According to Chris Perkins, president of investment firm Coinfund, the Capital Requirements (BCBS) from the Board of Banking Supervision (BCBS) from the Basel Committee on Supervision (BCBS) creates “chokepoints” designed to narrow the growth of the crypto industry.

Current capital rules lower the bank's equity return ratio (ROE). It is an important profitability metric in banking, enforcing a higher reserve requirement to hold crypto, and told Cointelegraph that crypto-related activity is too high for banks.

“It's a different type of chokepoint in that it's not direct. It's a very subtle way to curb activity by making it very expensive for banks to do similar activities that they can't,” he added.

If we have a certain amount of capital we want to invest in, we will invest in a high ROE business rather than a low ROE business,” he continued.

In April, Perkins criticized banks for international settlements over its proposal to impose customer knowledge requirements (KYC) and other legacy bank regulations on distributed finance (DEFI) protocols and stubcoin, saying it violated core principles of permitted networks.

The true systematic risk of the financial system comes from the asymmetry that allows for real-time shifts of online, unauthorized, peer-to-peer, decentralized networks.

International Bank for Reconciliation remains opposed to crypto

International Village Bank (BIS), which serves as the central bank of the Sovereign Central Bank and organizes the BCBS conference, released a report in April claiming that Crypto could destabilize the financial system.

The authors of the report also argued that the growth in the crypto market exacerbated the wealth gap and prompted stricter government regulations accordingly.

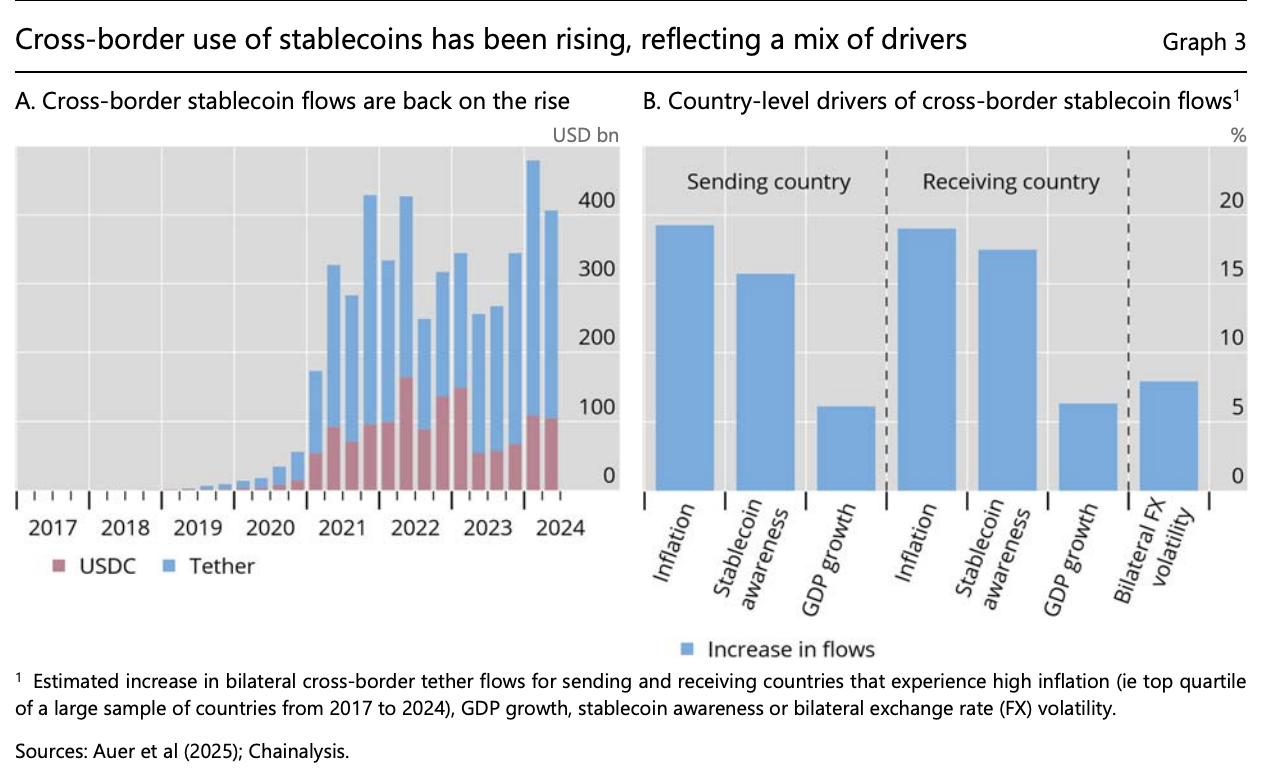

In June, BIS released a follow-up report entitled “Stablecoin Growth: Policy Challenges and Approachs.”

The cross-border use of stablecoins is growing. sauce: bis

“The rise in Stablecoins' market capitalization and increased interconnection with traditional financial systems have reached a stage where it can no longer be ruled out the potential ripple effects on that system,” the author of the report wrote.

BIS has repeatedly pushed for the adoption of central bank digital currency (CBDC) and other centralized digital technologies as an alternative to privately issued decentralized cryptocurrencies.