With Crypto Market beginning with an astonishing recovery in October, Ethereum (ETH) is leading the $4,500 level to support nearly two weeks later. Some analysts predict that breakouts from this critical area could set the stage for a 50% large gathering in the fourth quarter.

Ethereum retests the following major resistances

Ethereum bounced back 17% from last week's lowest and retested and retrieved the next important level. Cryptocurrency began this week with a recovery from a recent market correction, bringing its price to a weekly low of $3,815.

Since then, Altcoins' King has regained the intermediate zone of the macro range and has broken past the main sales wall, located at the $4,200-$4,300 level. In this performance, Market Watcher Ted Pillow emphasized that he will regain the next two major levels of resistance before the new all-time high (ATH) reaches $4,500 and $4,750.

Similarly, Ali Martinez detailed the $4,505 area “is one of the most important resistance levels for monitoring Ethereum.” Rejection from this major level could lead to a retest of $4,250 support, and if ETH breaks under it, a new price drop could be a risk risk.

Previously, some analysts warned that losing this area could allow gates to be opened for new failures towards low macro range. On the contrary, regaining $4,500 in resistance will set the foundation for the high-value challenges of the $4,800 level macro range over the coming weeks.

Market Watcher Lluciano pointed out that ETH appears to have been forming triangle formation since early August. He suggested that if he escaped this pattern, he could start a rally to a new high above the $5,000 barrier, saying, “The Q4 is here and the ETH New Wave is imminent.”

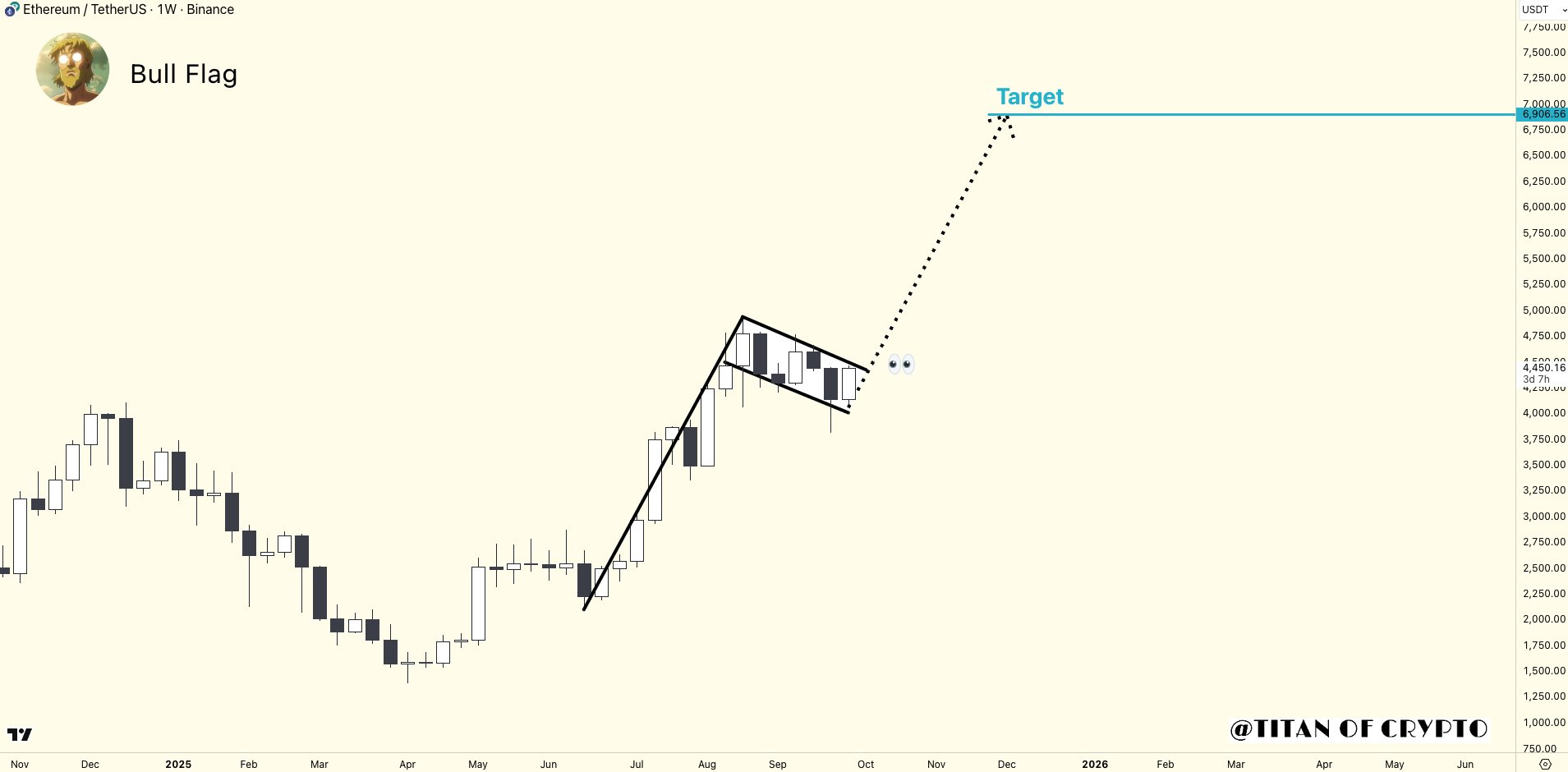

Meanwhile, Titan from Crypto highlighted the weekly bull flag pattern formed on ETH charts. A breakout from the formation cap, an area of $4,500 can send prices to 50% of the rally towards the $6,900 mark, according to analysts.

ETH weekly closings can “turn it all around.”

After closing the $4,100 area in September, analyst Rekt Capital confirmed that Ethereum may be developing a monthly bull flag within this macro range. He explained that cryptocurrency must reclaim $4,200 in a higher time frame to continue to be built on formation bases.

In particular, closing months below this level means that technically there will be a bearish retest position for ETH despite current bounces.

Despite this, Rekt Capital believes that “the monthly deadlines weren't very appealing, but the price should exceed $4.2K to exceed $4.2,000 per week.”

He noted that cryptocurrency performed similarly in late 2021 and this July, closing weekly beyond this level and retesting support after breakout. This technology sequence allowed the price to regain the $4,600 area and to be at a new high.

“If ETH can quickly close blue every week and return to support, there's a good chance to sign up for $4.6K in the future,” he concluded.

At the time of writing, Ethereum is trading at $4,502, an increase in daily time frame by 4.1%.

Unsplash.com featured images, tradingView.com charts