Past price comparisons between Bitcoin (BTC) and Gold suggest that cryptocurrencies could rise 35% in the fourth quarter.

In particular, an analysis by Ted Pillows projects a major upward movement in Bitcoin, suggesting that digital assets can reflect gold's historic breakout patterns. If the analogy holds, BTC could trade above $160,000 by the fourth quarter, he said in a July 26th X post.

The comparison is based on an analysis of gold and bitcoin market behavior, identifying stages of accumulation, distribution and re-accumulation before each asset enters a strong gathering.

In particular, rallies of gold ranging from under $2,000 to over $3,300 continued into a long-term re-accumulation phase. According to Pillow, Bitcoin appears to be nearing the end of a similar structure.

Analysts have proposed that the Bitcoin market cycle is currently moving from re-accumulation to the rally phase. This final leg could significantly boost cryptocurrency prices and exceed $160,000 by the end of the year.

It is worth noting that Gold delivered outstanding performance in 2025, as investors relied on precious metals for the appeal of a safe haven, amid growing concern over a potential recession.

There is a real possibility that Bitcoin will reach these levels, especially since some analysts argue that retaining key technical metrics is essential to its success. For example, as reported by Finbold, Crypto Trading expert Ali Martinez noted that as long as Bitcoin is above the $110,000 spot level, there is room for a new all-time high of $130,000.

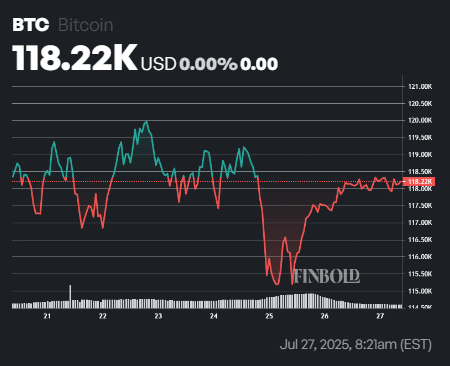

Bitcoin price analysis

As of press time, Bitcoin was valued at $118,216, recording a modest profit of less than 0.1% over the past 24 hours. However, over the past seven days, BTC has declined by 0.45%.

Meanwhile, Bitcoin's technological structure remains bullish, with the 50-day Simple Moving Average (SMA) at $110,580 and the 200-day SMA at $90,392, which will go up if the current price exceeds them.

The 14-day relative strength index (RSI) stands at 60.43, indicating that the market is approaching overbought conditions but has not yet reached it.

Featured Images via ShutterStock