This is a daily analysis by Coindesk analyst and chartered market engineer Omkar Godbole.

DXY vs BTC

Last week, the Federal Reserve made its first interest rate cut since December, indicating it will ease further in the coming months. But despite this disruption, Dollar Index (DXY), which tracks the value of greenbacks' major currencies, finished the week with Dragon Friedge on its weekly charts.

Dragonfly Doji gets its name from its unique “T” shape. This resembles the delicate wings of dragonfly or the toy blade of a bamboo copter. This pattern is formed when open, high and closed prices are roughly the same, and involves a long, low shadow that reflects a sudden drop in price with the purchase of pressure. DXY initially fell into news of Fed rate reductions, temporarily falling below its July low of 96.37 and bounced back through a week that barely changes at 97.65, supported by the resilience of US Treasury yields.

As in the case of DXY, the emergence of Dragon Friedge after a notable downtrend and critical support suggests an imminent bullish shift in market trends.

Traditionally, dollar strength has been addressing the wider weakness of risky assets, with the dollar being excluded and the dollar being set in an interesting stage over the next week.

DXY and BTC flash counter signals. (tradingView/coindesk)

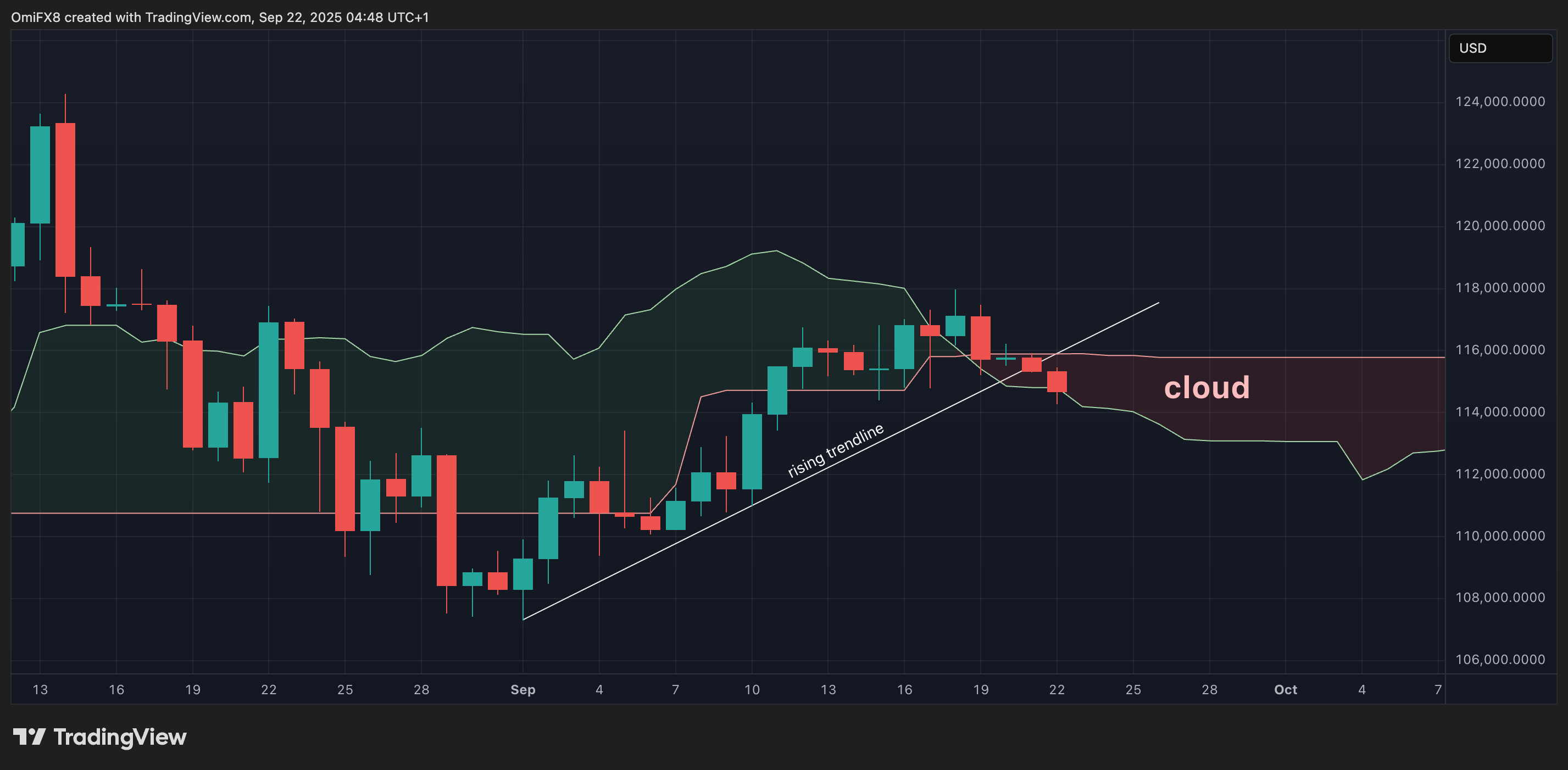

Bitcoin BTC$114,625.48 The theme was mirrored in the week that ended September 21st, forming an indecisive doji candle with critical resistance marked at the trendlines of the 2017 and 2021 Bull Market Peak. Given that this doji appeared on such a critical long-term trend line, it became more bearish, leading price action among bulls and updating sales pressure from major hurdles.

On the daily charts, BTC teases movements under one of the clouds, breaching trendlines from September 1st, implying potential downside risks.

The first line of support is a simple 50-day moving average of $114,473, with a low of nearly $107,300 on September 1. The past week's high of $118,000 needs to be overcome to weaken the bearish case.

BTC has lost support for the trendline. (tradingView/coindesk)

Ether range breakdown

Ether (ETH) faces its own technical dilemma. It floats below the bottom edge of the contract triangle pattern on the daily chart, suggesting updated seller domination and the possibility of deeper losses. This breakdown focuses on $4,000 in psychological support, following the August 20th low of $4,062. The 24-hour height of $4,458 is the level to beat for the Bulls.

ETH's contract price range was resolved badly. (tradingView/coindesk)

XRP's MACD flip is weak

Meanwhile, XRP presents the bull with an annoying photo. Despite the recent debut of the XRP ETF in the US on Thursday, the MACD indicator has surpassed bearish on the weekly charts, indicating an updated negative-side bias. Prices indicate that XRP is back to the upper limit of the triangle, which falls on the daily chart. A tentative breakout occurred last week, but the traders were cautious because they were unable to set fire to the sustained rally.

XRP is under pressure as MACD turns bearish. (tradingView/coindesk)

Focus on the Fed talk and PCE

Federal Reserve Chairman Jerome Powell and nine other officials will speak this week, and the market is likely to closely monitor the same clues about interest rate trajectories. While the Fed has been easing more while it cuts last week, Powell threw cold water into optimism by highlighting the >.

President Donald Trump's appointee Stephen Milan also speaks of his independence last week as a policymaker who is in favor of and against a massive cut of the 50 basis point rate.

The US Core PCE Index, the Fed's preferred inflation measure, is scheduled to be released on Friday. According to Amberdata, data is expected to show that inflation rates rose 2.7% year-on-year, and core jumps rose 2.9% in August, a slight rise from the previous month.