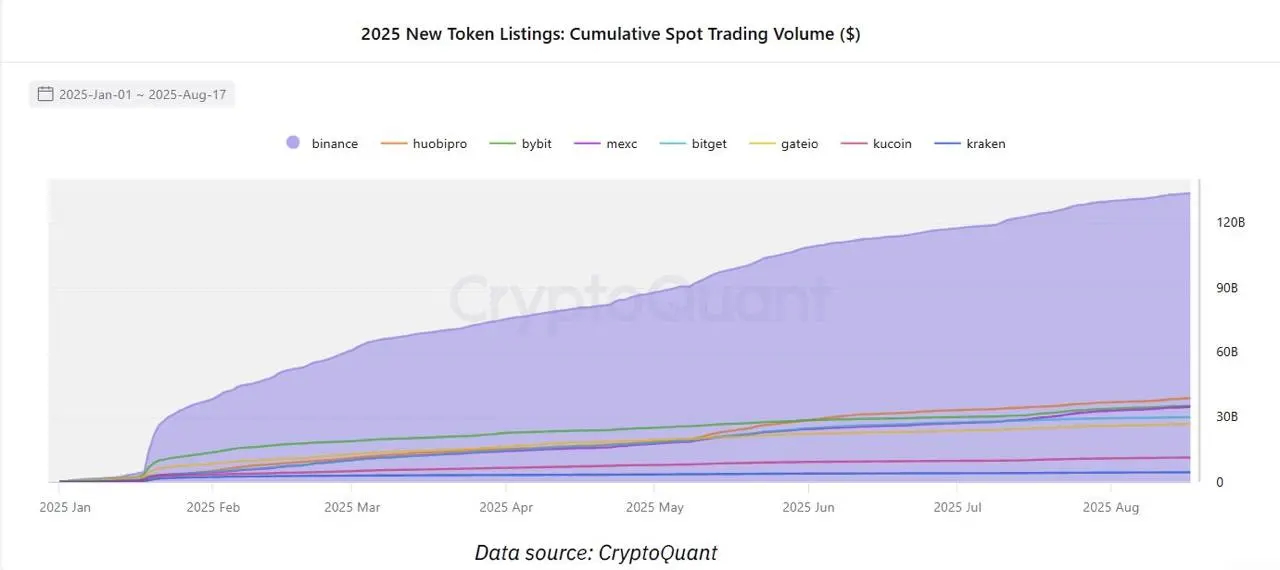

Binance has seen more than $133 billion in cumulative trading volumes for newly listed tokens in 2025. The encrypted report highlights how exchanges solidify their biggest position in the world.

According to data shared by Crypto analyst Onchaindatanerd, Binance stands head and shoulders above all other Crypto Exchanges, accounting for more trading volume than the next top three exchanges.

Encrypted data shows that Binance saw $133 billion in trading volume for new tokens this year. In comparison, HTX has second place with $38 billion, BYBit has $35 billion and MEXC has $34 billion.

2025 New Token List Spot Trading Volume (Source: Onchaindatanerd).

Onchaindatanerd pointed out that Binance's large volume means the number of traders flocking to exchange newly listed tokens, a show of confidence in the liquidity of the exchange compared to other exchanges.

They wrote:

“This clear leadership confirms #Binance as the leading destination for traders looking for early access and high liquidity.”

Interestingly, cumulative volume is not the only area where exchanges are better. It also has a big lead in daily trading volumes, peaking daily volumes of around $1.1 billion newly listed tokens over the past month.

This explains why the exchange has a dominant market share due to the daily trading volume of new tokens three times higher than the volume of other exchanges. Market share peaked at 54% on July 10th, but fell to about 34% by August 13th. Even at that level, it was higher than the HTX and MEXC levels of 22% and 15% respectively.

Binance Records Open interest in ETH futures in 2025 $4 trillion

Meanwhile, the vast amount of newly listed tokens is only part of Binance's control. Exchange domination is not just about spot trading as it attracts more derivative trading activities and demonstrates its status as one of the top locations in the future of ETH.

Open interest in ETH has skyrocketed in Binance as tokens gained momentum and significant value increases, according to Crypto analyst DarkFost. Between early April and the present, the exchange saw an additional $10 billion in open interest, which was added to $2.8 billion afore.

With ETH's growing open interest, Binance has set a new record of trading volume. Particularly because it attracts a significant portion of the liquidity of the derivatives market. This is more than what concentrated competitors like BYBIT and OKX, or decentralized platforms like HyperLiquid see.

The exchange has already set an all-time high in 2025 due to ETH open interest, surpassing $4 trillion this year alone. That was over $3.7 trillion in 2024, and before the end of the year, the exchange is on track to ensure that ETHAN achieves open profits in its $6 trillion ETH futures.

BNB will reach new highs as Binance continues

Binance maintains a significant majority of market share in both the spot and derivatives markets, so BNB tokens are one of the best performances of the current crypto cycle. According to CoinMarketCap, BNB has won 21.96% this year and is currently trading at $861.91.

The token recently hit a new all-time high of $882.58 and appears to be prepared to reach $1,000 in the current cycle with its strong performance and resilience. Technical trader Ali Martinez noted that BNB's performance is connected to Binance activities and that exchanges are the destinations for big money traders.

He said Binance recorded $698 billion in spot trading in July, up 61% from the previous month. Technical analysts said the exchange currently holds nearly 40% of the overall centralized exchange market, with its market share about 4.5 times higher than its closest competitors.

Such numbers mean that the exchange has a deeper book and less slippery, but it is more likely to continue to attract more users than other exchanges.