Bitcoin has been on a six-week uptrend, pushing prices beyond the key psychological barrier of $110,000.

Despite growing concerns that the rallies could face saturation points and potential drawdowns, Bitcoin's recent performance and historical trends suggest that Cryptoking is not over, potentially making more profits on the horizon.

Bitcoin investors show further growth

Historically, one important indicator of the bull cycle in the cryptocurrency market is the decline in the average age of held Bitcoin. Over the past five years, three major bull markets have preceded this trend. Since April 16th, Bitcoin's average dollar age has decreased from 441 to 429 days.

This trend is a powerful signal of Bitcoin's continued upward movement. Young coins in circulation mean that new investments are entering the market, suggesting strong ongoing interest. If this trend continues, it could further justify expectations of bullish action, extend the current rallies and drive Bitcoin towards new price milestones.

Bitcoin average dollar age. Source: Santiment

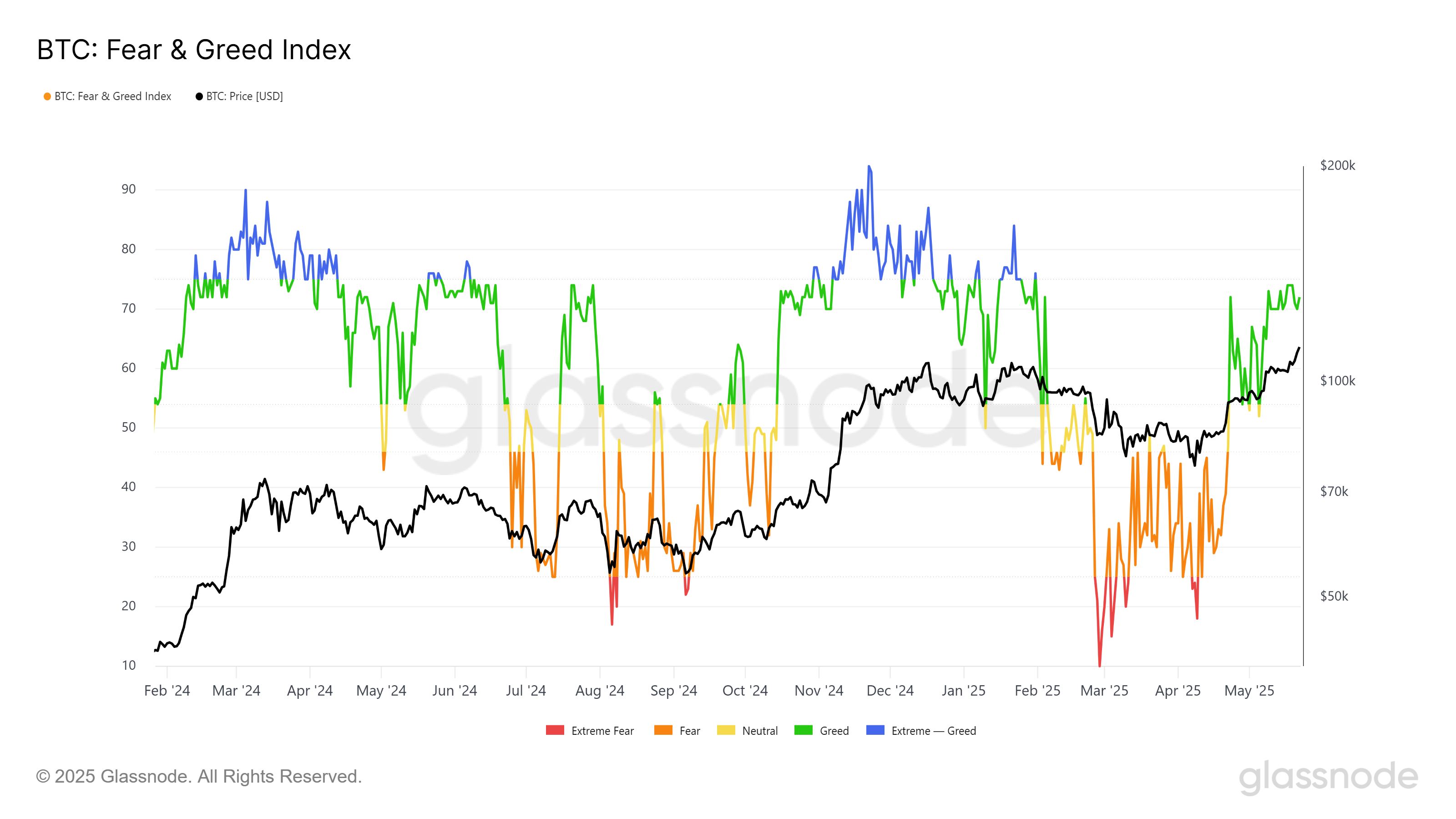

The indicators of fear and greed also show that Bitcoin's bullish momentum is not yet saturated. Historically, Bitcoin prices have risen sharply when the index violates the extreme greed zone.

However, Bitcoin has not yet reached this threshold, leaving room for price increases. This suggests that the market is not yet in the area where it was acquired, and there is still a potential for a significant rise. The index's position in the greedy zone indicates that investors are optimistic about Bitcoin's future price trajectory.

Bitcoin's fear and greed index. Source: GlassNode

BTC prices aim to continue the upward trend

Bitcoin prices have steadily risen over the past six weeks, reaching a new all-time high (ATH) of $111,980. OKX's global CCO, Lennix Lai, has contributed to Bitcoin's recent rally, highlighting macroeconomic factors, including favorable market conditions and growing institutional interest.

“Bitcoin has surpassed $111,000 into the new all-time best show. How strong the technical setup has become. I was particularly impressed with how little hiccups they handled Moody's US credit downgrade.

Going forward, Bitcoin prices could break past the current ATH and reach $115,000. This continued growth is likely to attract more investors and will further drive the rally. If positive momentum continues, Bitcoin can solidify its position as a major asset in the market.

Bitcoin price analysis. Source: TradingView

However, Bitcoin could experience a short-term pullback if investors start selling their holdings to secure profits. A drop below $106,265 could weaken investors' sentiment and reduce to $102,734. If this occurs, bullish outlook could be invalidated, resulting in a temporary integration phase in Bitcoin prices.