ETH prices appear to be poised even further upward as they show investors withdrawing record amounts from the exchange.

summary

- Despite failing to break into the $4,800 level on two tries, ETH prices continue to form a higher low, keeping the uptrend intact.

- The balance of exchange flux in ETH has been transformed into negative for the first time in history, indicating a strong accumulation.

Ethereum (ETH) prices have recently faced another denial at the $4,800 level, despite a temporary peak at $4,957 on Sunday. However, ETH continues to form highs and continues to remain the upward trend market structure as it currently integrates beyond its horizontal support of $4,200 and maintains its previous high at $4,060.

Technically, the Bulls are maintaining price action beyond the 20-day EMA, with the 7-day EMA standing above the 20-day EMA showing short-term bullish momentum. If Bulls can push ETH prices ahead of the $4,500 $4,500 level and then push for a $4,800 resistance, then ETH prices could retest their recent highs nearly $5,000 and rise even further.

Source: TradingView

You might like it too: Synthetix (SNX) price risk decreases by 10%.

why ETH prices are ready to rise even further

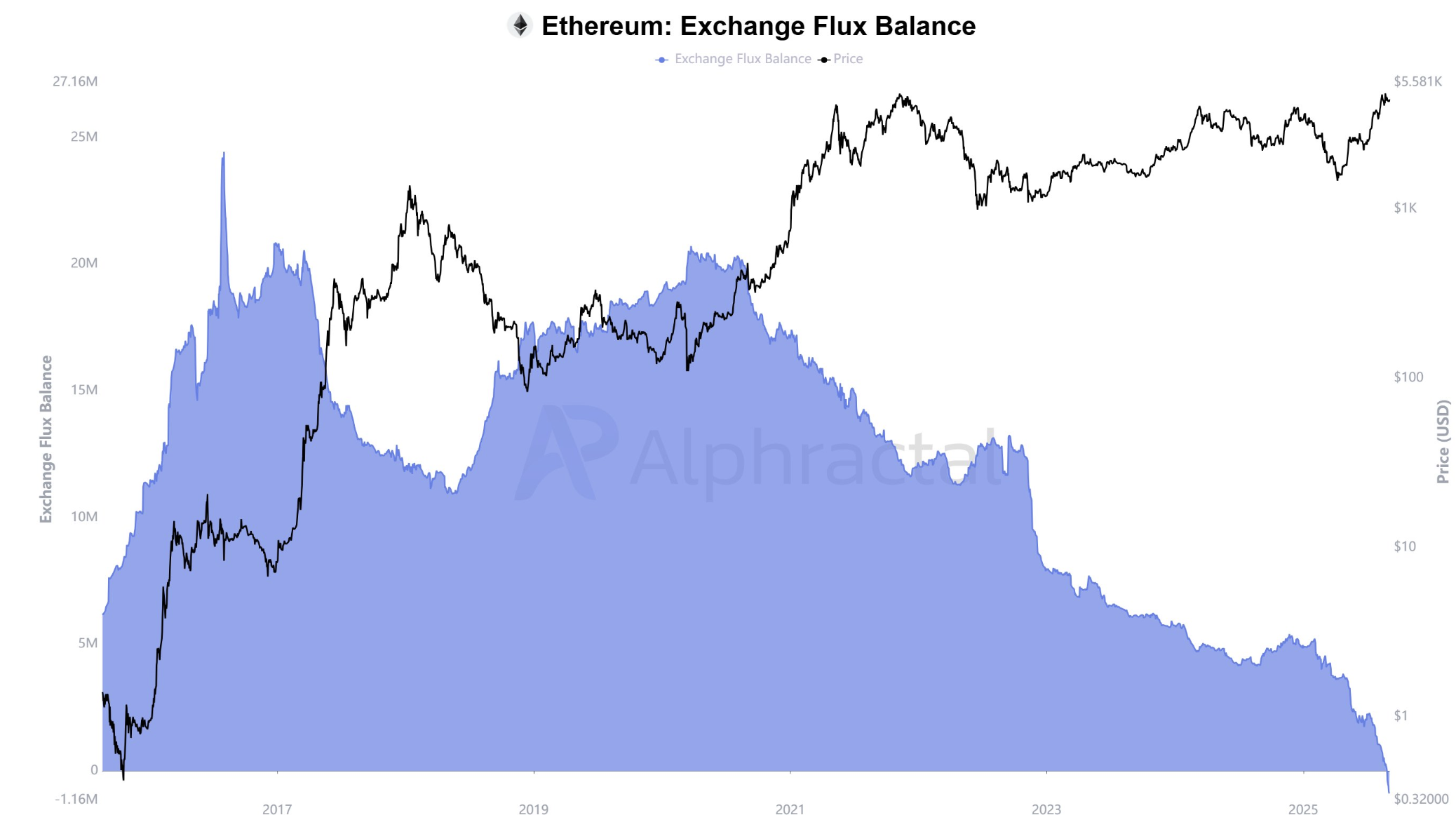

According to Joao Wedson, founder and CEO of Alphractal, ETH's exchange flux balance has become negative for the first time in its history. Exchange Flux Balance tracks the accumulated net flow of assets across all exchanges over time, summing daily inflows and outflows.

Negative measurements show that more Ethereum is withdrawn from the exchange than deposits, indicating that investors are moving their holdings to private wallets for long term storage, rather than staying on an exchange where possible sales are possible.

You might like it too: Boerse Stuttgart launches its first pan-European blockchain payment platform