Bitcoin (BTC) has risen 3% since the beginning of May after an increase of 14% in April.

The inflow into BTC Exchange-Traded Funds (ETFs) has accelerated over the past two weeks, but the consistent Bitcoin Treasury accumulation continues to support the market.

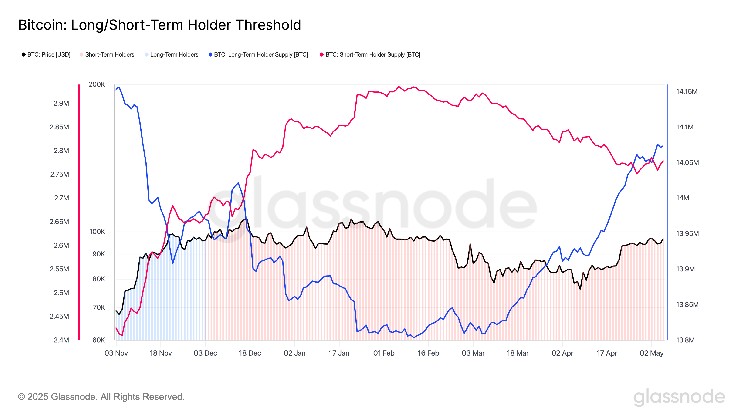

From a chain perspective, GlassNode data shows that both Short-Term Holders (STH) and Long-Term Holders (LTHS) have increased their supply holdings since early March, and STH has begun to accumulate over the past week.

GlassNode defines LTHS as an investor with BTC held for more than 155 days, with STH holdings less than 155 days. GlassNode notes in its latest weekly report that LTHS has increased its total cohort supply to 14 million BTC since the beginning of March.

“This suggests that some confidence has returned, suggesting that accumulation pressures will outweigh the tendency of investors to use and eliminate risk,” GlassNode said.

STH often acts against LTHS, but they have also shown signs of new accumulation, adding over 25,000 BTC over the past week. This is a reversal from the net distribution of over 200,000 BTC that began in February 2025, coinciding with the onset of a 30% drawdown for Bitcoin.

With BTC currently flirting at the $97,000 level, this broad accumulation indicates a recovery in confidence across the investor cohort. However, according to GlassNode data, GlassNode identifies a major resistance level of $99,900 at $99,900.

“So we can predict that as the market approaches this zone, sell-side pressure will rise, which could require significant buy-side demand to absorb the distribution and maintain upward momentum.”

Read more: Is the Giant Bitcoin Bull running first? Two chart patterns reflect BTC gatherings at $109,000