Binance, the world's largest cryptocurrency exchange, is facing widespread anger after users reported account freezes, failed stop-loss orders, and a flash crash that saw multiple coins drop to near zero, as markets reel from President Trump's increased tariffs.

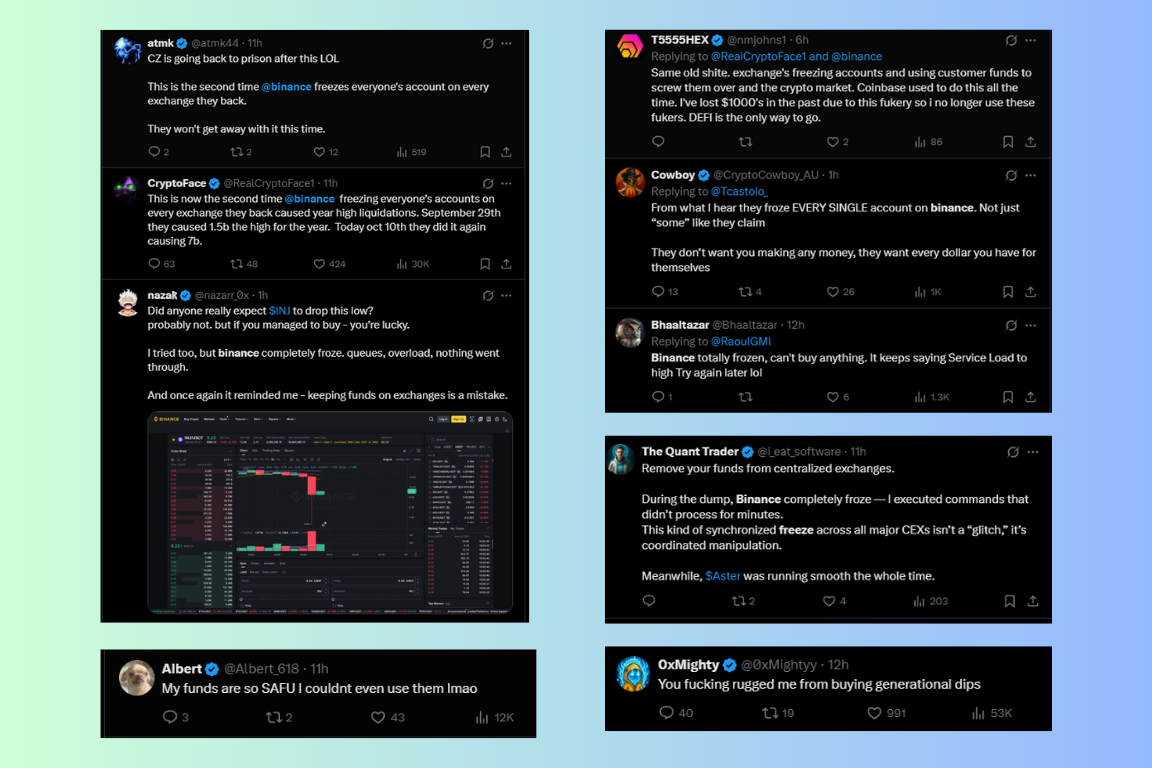

Social media was abuzz late Friday after traders claimed Binance's systems were locked up during the most intense wave of liquidations this year.

Multiple altcoins crash to zero on Binance

coins such as Engine (ENJ) and Cosmos (Atom) temporarily indicated that prices had plummeted to $0.0000 and $0.001respectively, before rebounding.

Some traders reported being unable to close or hedge their positions as losses skyrocketed.

Binance proves once again why they are the biggest scammer in the crypto industry

During the recent market crash, they completely froze user accounts, preventing traders from accessing their funds at critical moments. The limit order and stop loss functions were convenient… https://t.co/2KACQ9Ns6B pic.twitter.com/BA08yzezwT

— Cowboy (@CryptoCowboy_AU) October 11, 2025

Binance acknowledged the disruption, citing “intense market activity” that caused system delays and display issues, but assured users that “the funds are SAFU.”

However, users accused the exchange of market manipulation and argued that the freeze allowed Binance to profit during what some have described as the largest liquidation event in crypto history.

Some users may end up with negative balances due to market maker operations

We are actively working to ensure that everyone receives their fair share.

Don't celebrate yet. Bags can still go down by -90%

Thank you for your consideration in this matter.

— Ola Ξlixir (@thegreatola) October 10, 2025

Several prominent traders argued that: Binance has disabled limit and stop loss functionality At critical moments. Others claimed that both long and short positions were liquidated while the order book was frozen.

The tweet described widespread system overload and users being unable to execute trades for several minutes at a time.

Notably, Binance was not the only exchange to experience such outages and trading freezes. Coinbase and Robinhood reported similar issues.

Massive community backlash against Binance after yesterday's crypto market crash

However, this is not the first time Binance has faced such accusations. Some traders compared this to a similar incident earlier this year, when services suddenly went out at the same time as a large liquidation.

Critics are now calling on regulators to investigate exchanges' internal controls, while retail traders are renewing calls to move money away from centralized exchanges.

Binance is likely to go down It amplified the crash caused by President Trump's threat of 100% tariffs on China.had already wiped $200 billion from the global cryptocurrency market earlier in the day.

A combination of geopolitical panic and technological failure turned an already severe decline into a historic collapse.

For now, Binance says its systems are back online, but users continue to report delayed withdrawals and frozen P2P transactions. The company has not announced compensation for traders affected by the flash crash.

The post Binance faces intense backlash over market crash – and some claims are shocking appeared first on BeInCrypto.