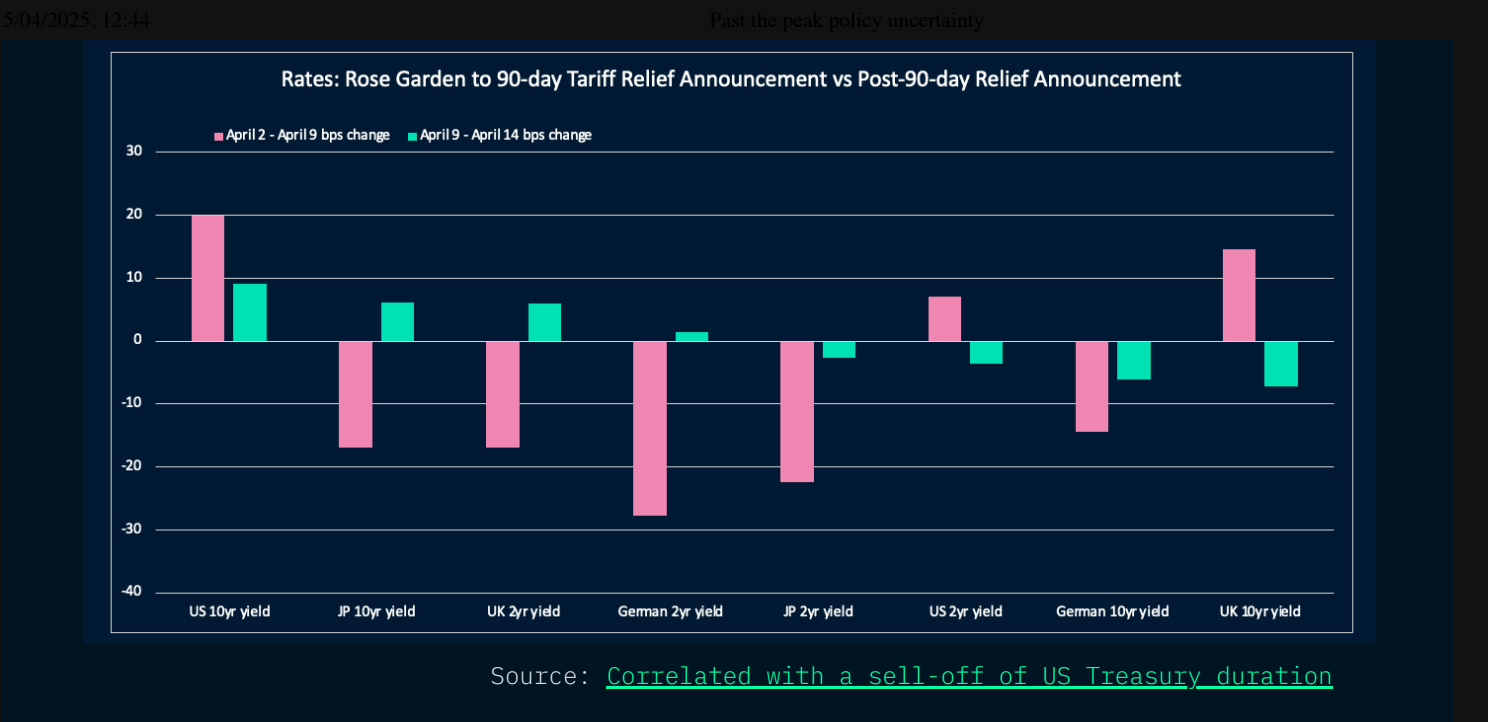

The report points to weakening demand and dollar declines in the US Treasury as a sign of foreign capital hedging for further volatility. Non-US stocks, particularly European and Chinese stocks, are performing poorly during tariff tensions, Nansen data shows. However, the company warns that the lack of viable alternatives could continue to lock global investors into the US market.

Barthere's analysis recommends a conservative approach that supports assets such as Bitcoin (BTC), discount technology stocks such as Nvidia. Gold is also cited as a geopolitical hedge. The company's risk barometer went “risk-on” late last week, reflecting cautious optimism. However, Barthere warns that climbing will be bumpy:

We probably passed on peak tariff uncertainty, and risky assets are now climbing bumpy walls because they are worried.