- DEX celebrates surpassing $100 million in total amount locked.

- Reflecting investor enthusiasm, the AVNT token rose over 60% the previous day.

- Avantis is targeting $500 million in TVL, hinting at future revenue consolidation.

Cryptocurrencies have since recorded mixed performance Monday's meeting.

After hitting a high of $111,600, Bitcoin fell back below $110,000.

While the altcoin market remained somewhat depressed, Avantis made headlines with its native token rising an impressive 60% on the 24-hour price chart.

AVNT rose from the daily price of $0.4703 to an intraday high of $0.7611, representing an increase of approximately 61.86%.

The bullish sentiment comes as Avantis seeks a defining moment in its enduring decentralized trading journey.

The DEX team brought this to X to celebrate the total amount locked exceeding $100 million.

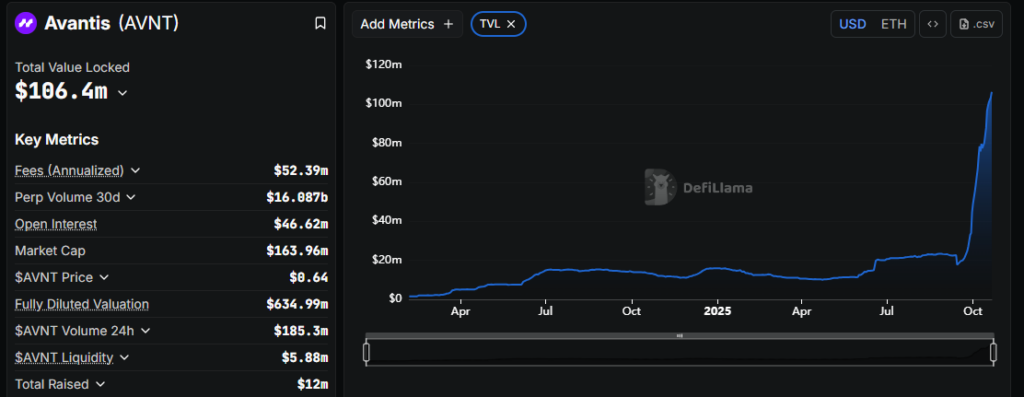

This milestone has upset the cryptocurrency community as it reflects growing confidence in DeFi projects.

Additionally, this jump follows TVL's solid growth since the middle of last month and likely confirms the general trend of perpetually decentralized exchanges gaining momentum.

Avantis has established itself as a leading project for efficient yield generation.

Meanwhile, the results sparked optimism and fueled a surge in AVNT within hours of the announcement.

Avantis simplifies passive income generation

DEX announces Avantis USDC (avUSDC) increased liquidity a week ago, increasing earning potential for DeFi enthusiasts.

Precisely, a single stablecoin vault allows users to benefit from PERP yields without having to trade or manage complex strategies.

This approach likely resonated with both experienced and new participants and contributed to Avantis' recent upward trajectory.

avUSDC allows people to generate passive income similar to a compound interest savings account. The team said:

Avantis USDC (avUSDC) simplifies access to perpetual yield, allowing anyone to become a passive market maker.

Avantise's bright future

While the total amount locked exceeds $100 million, which is impressive, the DEX remains focused on the future.

DeFiLlama data is as follows Avantis has a TVL of $106 million with a target of $500 million.

The team emphasized that the path to TVL of $500 million continues.

We focused on AvantisUSDC's composable yield integration and highlighted innovative yield as a key catalyst for this growth.

This includes ensuring compatibility between DeFi platforms and Avantis' revenue system to increase revenue opportunities for users.

Such integration could make avUSDC more compatible with a variety of decentralized applications (dApps), increasing its versatility and adoption.

AVNT price outlook

The digital coin is trading at $0.7202 after falling slightly from its intraday high.

AVNT has seen its daily trading volume soar more than 580%, indicating renewed interest in Avantis.

Therefore, Alto Eye is trending further upwards.

If the current momentum continues, AVNT will hit the resistance level at $0.8739, paving the way to the $1 psychological zone.

The bulls are likely to extend to the $1.1849 target, which would represent an approximately 65% upside from Avantis’ market price.

Nevertheless, buyers need to sustain above $0.55-$0.60 to confirm bullish strength before overcoming higher resistance areas.