Bitcoin stabilized after a turbulent few days after a bullish intervention by Tesla billionaire Elon Musk surprised the market.

Bitcoin price is trading around $112,000 per Bitcoin, despite serious warning lights flashing red for Bitcoin price after factoring in the risk of a sharp fall below $110,000 yesterday.

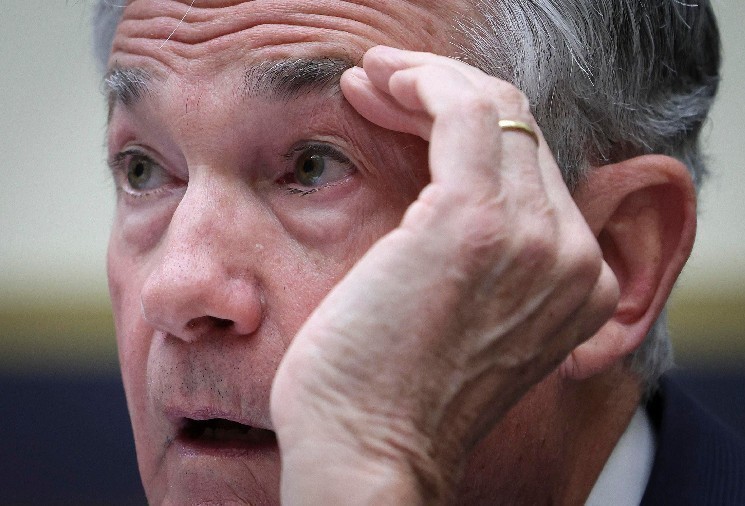

Now, after a “flash crash” in Bitcoin prices prompted a stark warning from BlackRock, Federal Reserve Chairman Jerome Powell said the Fed is rapidly approaching a point where it can end its balance sheet reduction program through quantitative tightening.

“Our long-standing plan is to stop balance sheet drains when reserves rise slightly above what we consider to be consistent with adequate reserve conditions,” Powell said in prepared remarks for a conference of the National Association for Business Economics in Philadelphia. CNBCwhich also opens the door to further interest rate cuts.

“We may be approaching that point in the coming months and are closely monitoring a wide range of indicators to inform this decision.”

The Fed's quantitative tightening program, which began in 2022, has shrunk the Fed's balance sheet from its peak of about $9 trillion to $6.6 trillion.

forbes'Cascading' price warning brings Bitcoin to the brink ahead of impending BlackRock $100 billion tipping pointby billy bumbrough

“In his speech, Chairman Powell expressed concern about the recent deterioration in the U.S. labor market,” David Morrison, senior market analyst at Trade Nation, said in an emailed comment.

“This is now the Fed's focus, replacing inflation, which is well above the U.S. central bank's 2% target rate. Markets continue to price in the possibility of two 25 basis point rate cuts by the end of the year. But Powell will focus on quantitative tightening, which will reduce the Fed's balance sheet, which grew to unprecedented levels during the Great Financial Crisis and added to during the coronavirus panic. Powell has indicated that this reduction program may end soon.''

The tapering of its quantitative tightening program comes as the Fed is widely expected to cut interest rates again at the Federal Open Market Committee meeting later this month, and as Bitcoin exchange-traded funds (ETFs) soar to record levels as Wall Street financial institutions jump in.

“This institutional firepower, combined with the Federal Reserve's dovish stance after the September interest rate cut and continued macroeconomic uncertainty, including the US government shutdown, has reinforced Bitcoin's new role as a digital hedge alongside gold, which broke the $4,000 per ounce barrier on its own (last week),” he said in an email.

“It will be interesting to see if we see any meaningful gains as we move through the Uptober. Fed policy developments at the October 28-29 FOMC meeting could be the catalyst for a move that could extend the bull market or cause a healthy consolidation.”