The Bitcoin mining industry has faced a more challenging operating environment since the 2024 halving, a core feature of Bitcoin's currency design that reduces block rewards approximately every four years to enforce long-term scarcity. While the halving will intensify the economic hardships for Bitcoin, it will also put immediate pressure on miners as their profits plummet overnight.

According to TheMinerMag, this will result in the “toughest margin environment in history” in 2025, with collapsing earnings and skyrocketing debt posing major obstacles.

Even publicly traded Bitcoin (BTC) miners with large cash reserves and access to capital struggle to maintain revenue from mining alone. As a stopgap measure, many companies are accelerating their efforts toward alternatives.Bitcoin miners could boost enterprise adoption as crypto treasury purchases slow

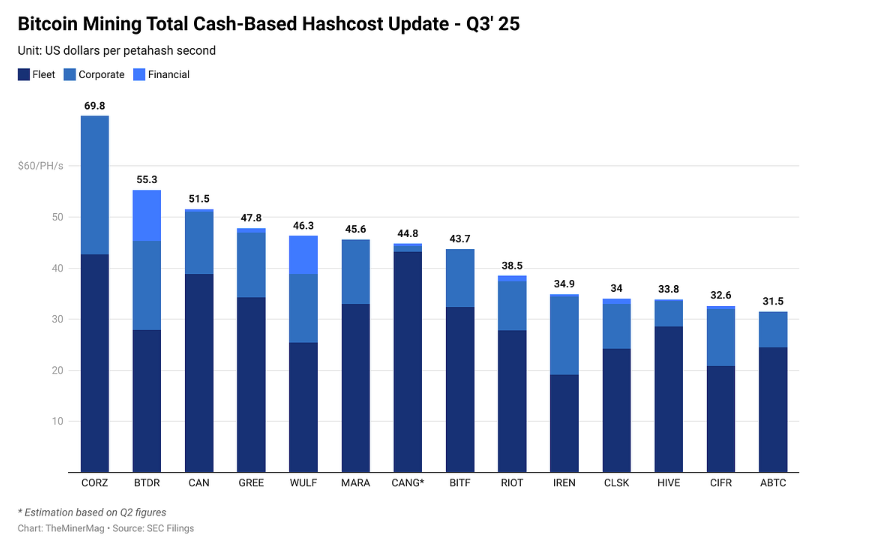

Average Bitcoin mining costs for 14 publicly traded mining companies in Q3 2025. Source: TheMinerMag

By 2026, Bitcoin will continue its fourth mining era, which is expected to begin after the April 2024 halving and last until around 2028. With the block subsidy pegged at 3.125 BTC, competition is increasing, reinforcing the industry's shift towards efficiency and revenue diversification.

Below are three key themes expected to drive the Bitcoin mining industry in 2026.

Mining profitability depends on energy strategy and price market

Hashrate measures the computational power securing the Bitcoin network, and hash price reflects the revenue earned from this computational power. This distinction remains at the heart of the mining economy, but as concession subsidies continue to shrink, profitability is increasingly shaped by factors beyond scale.

Access to low-cost energy and exposure to Bitcoin's transaction fee market have become critical to miners' ability to maintain margins throughout the cycle.

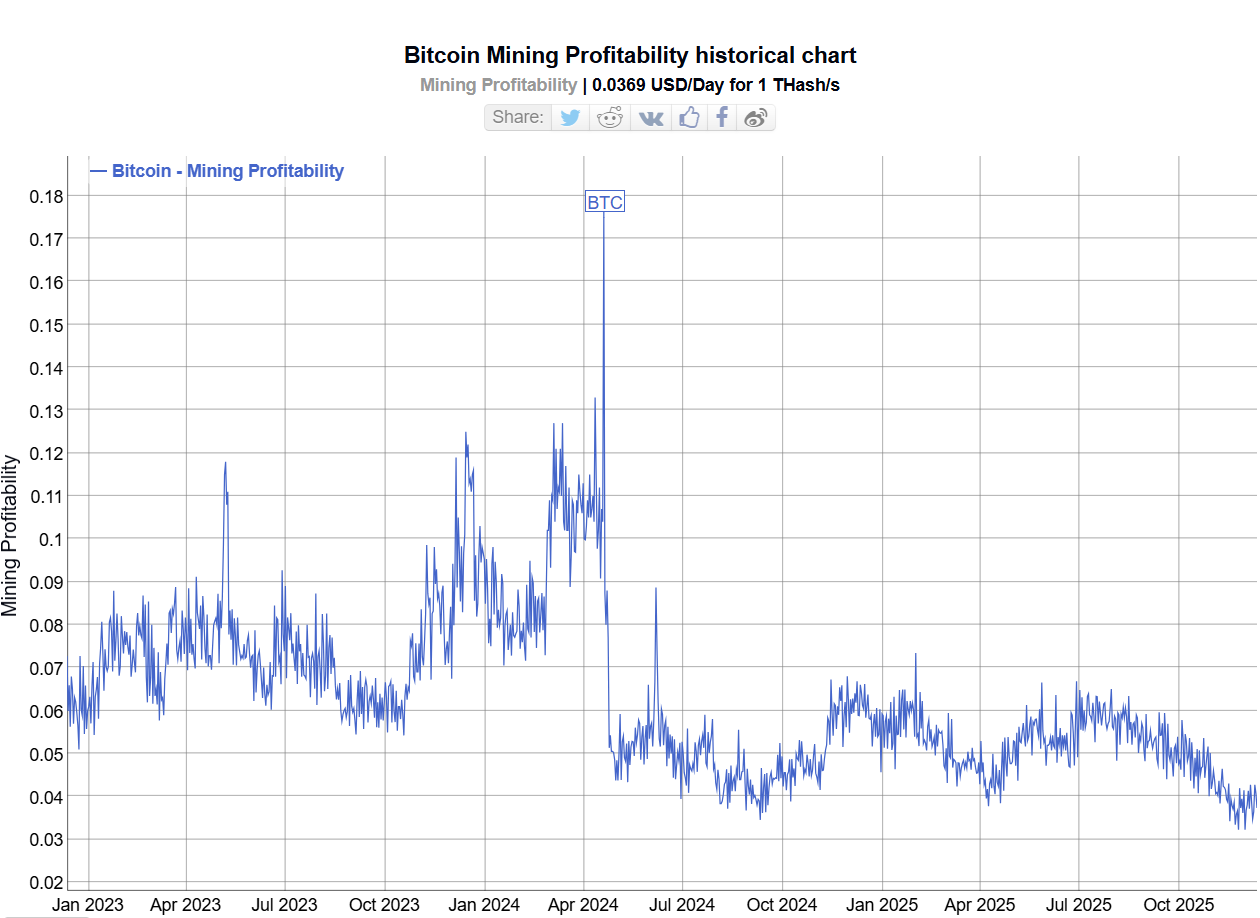

Bitcoin price still plays a disproportionately large role. But 2025 did not produce the spike that many in the industry had expected, or that typically occurs in the year following a halving.

Instead, Bitcoin rose in a more cautious manner, climbing the ladder until it peaked above $126,000 in October. Whether it marked a cycle high remains an open question.

However, volatility has a clear impact on miners' profits. According to data from TheMinerMag, hash prices have fallen from an average of about $55 per petahash per second (PH/s) in the third quarter to near $35/s, which the magazine describes as a “structural low.”

Adding to the burden, the average Bitcoin mining cost rose steadily throughout 2025, reaching around $70,000 in the second quarter, further compressing profit margins for operators already working to lower hash prices.

The decline largely mirrored the sharp correction in Bitcoin's price, which fell from its high to below $80,000 in November. If Bitcoin enters a broader downturn, the pressure on miners could continue into 2026, a pattern seen in previous post-halving cycles, but there is no guarantee it will repeat.

Over the past three years, the profitability of Bitcoin mining, measured by revenue per unit of hashpower, has trended downward, reflecting the post-halving revenue compression and increased difficulty. sauce: bit information chart

AI, HPC, and integration will reshape the mining environment

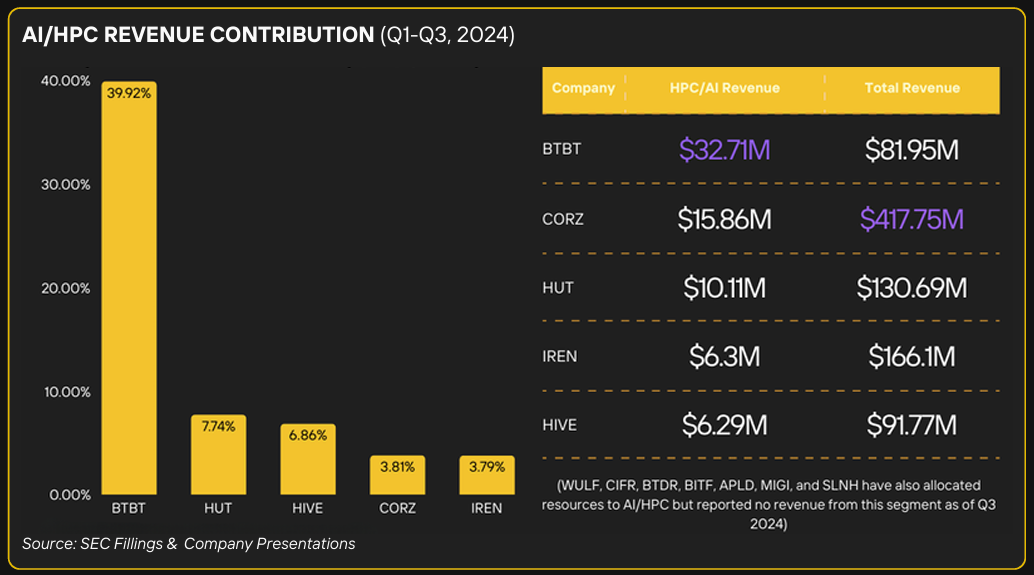

Publicly traded Bitcoin miners no longer position themselves as just Bitcoin companies. Beyond block rewards, more and more companies are describing their businesses as digital infrastructure providers, reflecting broader strategies to monetize power, real estate, and data center capabilities.

One of the earliest movers was HIVE Digital Technologies, which began pivoting part of its business toward high-performance computing in 2022 and reported HPC-related revenue the following year. At the time, this strategy stood out in an industry that was still primarily focused on expanding hashrate.

Since then, a growing number of public miners have followed suit, repurposing or informing plans to repurpose parts of their infrastructure for GPU-based workloads related to artificial intelligence and HPC. These include Core Scientific, MARA Holdings, Hut 8, Riot Platforms, TeraWulf, and IREN.

The scale and implementation of these efforts vary widely, but taken together they represent broader changes across the mining sector. With margins under pressure and competition increasing, many miners are now looking at AI and computing services as a means to stabilize cash flow, rather than relying solely on block rewards.

By 2024, AI and HPC are already generating significant revenue for some miners. sauce: Digital mining solution

This change is expected to continue until 2026. This builds on the consolidation trend for 2024 by digital asset investment and advisory firm Galaxy, which shows a growing wave of mergers and acquisitions among mining companies.

Related: Texas grid is heating up again, but this time it's not Bitcoin miners but AI

Bitcoin mining stocks: volatility and dilution risk

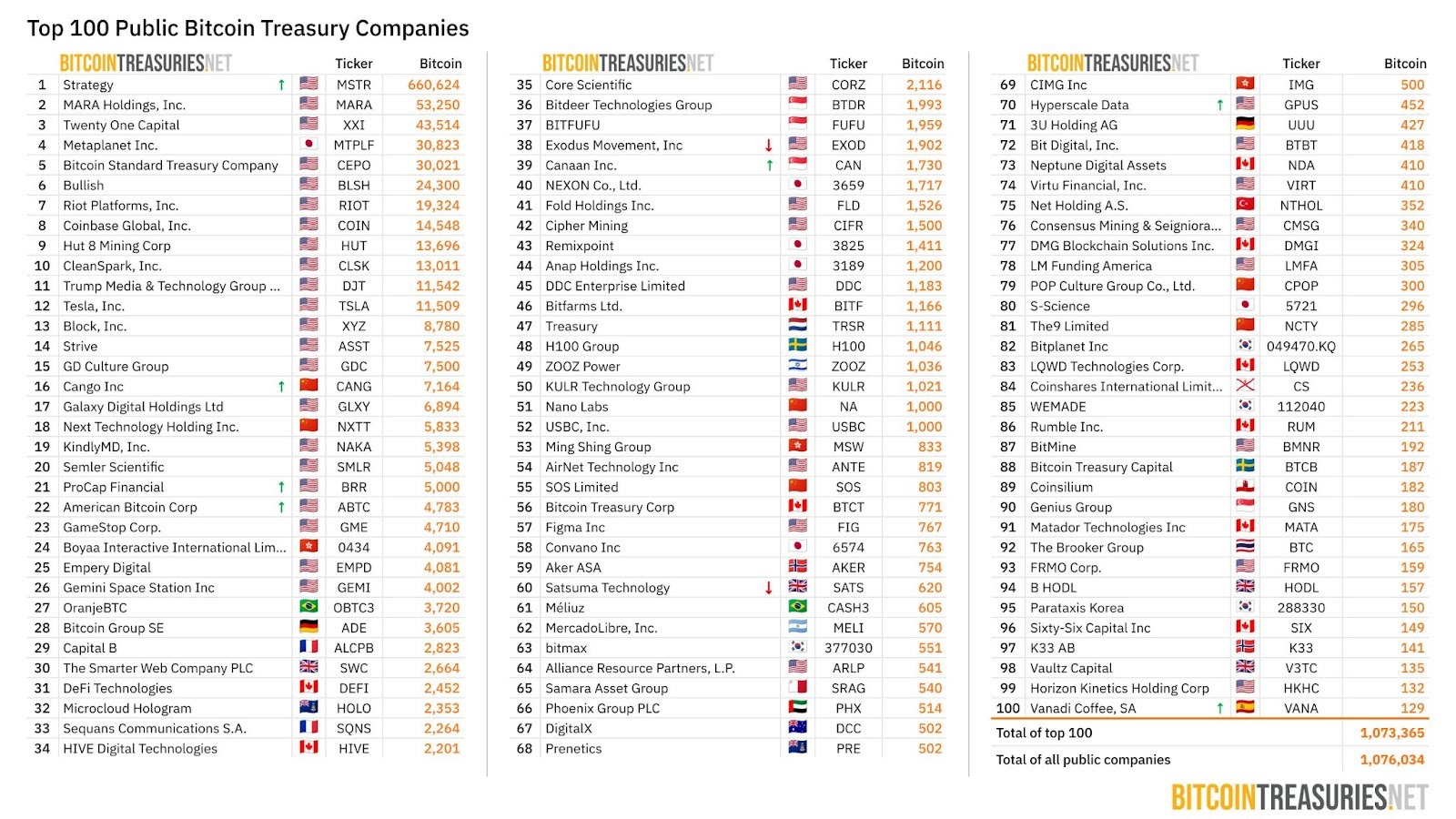

Public Bitcoin miners play an outsized role in the market, not only by securing the network but also by emerging as some of the largest corporate holders of Bitcoin. Over the past few years, many publicly traded miners have moved beyond a pure operating model and started treating Bitcoin as a strategic balance sheet asset.

As Cointelegraph reported in January, more miners are adopting a more cautious Bitcoin financial strategy by holding on to a portion of the BTC they mine, taking a cue from Strategy's Michael Saylor's strategy. By the end of the year, miners ranked among the largest public Bitcoin holders, with MARA Holdings, Riot Platforms, Hut 8, and CleanSpark all in the top 10 by total BTC holdings.

Bitcoin's largest publicly traded financial company. sauce: BitcoinTreasuries.NET

However, that exposure increased the risk of volatility. As Bitcoin prices fluctuate, miners holding large amounts of BTC treasury experience amplified balance sheet fluctuations, similar to other digital asset treasury companies that have been strained by the market decline.

Mining stocks also face persistent dilution risk. The business remains capital-intensive, requiring continued investment in ASIC hardware, data center expansion, and debt service during downturns.

As operating cash flow tightens, miners have frequently turned to equity-linked financing, such as at-the-market (ATM) programs and stock offerings, to maintain liquidity.

Recent fundraising efforts highlight this trend. Several miners, including TeraWulf and IREN, are using the debt and convertible bond markets to strengthen their balance sheets and fund various growth plans.

Bitcoin mining companies across the industry raised billions of dollars through debt and convertible bond issuance in the third quarter alone, extending a funding pattern that gained momentum in 2024.

Looking ahead to 2026, dilution risk is likely to remain a key concern for investors, especially if mining margins remain compressed and Bitcoin enters a bear market.

Operators with higher break-even costs and aggressive expansion plans may continue to rely on equity-linked capital, while those with lower break-even costs and stronger balance sheets will be better positioned to limit shareholder dilution as the cycle matures.

Related: Google acquires 14% stake in Bitcoin miner TeraWulf, becoming its largest shareholder