Many in the crypto industry have been repeating a familiar refrain in recent months: “The four-year crypto market cycle is over.” Bull theorists argue that while the four-year cycle may be over, the Bitcoin bull market itself is simply delayed and could last until 2027.

Why the 4-year cycle is coming to an end

Recently post On social media platform X, formerly known as Twitter, Bull Theory analysts pointed out that the concept that Bitcoin follows a neat four-year cycle is weakening.

They emphasized that the significant price movements over the past decade were not solely caused by halving events. Rather, it was affected by changes in global liquidity.

Analysts noted that despite the recent economic downturn, stablecoins remain highly liquid, indicating that large investors remain engaged in the market and ready to invest when the right macroeconomic conditions arise.

In the United States, financial policy It is emerging as an important catalyst. While the recent share buybacks are notable, the bigger story lies in the Treasury General Account (TGA) balance, which currently stands at about $940 billion, almost $90 billion above its normal range, analysts stress.

This excess cash is likely to flow back into the financial system, tightening funding conditions and adding liquidity that would normally be attracted to riskier assets.

Globally, this trend looks even more promising. China has been injecting liquidity for months, and Japan recently announced an economic stimulus package worth about $135 billion, alongside efforts to simplify crypto regulations.

Canada is also moving towards monetary easing, and the US Federal Reserve has officially suspended monetary policy. quantitative tightening (QT) Measures – Historical precursors of some kind of liquidity expansion.

Political and financial factors align to create a bullish situation

Analysts explained that risk assets like Bitcoin tend to react more quickly than traditional stocks and the broader market when major countries simultaneously introduce expansionary monetary policy.

Additionally, potential policy tools include: Additional leverage ratio The (SLR) exemption introduced in 2020 to give banks more flexibility to grow their balance sheets is likely to be reinstated, resulting in an increase in credit creation and market-wide liquidity.

There are also political aspects to consider. President Trump has discussed possible tax reforms, including eliminating the income tax and distributing $2,000 tariff dividends.

Moreover, the possibility of a new Federal Reserve chair who supports liquidity support and is constructive on cryptocurrencies could strengthen the conditions for economic growth.

Bitcoin uptrend extension

Historically, research institutes Supply Management Purchasing Manager Index After (ISM PMI) crossed 55, the altcoin season continued. According to bull theory, the probability of this happening in 2026 seems high.

The convergence of increased stablecoin liquidity, Treasury cashback injections into the market, global quantitative easing, the US suspension of QT, possible bank loan bailouts, pro-market policy shifts in 2026, and entry of major corporations into the crypto sector suggests a very different scenario than the old four-year halving model.

Analysts concluded that Bitcoin is unlikely to reverse that trend if liquidity expands in the United States, Japan, China, Canada, and other major countries at the same time.

So, rather than experiencing a sharp rise followed by a long-term rise, bear marketthe current environment points to a longer-term, broader upward trend that could continue through 2026-2027.

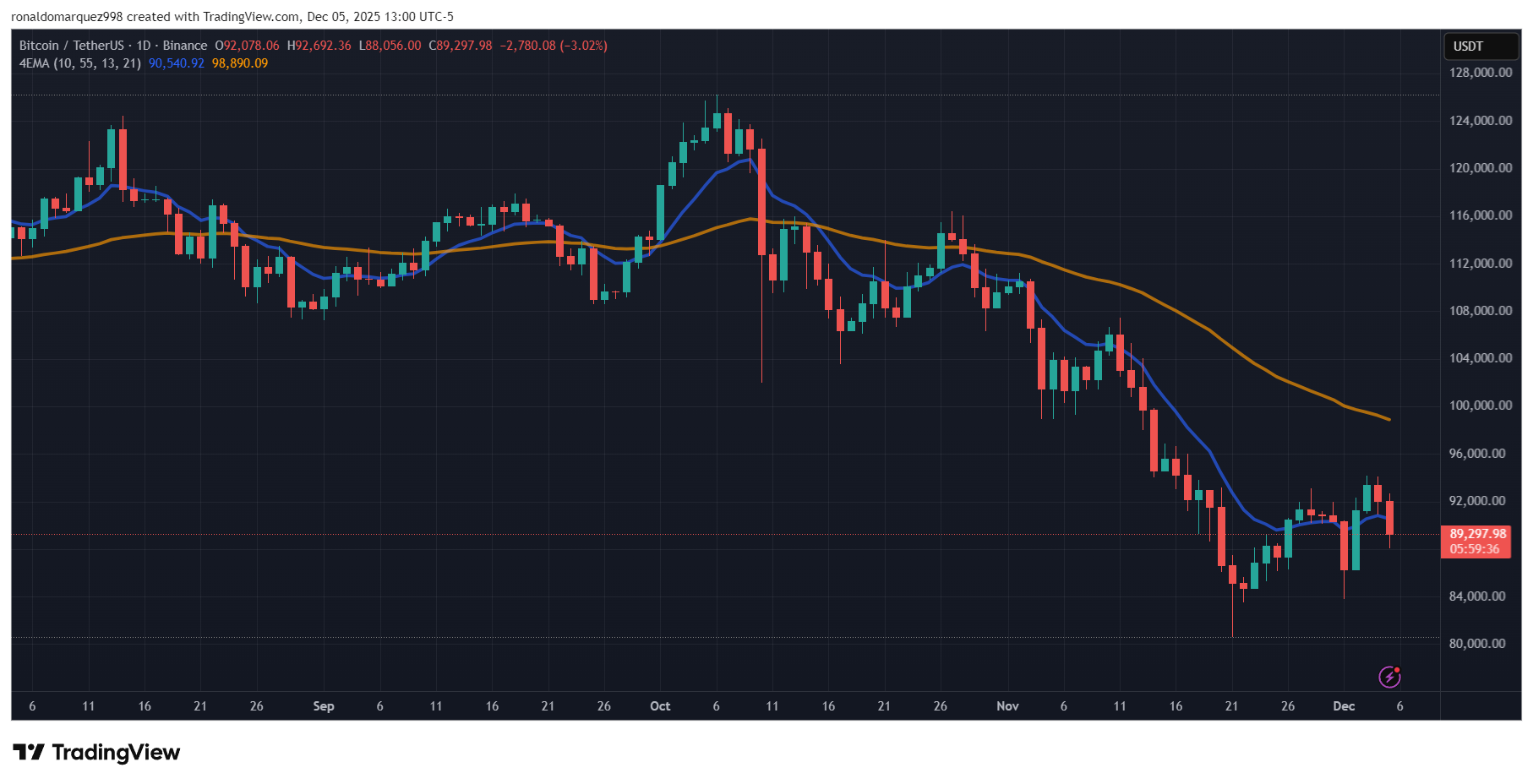

Featured image from DALL-E, chart from TradingView.com