The Bitcoin Exchange-Traded Funds (ETF) extended the setback from bullish momentum yesterday, recording net outflows of over $250 million. This comes just after a 77% decline in net inflow the previous day.

The pullback follows a fall in BTC below the psychological $105,000 price range during Thursday's trading session.

BTC SpotETFS bleeding capital price drops to $101,000

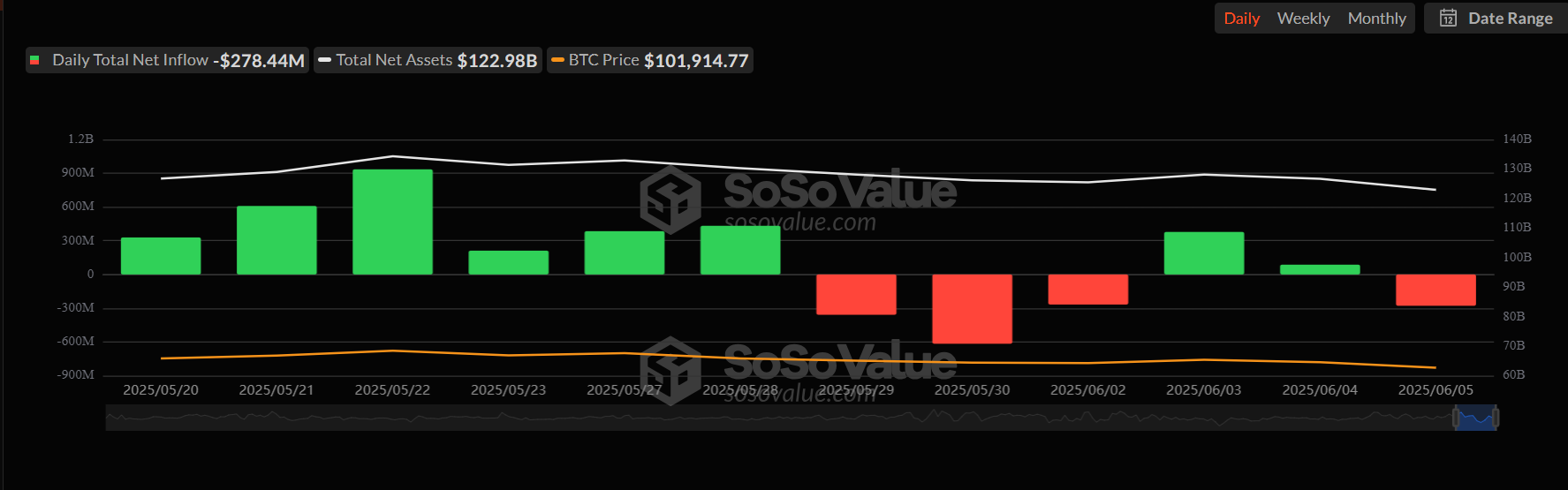

On Thursday, Bitcoin Spot ETFS recorded a net spill of $278.44 million. The capital outlet begins with a 77% decrease in net inflow the previous day, extending the decline in bullish sentiment.

Total Bitcoin Spot ETFs inflows. Source: SosoValue

The sale of the ETF followed a slower movement in BTC prices during the trading session that day. The main coins fell below the $105,000 support level and fell to an intraday low of $20101,201, weakening investors' sentiment.

The sustained net outflow from BTC spot ETFs shows weakening the change in investor reliability and market sentiment. This creates additional sales pressure on BTC, which exacerbates the price decline.

Yesterday, ARKB from ARK 21Shares led the pack in the highest daily spills, totaling $122 million. The total historic net inflow at press time is $4.677 billion.

Bitcoin down as futures market cools

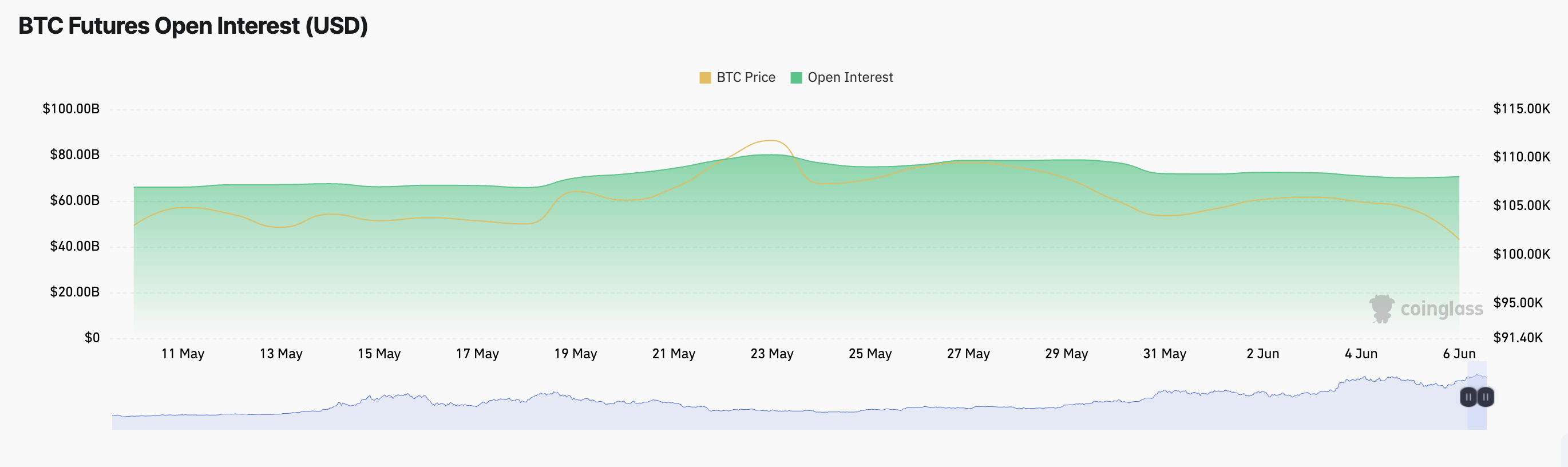

As of Friday, BTC had dropped by another 2% that day. During the same period, open interest in its futures has also soaked 1%, suggesting that traders are closing positions rather than adding new leverage.

BTC futures are open to interest. Source: Coinglass

Open profit refers to the total number of unresolved derivative contracts, such as unresolved futures and options. If that falls, traders have closed their existing positions and are losing participation in the market. This puts BTC at risk of further price drops.

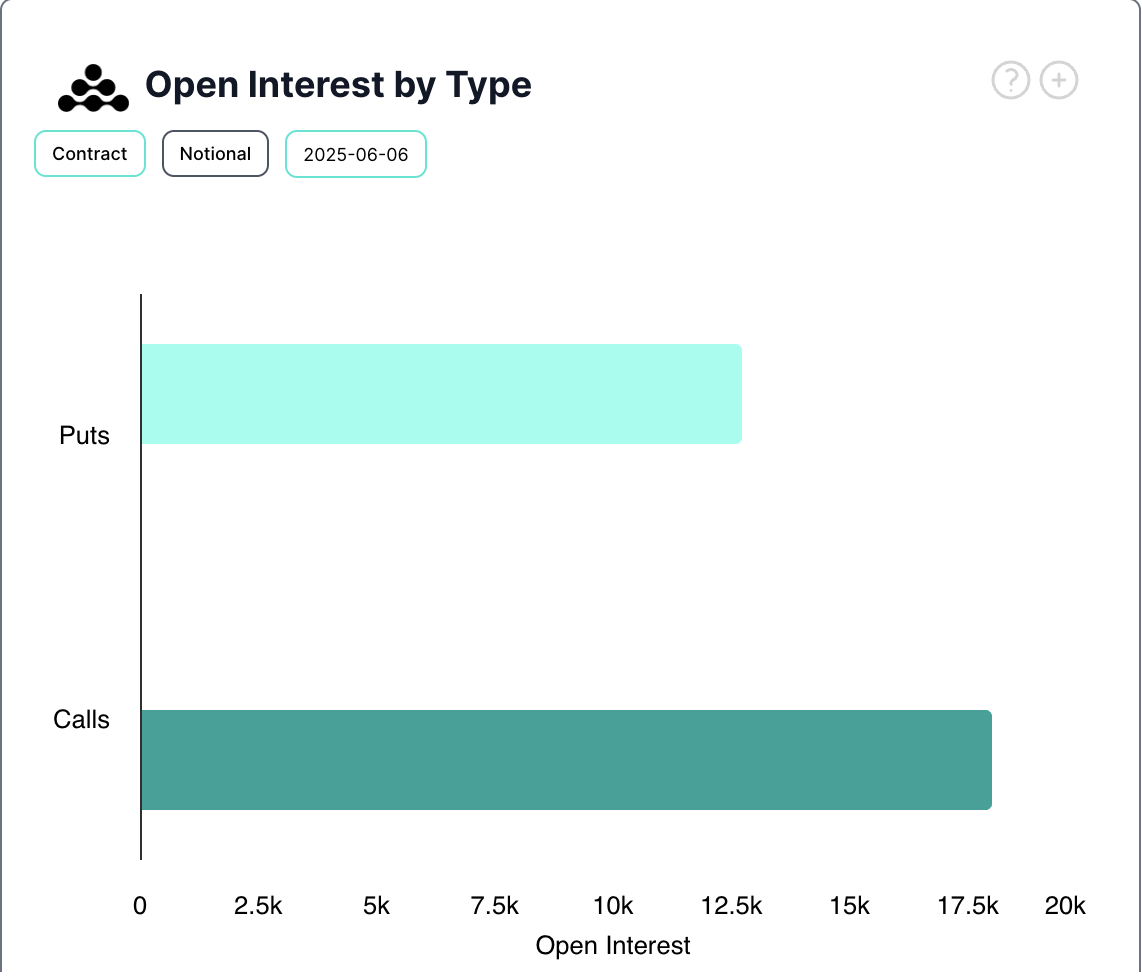

Interestingly, despite the recession, the options market is particularly resilient. The demand for call options (bullying bets) continues to outweigh that of PUTS. When this happens, traders are anticipating an upward price movement, suggesting they are positioning for potential gatherings.

Interested in BTC options. Source: Deribit

A combined reading of ETF flows and options sentiment indicates that derivative traders are monitoring potential benefits while institutional capital is receding.