This is a segment of the Imperial newsletter. Subscribe to read the full edition.

Shall we sum up a bit in the middle of the year?

I mentioned K33's H1 report on An Intro the other day, and there is a lot of interesting data to digest.

The official transition from H1 to H2 has been marked, including the fact that the Bitcoin finance company had acquired a whopping 244,991 Bitcoins by the end of June.

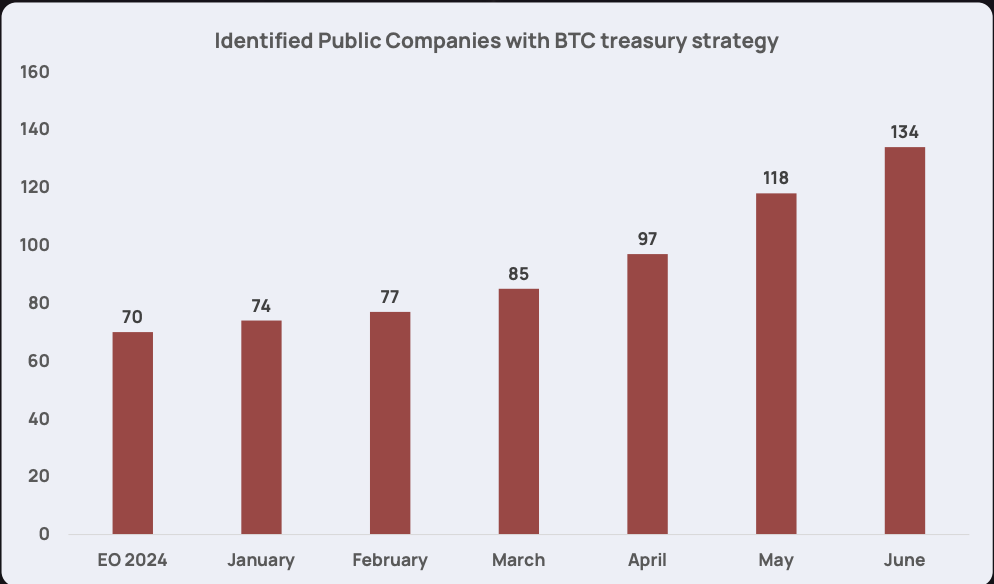

Needless to say, perhaps not surprising, it goes without saying that the number of finance companies has almost doubled by the end of the first half. At the beginning of the year there were 70 companies on their balance sheets that had Bitcoin, which quickly swelled to 134.

Source: K33

Source: K33

According to K33, companies in the US, Canada, Japan and the UK are at the top of the list when it comes to companies pivoting into Bitcoin's financial strategy, but the total is made up of companies from 27 countries. This gives us a rough idea of how global this is, but the US outperforms the charts with 41 public companies.

But it's not just Bitcoin finance companies or Bitcoin. a Many This year happened because CEO CARLOS Domingo and Bitwise CEO Hunter Horsely wanted to point us out this week.

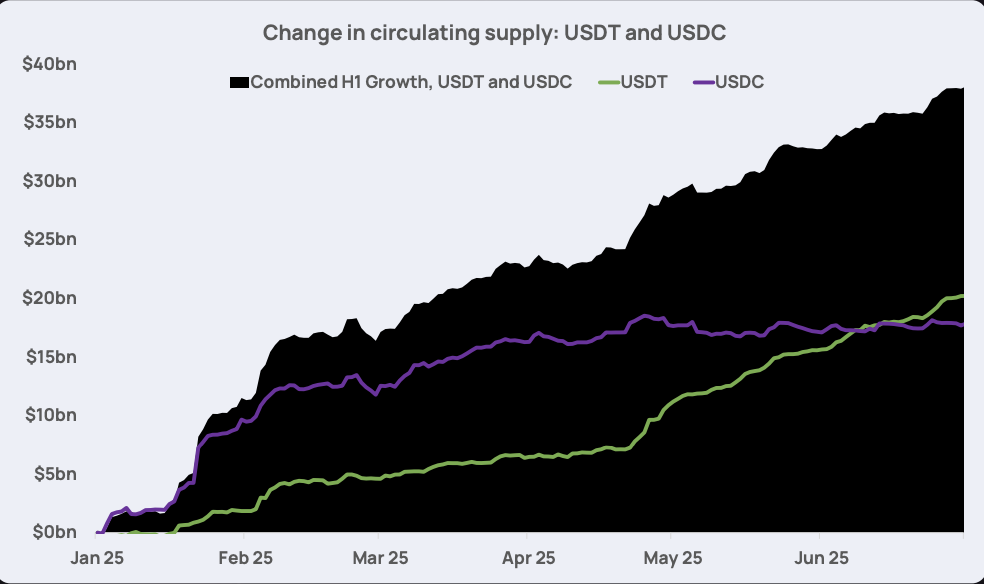

In the first half of the year, USDT and USDC distribution supplies increased by $38 billion as people gathered in the Stablecoin story.

Source: K33

Source: K33

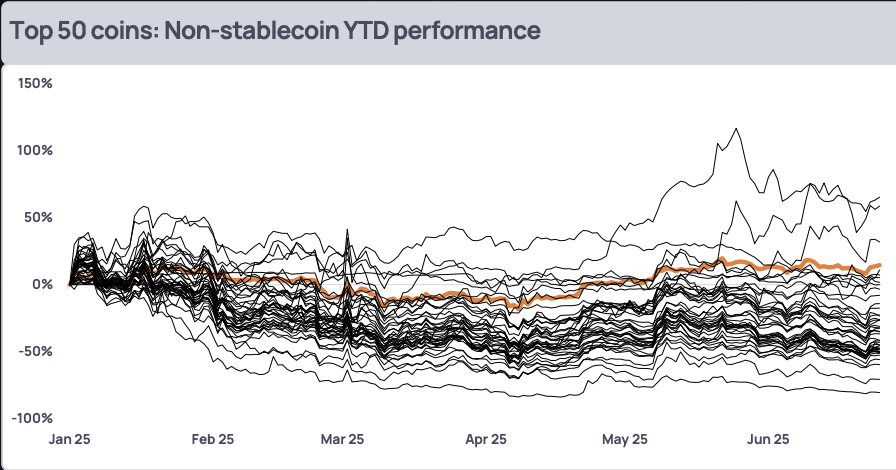

Unfortunately, when taking stubcoins out of the mix, only nine of the top 50 ciphers who saw a positive return in H1 show that altcoins are struggling to find a foothold in a market dominated by Bitcoin and Stubcoin.

Of those nine, K33 noted that outweighed three distinctly superior Bitcoins: XMR, Hype and Sky.

Source: K33

Source: K33

So it seems that the momentum for the Altcoin season doesn't exist yet. But looking ahead, if some of these Altcoin ETFs are approved, there may be some hope on the horizon.