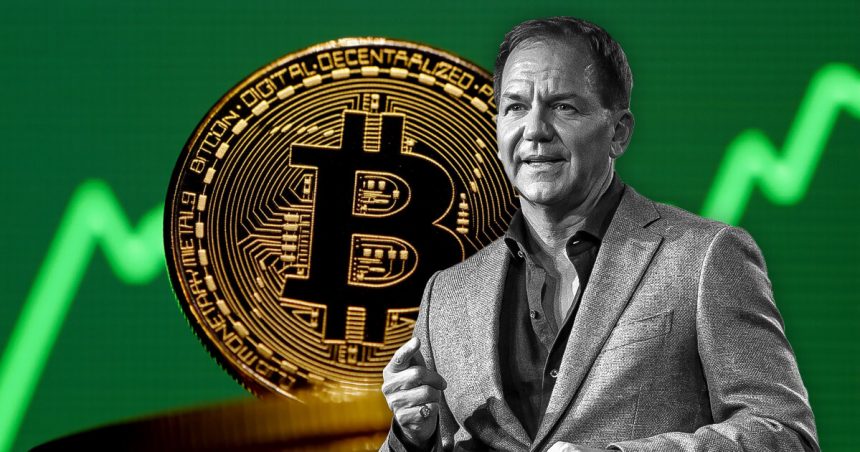

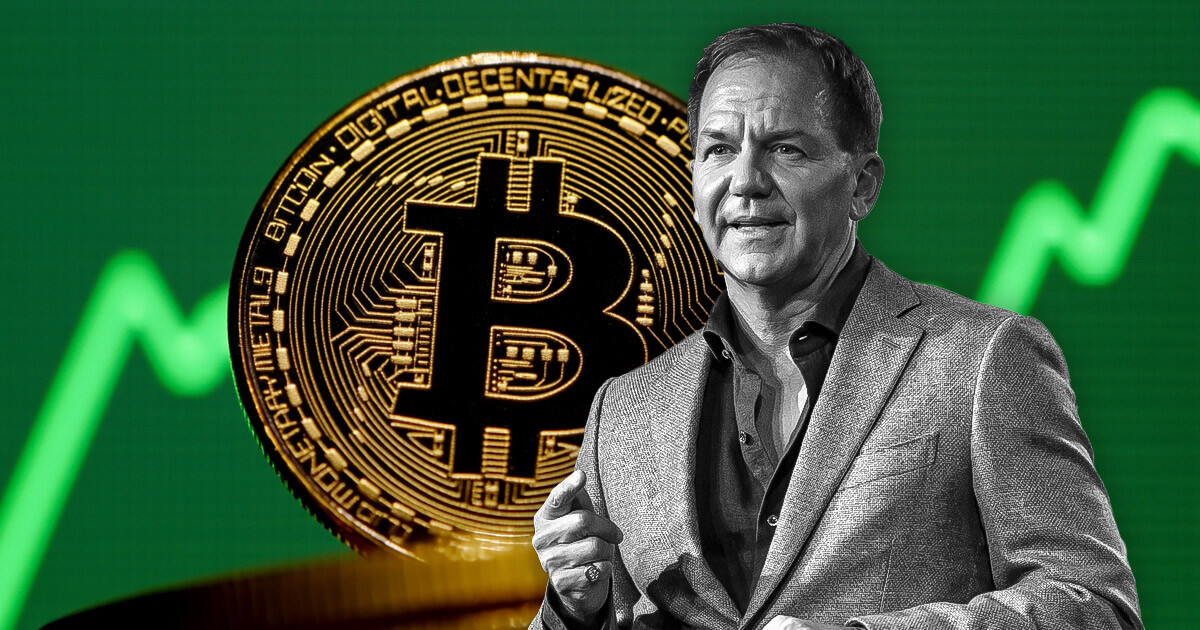

Billionaire hedge fund manager Paul Tudor-Jones reaffirms his preference for Bitcoin over gold as a hedge against inflation, and also shows optimism about market profits.

Jones, founder and chief investment officer of Tudor Investment Corporation, oversaw roughly $40 billion in assets while appearing on CNBC's Squawk Box on October 6th.

He said he maintains “single digits” exposure to cryptocurrencies in his portfolio. He added that the global financial system will “move into an increasingly digitalized world.” There, a fixed supply of Bitcoin provides an excellent protection against price increases.

He also said he sees a changing structural trend towards digitalisation and alternative financial systems. He describes Bitcoin as “very attractive” in the current macroeconomic environment and considers it to be superior to all other asset classes.

According to Jones:

“We are in a period that encourages massive price increases in a variety of assets.”

Jones compared the flagship code to gold. Gold is a long-standing safe seafarer's asset that has struggled to accommodate inflation-adjusted returns in recent years.

He said:

“Bitcoin will be a big hedge… gold has its role, but in a world of monetary stimulation and fiscal expansion, the fixed supply and decentralized nature of Bitcoin will lift the legs.”

He added that Bitcoin's appeal is more than just speculative, but is increasingly relevant as a portfolio diversifying device and inflation shield.

At the time of reporting, Bitcoin was trading at a new high of over $125,000. This is far from the initial value of less than a dollar in 2009. Limited supply, increased institutional profits and a global search for inflation-resistant assets have made it one of the most profitable investments in history.

Jones was one of the first major Wall Street figures to publicly support Bitcoin, and revealed his position in 2020, calling him “the fastest horse in the race” during an unprecedented financial stimulus by the central bank.

He also places emphasis on the broader market and told the hosts he hopes there will be room for the stock rally to run before it reaches what is called a “blow-off top.”