Individual investors are heading into 2026 blindfolded. More products related to cryptocurrencies and private credit are about to become available to the public in the United States as the Trump administration and Paul Atkins' Securities and Exchange Commission push for greater market access.

The problem is that ordinary investors may be left with all the risk and no safety net.

Both the White House and the SEC have said they want to give people more ways to invest. They believe that asset classes such as private equity and cryptocurrencies have the potential to deliver higher returns.

But some advisers worry that individuals don't fully understand what they're investing in, especially when it comes to saving for retirement.

Washington moves to open markets as regulators push new products

The SEC says it remains focused on protecting people. “Chairman Atkins is committed to ensuring the SEC maintains fair, orderly and efficient markets while protecting everyday investors,” White House Press Secretary Taylor Rogers said in a statement.

But let's be real. The door is already wide open. The Department of Labor has confirmed it is working on new rules on how personal assets can be made available to retirement investors.

In August, the Trump administration directed the Secretary of Labor to work with the SEC and other agencies to make it easier for individuals to invest in private credit and private equity. Atkins said in November that most retirement plans do not provide access to these assets, putting people at a disadvantage.

Currently, retirement plans like 401(k)s are dominated by stocks and bonds through mutual funds and ETFs. Sure, including private credit in these plans sounds like a way to diversify, but some have their doubts. How are these assets valued? Can they be sold quickly? Are people even given a decent choice?

For those considering retirement, these are no small issues.

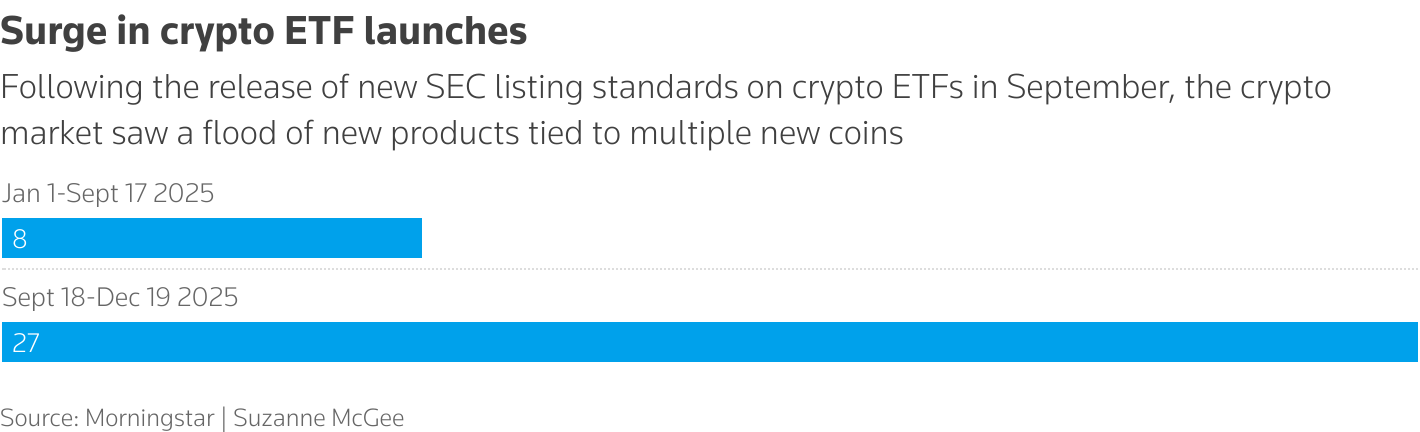

The SEC is also moving quickly to unlock more crypto access. In September, we lowered a key hurdle by releasing universal listing standards to accelerate the launch of spot crypto ETFs. Since then, new crypto ETFs have been rolled out, with Bitwise Asset Management saying 100 more stocks could be dropped in 2026.

New ETFs and funds increase pressure on retail investors

However, as the number of products increases, so does the risk. Robert Persisitte, a financial planner at Deragify Financial in Colorado, said these new tools can be harmful to inexperienced people.

“This little guy doesn’t have a team of advisors on his side,” he said. He warned that these products are not simple and the average investor does not know how to price or exit.

Morningstar data supports this trend. Cryptocurrency ETF launches skyrocketed after the SEC's new rules. That's not all. Interval funds that invest in personal assets are also on the rise. These funds are marketed as particularly suitable for retirement plans.

“We expect to see an influx of personal asset holdings in 2026,'' said Morningstar analyst Brian Armor.

Just to be clear, ETFs, interval funds, and even target-date mutual funds themselves are not risky. No, what matters is what they hold inside, and when you start loading them with volatile assets like cryptocurrencies or hard-to-sell things like private credit, the whole game changes.

Some market participants have welcomed the change. Duncan Moir, president of 21Shares, which recently launched six crypto ETFs, said cryptocurrencies “play an important role in investors’ portfolios.” But that's only true if investors know what they're doing. Let's be honest, most people don't.