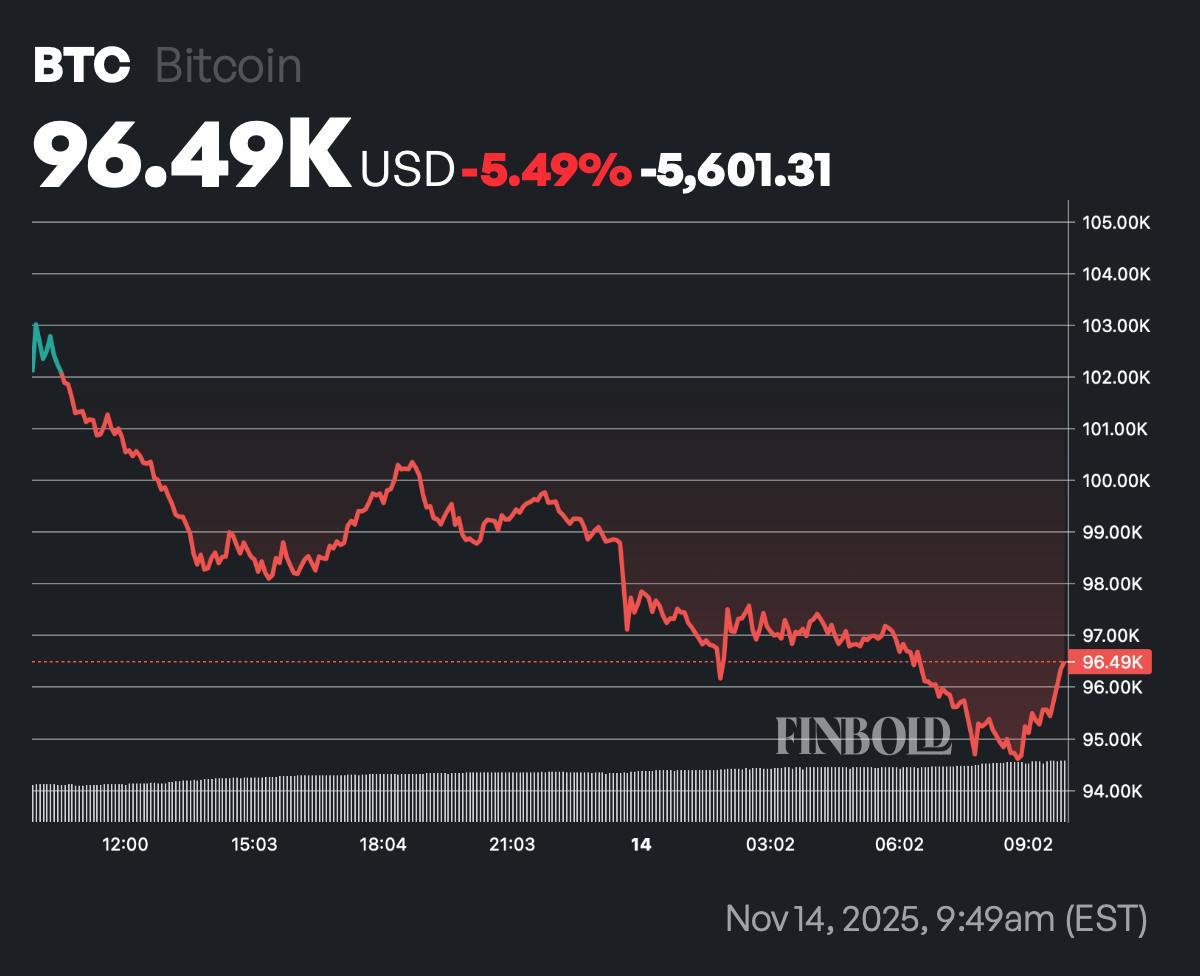

Bitcoin (BTC) fell 5.49% over the past 24 hours, dropping to $95,383 before attempting to stabilize above $96,000.

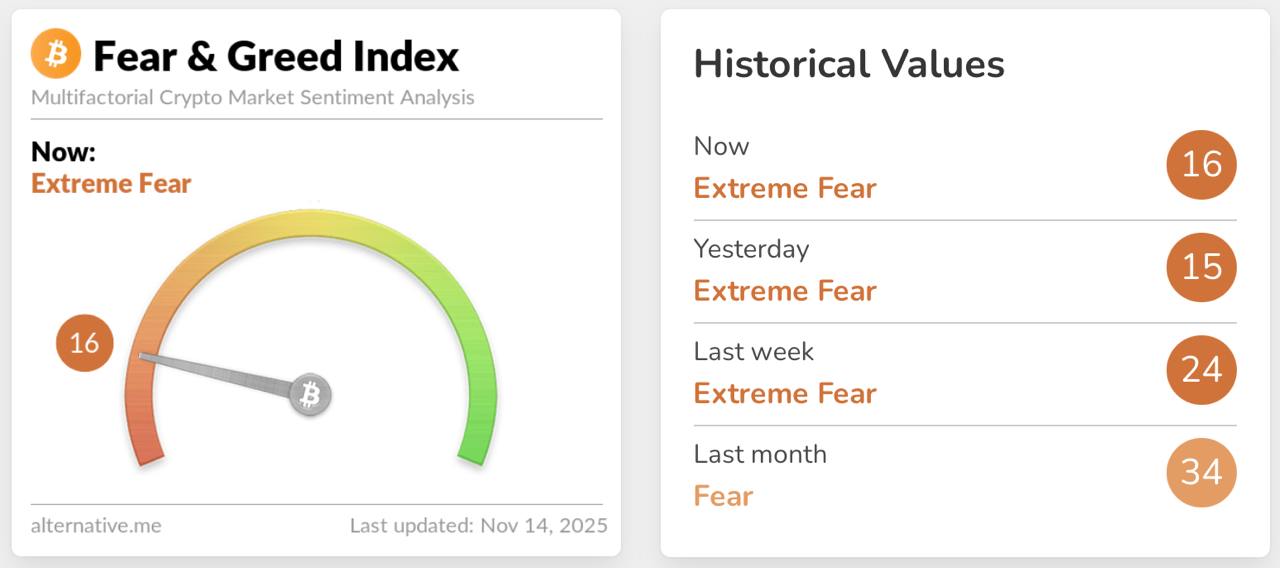

The selloff hit sentiment hard. Bitcoin’s Fear and Greed Index fell to 15 on November 13th and rose to 16 on November 14th, firmly in extreme fear territory.

The sell-off intensified after the Federal Reserve ruled out a December interest rate cut, a decision that spooked risk assets across global markets. Bitcoin's decline coincided with a 2% decline in the Nasdaq, reflecting the asset's continued sensitivity to macro catalysts. Both TradFi and cryptocurrencies faced simultaneous outflows as US Treasury yields rose and liquidity tightened.

The macro context explains much of the pressure. Rising interest rates reduced capital turnover into speculative assets, and the bond market reaction triggered widespread risk aversion across equities, tech and digital assets. Bitcoin stayed roughly in line with major U.S. indexes during trading on Thursday, highlighting how quickly sentiment changed after the Federal Reserve took a more restrictive stance.

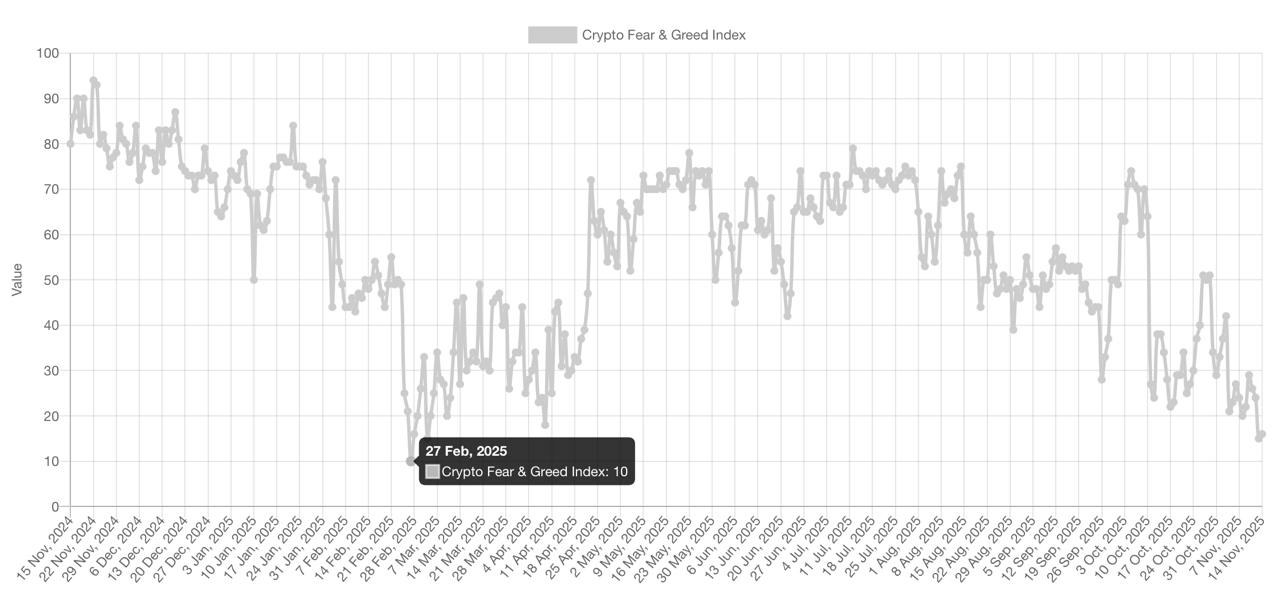

History of Bitcoin Fear and Greed Index

Historical sentiment data confirms the severity of the decline. The index hovered around 34, the standard “fear” reading, last month, fell to 24 last week, and finally fell into the mid-teens this week. The last time the index reached a similar low was on February 27, 2025, when the index reached 10, following weeks of significant declines.

Despite the pullback, Bitcoin is now approaching the zone that has traditionally attracted long-term buyers. In past cycles, extreme fear readings have often coincided with local bottoms, especially when macro-driven selling outpaces crypto-native fundamentals. But with rising Treasury yields and pressure on tech stocks, the market may need a clearer signal from the Fed before it regains confidence.