South Korea's central bank is considering returning to gold purchases for the first time since 2013, signaling a possible change in reserve management strategy.

The move comes amid rising demand for precious metals as investors seek protection from inflation and currency depreciation.

Bank of Korea reconsiders gold purchase

According to the latest data from the World Gold Council (WGC), as of October, the Bank of Korea held 104.4 tons of gold, ranking 41st in the world. The last time it increased its gold reserves was in 2013, ending a three-year buying spree that began in 2011.

During this period, the central bank purchased 40 tonnes in 2011, 30 tonnes in 2012 and 20 tonnes in 2013. Nevertheless, the decision drew domestic criticism as gold entered a prolonged price slump. The bank's timing sparked a huge backlash, contributing to its reluctance to re-enter the market.

Nevertheless, deteriorating macroeconomic conditions, accelerating inflation and a weaker currency have caused the bank to reconsider its previous stance.

Jung Heung-sun, head of reserve investment at Bank of Korea Reserve Management Group, announced the decision during an event held by the London Bullion Market Association and the London Bullion Market in Kyoto on Tuesday.

“The Bank of Korea plans to consider additional gold purchases from a medium- to long-term perspective,” he said.

Jung said the bank will monitor the market before deciding when and how much gold to buy. He added that any move would depend on the development of the country's reserves, the price of gold and the Korean won.

Global central banks lead gold accumulation

The Bank of Korea's renewed interest in gold comes amid a major reallocation of global reserves. In the first half of 2025, 23 countries increased their gold holdings.

In the second quarter, Poland gained 18.66 tons, Kazakhstan 15.65 tons, Turkey 10.83 tons, China 6.22 tons and the Czech Republic 5.73 tons. Additionally, BeInCrypto recently highlighted that for the first time since the mid-1990s, central banks hold more gold than US Treasuries.

especially, The bank is expected to purchase 900 tonnes of gold in 2025. The shift underscores the erosion of confidence in dollar-denominated assets amid U.S. budget deficits and trade tensions. Retail investors also echoed this trend, lining up at dealers to protect against currency depreciation.

Gold price volatility tests market sentiment

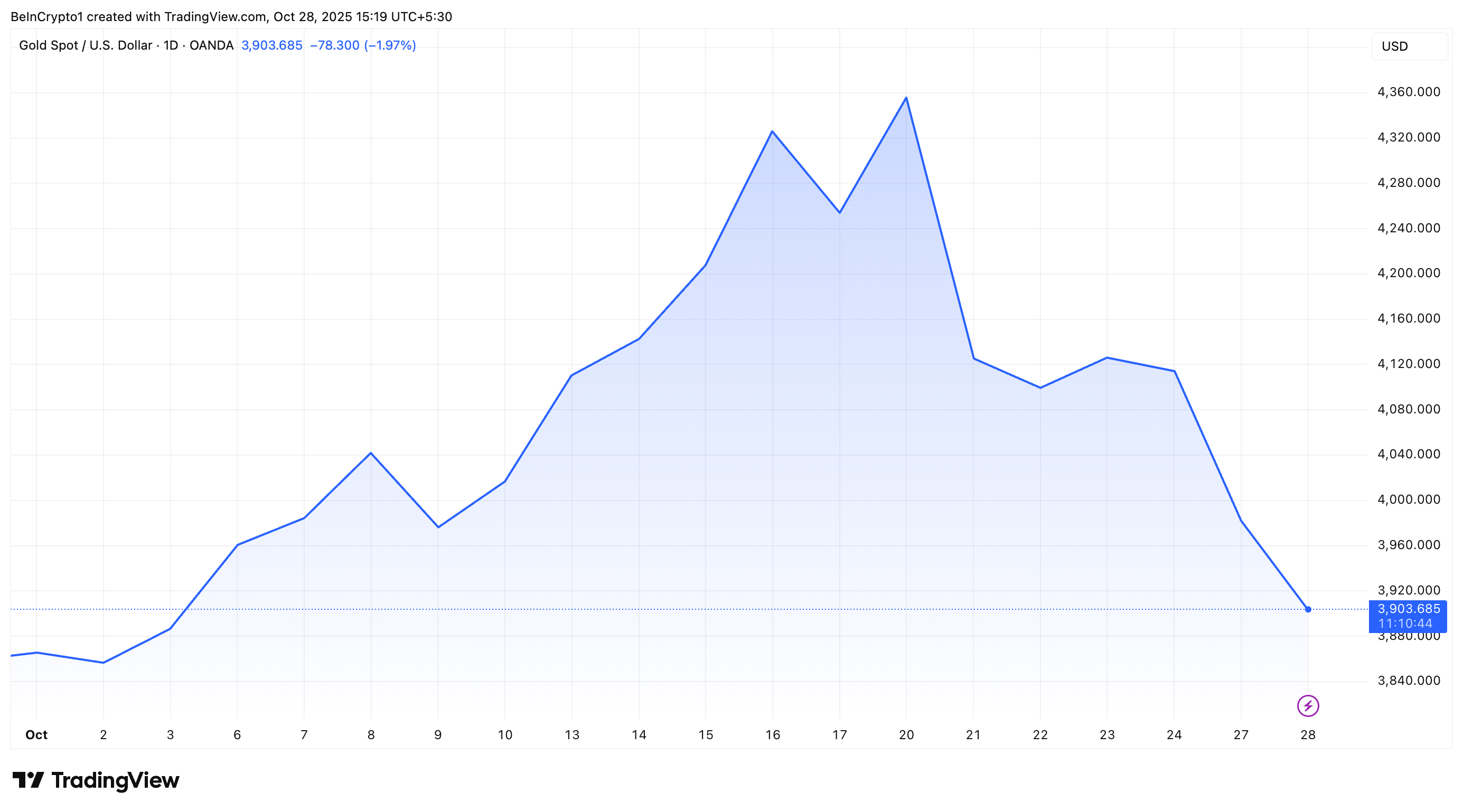

Meanwhile, rising global demand has pushed up gold prices, hitting an all-time high of $4,381 an ounce last week. However, modifications followed.

After hitting an all-time high, gold fell 6% in its worst single-day decline in 12 years, wiping out about $2.1 trillion in market value, BeInCrypto reported.

The decline continues, with the value of gold falling by 8.4% in the past week. Additionally, a downward trend yesterday pushed prices below $4,000 per ounce for the first time since October 13th.

Gold price performance. Source: TradingView

Nevertheless, some market experts remain optimistic about gold's comeback. Economist Steve Hanke described the decline as a buying opportunity and predicted the bull market would peak at $6,000 an ounce.

Analyst Rashad Hajiyev suggested that the current decline in gold prices is “necessary” before another big rally. He sees this drop as a way to weed out weak traders and set the stage for a strong move towards $5,500-$6,000.

“Gold is a great buy under $4,000, and silver is an even better buy under $47. Remember, it was only a week ago that gold was trading close to $4,400 and silver was trading above $54.40. These highs are probably not even close to the peak of this bull market,” added Peter Schiff.

gold

We're nearing the bottom https://t.co/rjO4oBgpzN pic.twitter.com/HLrod347AK

— Great Tuesday (@great_martis) October 28, 2025

The post Bank of Korea considers gold purchase after 12-year hiatus appeared first on BeInCrypto.