Ethereum’s long-term trajectory has come back into focus after Arthur Hayes published a comprehensive forecast of Ethereum’s institutional future, price potential, and competitiveness.

His comments arrive as Ethereum trades near $3,200, having fluctuated between $3,060 and $3,440 over the past week. Major companies such as Tom Lee's Bitmine have also increased their Ethereum holdings at an unprecedented pace.

Ethereum becomes the institutional default

Hayes believes the market still misunderstands how deeply traditional institutions intend to integrate Ethereum. He argues that after years of failed experiments with private blockchains, banks are now recognizing the need for a public payments layer.

“These organizations finally realized: You cannot have a private blockchain. Must use public blockchain for security and real-world usage” he said.

He links this change to the stablecoin boom, which has forced banks to embrace the value of on-chain payments.

According to Hayes, Ethereum is positioned as the only platform with the security, liquidity, and developer depth that institutions need.

He expects this change to drive a strong recovery in Ethereum's price in the next cycle, complementing aggressive capital accumulation by companies like Bitmine.

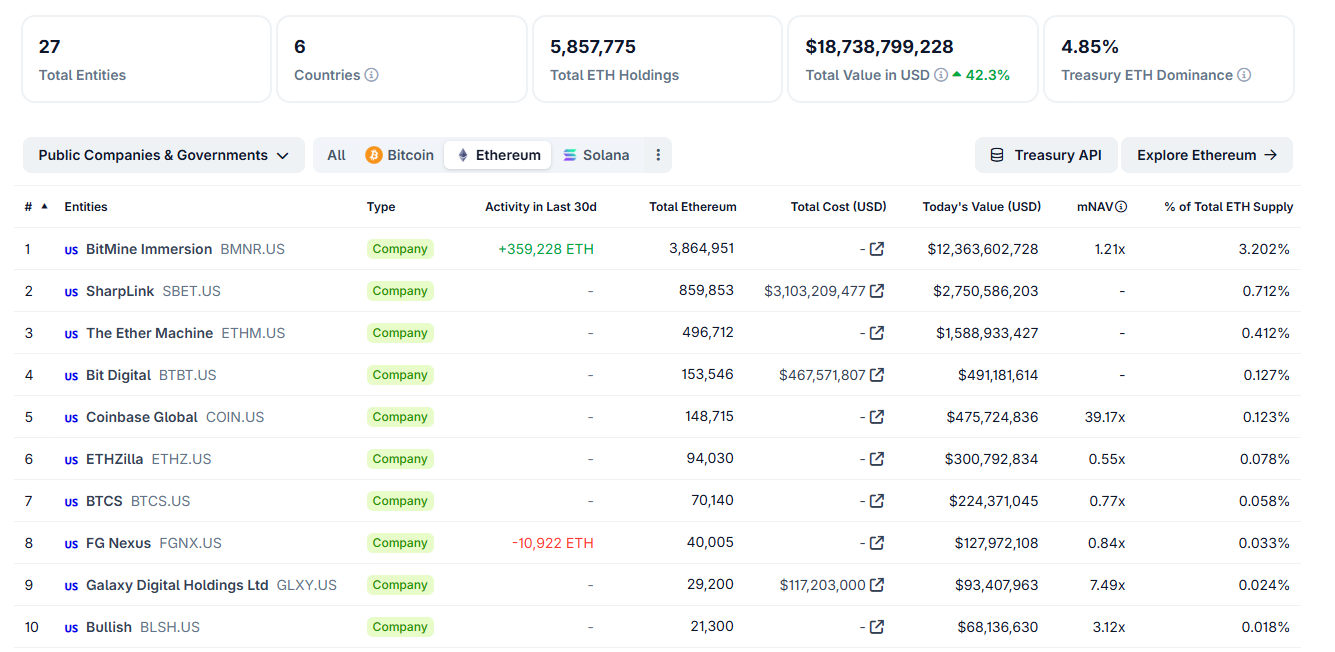

BitMine purchased 33,504 ETH ($112 million) this week and 138,452 ETH (approximately $435 million) in early December, for a total of approx. 3.86 million Ethereum. Accumulations of this magnitude reinforced the narrative that institutions are positioning themselves for Ethereum's next major cycle.

Ethereum government bonds hold nearly 5% of the ETH supply. Source: CoinGecko

Privacy remains Ethereum's biggest weakness, but L2 will cover it

Hayes acknowledged that Ethereum still lacks the privacy guarantees that large institutions seek. He notes that this is “the biggest thing Ethereum doesn't have yet,” but says Vitalik Buterin's roadmap is actively working on this.

Despite this gap, he insists that institutional implementation will not be delayed. Instead, companies will implement privacy features. layer 2 network It relies on Ethereum for payments.

He believes Ethereum L1 will remain the “security foundation” regardless of whether the activity occurs on L2 like Arbitrum or Optimism.

He said that “there may be a need to discuss how fees are distributed between L2 and Ethereum L1,” but stressed that this does not change the underlying reality. This means institutions will still use Ethereum to secure their operations.

This is consistent with current ecosystem trends. Exchange balances are at their lowest level in years, with whales accumulating more than 900,000 ETH in recent weeks, according to Santiment data.

Even though fees are coming down amid the L2 transition, the institutional architecture continues to be formed around Ethereum’s base layer.

Narrow field winners: Ethereum in 1st place, Solana in 2nd place

Hayes sees the future of public blockchains as being consolidated around very small groups. He has Ethereum as the clear long-term winner, with Solana in a distant but solid second place.

He attributes Solana's rise from $7 to $300 to the meme coin's high activity in 2023 and 2024. However, he said Solana “needs new tricks” to outperform Ethereum again.

While he expects Solana to remain relevant, he doesn't expect it to match Ethereum's institutional role or long-term price strength.

Hayes believes that nearly all other L1s are structurally weak. He dismissed high-FDV chains like Monad as overinflated projects likely to collapse after the initial pump.

“Monad will not be able to compete with Ethereum”

I do not believe this is a legitimate blockchain.

It will never actually be used. ”

— Arthur Hayes

If you understand network effects, you can see that Ethereum continues to be on top.

The monad solution is simple: build on… pic.twitter.com/EuXpU6VK1N

— rip.eth (@ripeth) November 29, 2025

With 50 ETH you can become a millionaire by the next election

When asked how much ETH it would take to become a billionaire in the next cycle, Hayes gave the clearest numerical prediction.

He said Ethereum can reach $20,000imply that 50 ETH will be enough to achieve a 7-digit portfolio.

BitMex founder expects this target price to materialize By the next US presidential election. His outlook is consistent with the current supply environment. Exchange reserves are dwindling, institutional investors are accumulating, and government bond buyers like Bitmine continue to invest hundreds of millions of dollars into ETH.

Arthur Hayes was just asked about Tom Lee's statement that $ETH could reverse $BTC.

He said Ethereum is the best L1 with the most developers, the best DeFi, and the strongest talent. pic.twitter.com/EsQ74JpNRV

— SamAlτcoin.eth 🌎 (@SAMALTCOIN_ETH) October 21, 2025

If Ethereum fails to live up to these expectations, it will be because of a broken narrative, Hayes said.

Bitcoin could also outperform Ethereum over the long term if stablecoin usage slows or financial institutions withdraw from on-chain transactions.

However, he argues that the current market structure favors Ethereum's long-term advantage, especially as banks prepare to implement Web3 strategies on public infrastructure.

The post Arthur Hayes predicts Wild Ethereum in 2026 and beyond appeared first on BeInCrypto.