Alternative inflation data shows a sharp cooling in U.S. prices, strengthening the case for rate cuts and having broader implications for risk assets, including cryptocurrencies.

Real-time inflation data suggests policymakers may be out of sync with rapidly improving price conditions, after the Federal Reserve paused interest rate cuts last week and signaled there was no clear path to lower rates in the near term.

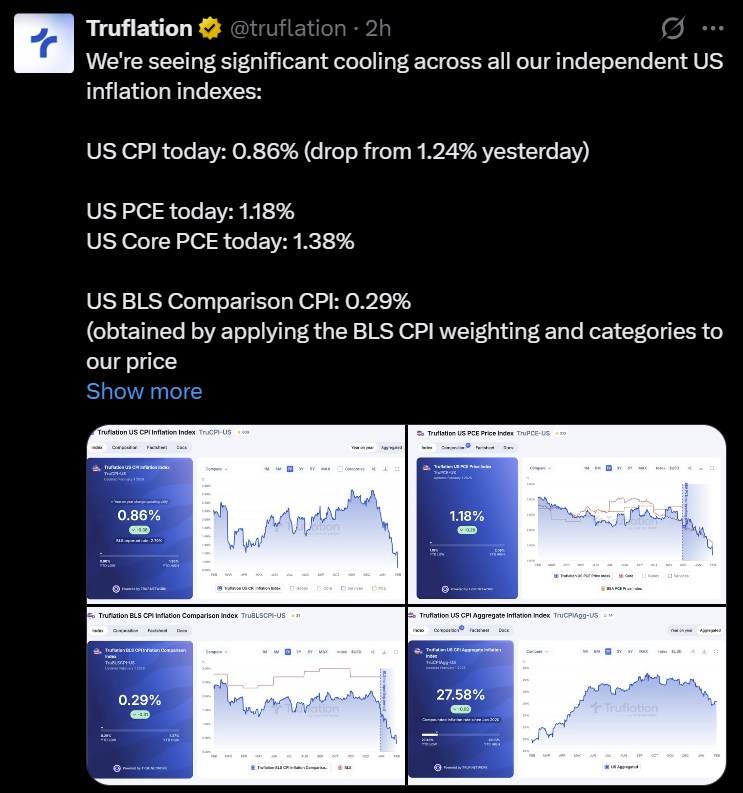

Truflation, an alternative inflation tracker that aggregates millions of price points daily from dozens of independent data providers, showed widespread cooling across its U.S. inflation index.

As of Sunday, the U.S. Consumer Price Index (CPI) for truffles was 0.86% year over year, down from 1.24% the day before.

The platform's measure of core personal consumption expenditures (PCE), the Fed's preferred measure of inflation, came in at 1.38%, well below the central bank's 2% target.

sauce: Torflation

“All of our indexes are calculated daily as a year-over-year percentage using millions of data points from dozens of data providers,” Torflation said Sunday.

This figure is in sharp contrast to official government data, which showed annual CPI at 2.7% in December and core PCE at 2.8% in November.

As Cointelegraph recently reported, the Fed's interest rate trajectory has significant implications for the US dollar, global liquidity conditions, and financial markets. Interest rate cuts are widely seen as a headwind for the dollar, whose movements have historically supported risk assets such as Bitcoin (BTC) and the broader crypto market.

Related: 2026 Investment Strategy for Cryptocurrency: Bitcoin, Stablecoin Infrastructure, and Tokenized Assets

US dollar is stuck

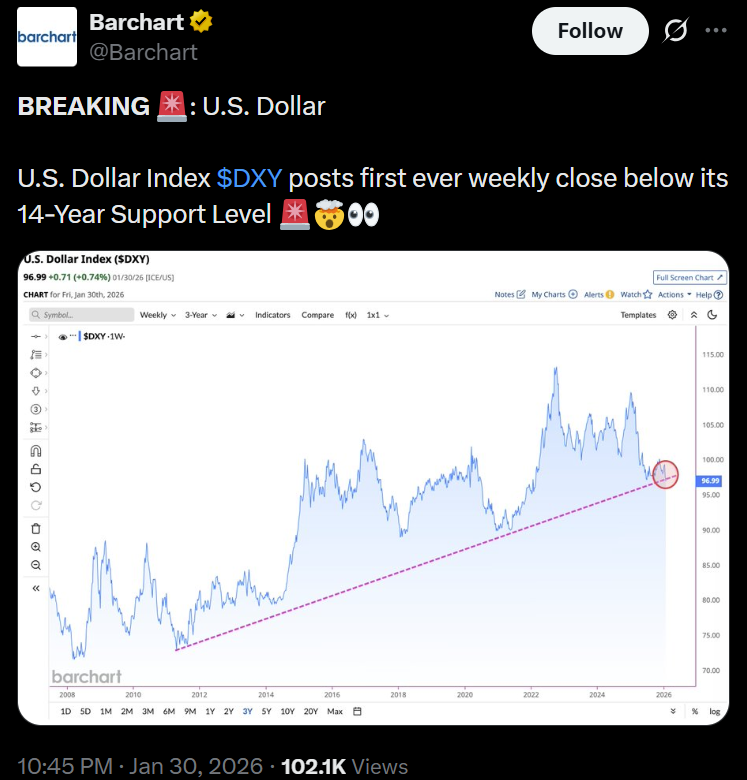

Recent market signals suggest the U.S. dollar may be nearing a tipping point, with technical and structural factors increasingly shaping its trajectory beyond Fed policy alone.

The U.S. Dollar Index, which tracks the dollar's performance against a basket of six major currencies, recently closed the week below long-term support, where it has held for more than a decade, according to data from BarCharts. This move could signal further downside risks if the breakdown continues.

sauce: bar graph

Macro investors have long argued that a weaker dollar is not only acceptable but desirable under the current circumstances. Raul Pal, founder of Real Vision, previously said that “everyone needs and wants a weaker dollar to pay down dollar debt,” especially in a global system that relies heavily on dollar debt.

Pal also argued that a weaker dollar would tend to ease financial conditions and support global liquidity, so it would be consistent with the Trump administration's broader growth goals, including goals related to fiscal and industrial policy.

Related: Gold is acting like the hedge Bitcoin promised