Bitcoin futures market is being cooled after months of high stakes activity. New data suggests retailers dominate the scene as whales shrink.

summary

- Whale participation in Bitcoin futures is declining.

- Retailers currently dominate the BTC futures market, weakening their price momentum and contributing to increased volatility.

- Futures Sentiment has become bearish. Despite the BTC exceeding $110,000, it has surpassed Taker's selling volume, which has surpassed its shopping since late July.

- Bitcoin has been consolidated between $10,000 and $125,000, and with no renewed interest in whales, a breakout remains unlikely in the near term.

The Bitcoin (BTC) futures market appears to be in the cooling phase, with participation from whales declining and influence from retailers increasing. This change has sparked concerns of bearish feelings and potentially bound movement despite broader market optimism.

BTC futures market weakens as whale activity decreases

According to crypto analyst Egypthashx, the futures market has shifted from whale-driven to more retail-driven, affecting Bitcoin's short-term trajectory.

“The Bitcoin futures market is cooling, whale activity is declining, retail impacts are strengthened, bearish sentiment is strengthened. Unless whale demand has returned, prices may remain bound by range or pressure on the underside may continue to shake,” Ejihash said.

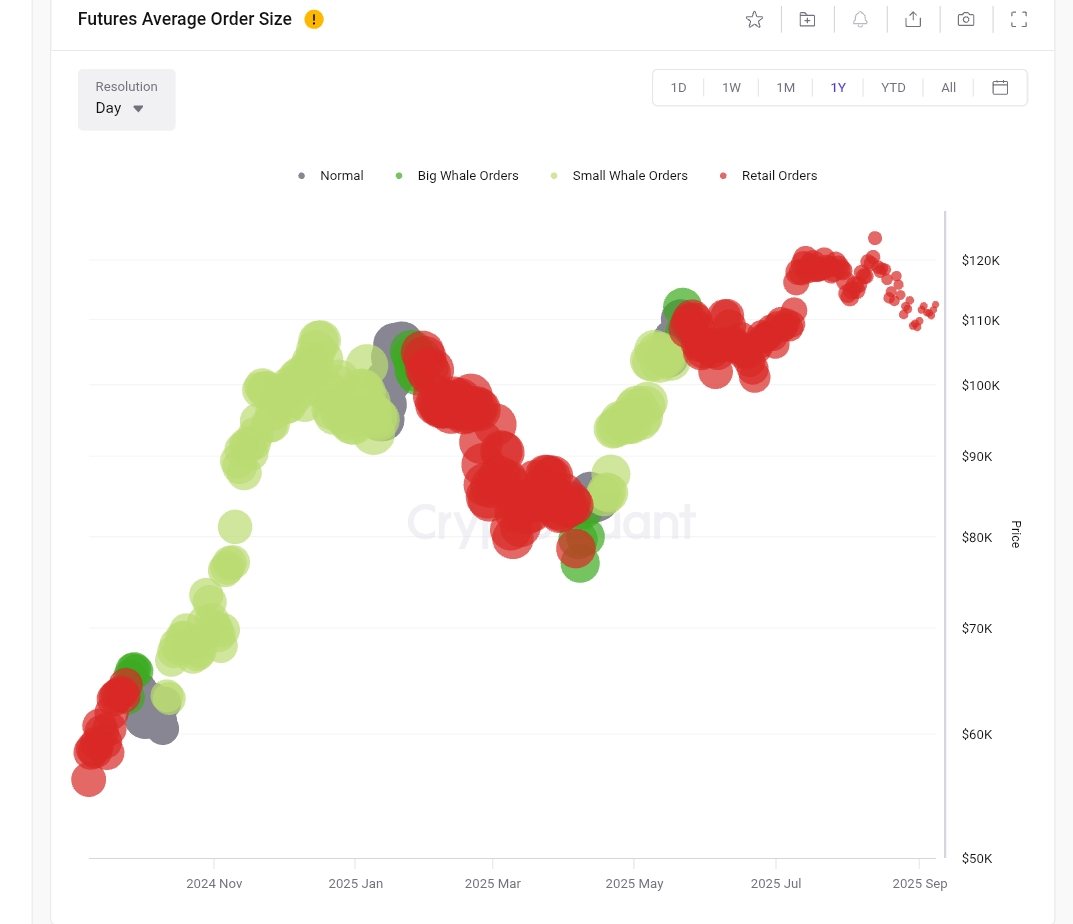

The futures average order size chart reflecting the volume per transaction shows a clear decline in large transactions.

Average futures order size | Source: Cryptoquant

When Bitcoin rose from $100,000 to $120,000 between June and September 2025, retail participation surged, overwhelming the impact of institutional players. This pattern contrasts with the period from October 2024 to January 2025, whales entered the market at a $90,000 accumulation stage for Bitcoin.

You might like it too: Bitcoin's record highs disappear into consolidation – where does the code go from here?

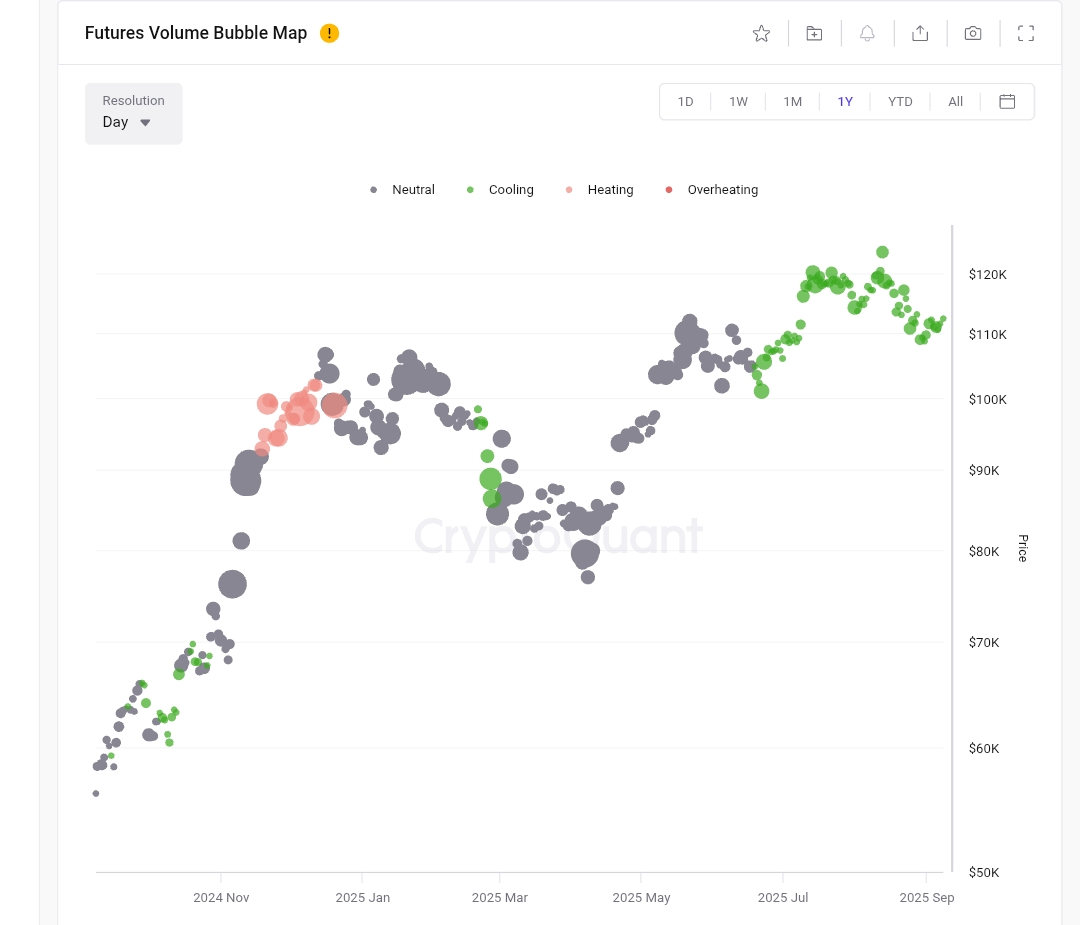

Supporting this observation, the volume bubble map of futures highlights how current price rally differs from previous speculative spikes.

BTC Futures Volume Bubble Map | Source: Cryptoquant

The recent months have shown primarily green “cooling” air bubbles, suggesting healthy trading activities without excessive leverage prior to sharp corrections. The organic nature of the current gathering means more structurally stable climbing, but it also indicates a decrease in market excitement and points to more careful sentiment among large players.

When rice rises, sellers control

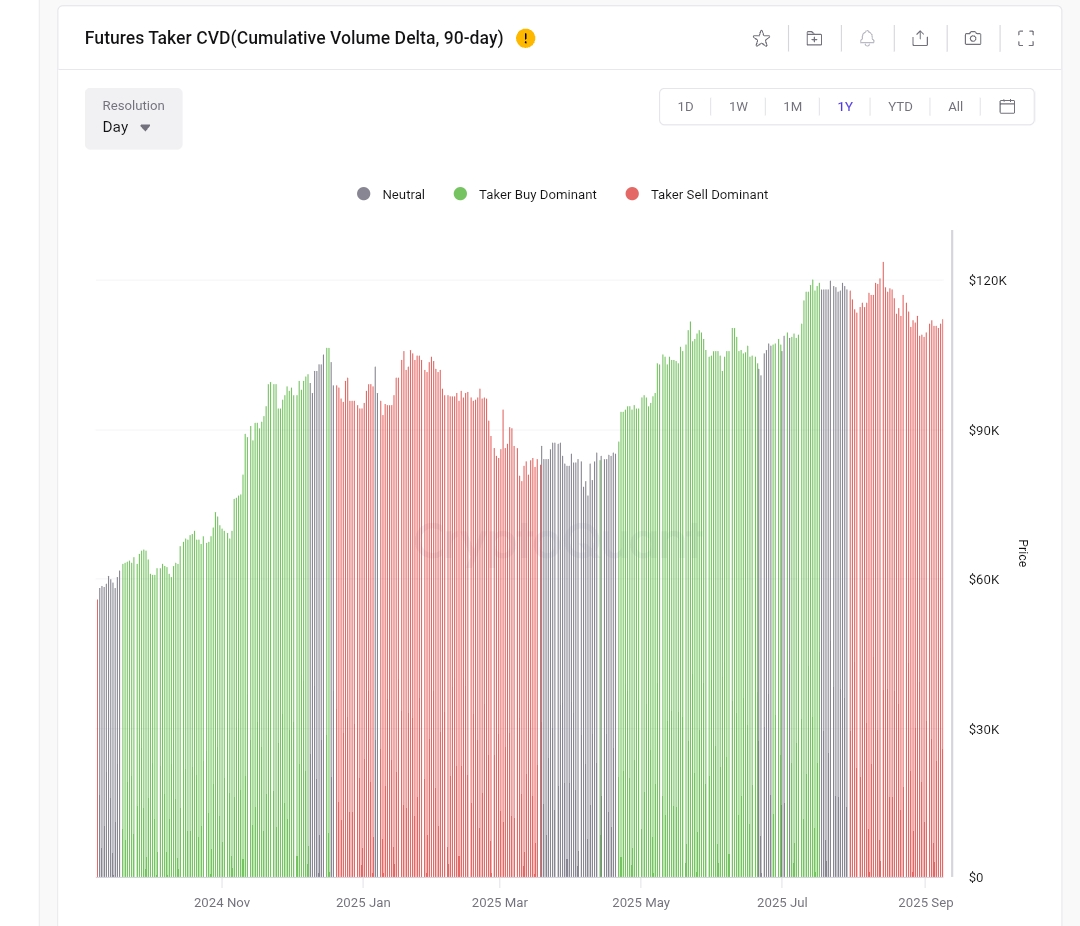

In addition to its bearish tone, Bitcoin Futures Taker CVD (Cumulative Volume Delta) reflects dominant sales activities.

BTC's Futures Taker CVD | Source: Cryptoquant

Between January and April 2025, the red bar on the chart indicates that Taker's sales orders have been taken over. There was a short-lived buyer revival between May and July, but sellers have once again gained the advantage since late July, despite the price of Bitcoin exceeding $110,000. This discrepancy between price action and futures sentiment reduces the persuasiveness of the current uptrend.

Crypto.News previously reported that whales have dumped 100,000 BTC in the last 30 days, further supporting the latest shift from whales to retail-driven markets. At the moment, market data shows that Bitcoin is trading at $112,952 at press time, recovering slightly after dropping out of the $110,000 support zone.

Meanwhile, technical indicators are becoming bullish. The MACD histogram is inverted green, and the MACD line crosses above the signal line, indicating early bullish momentum. The RSI stands at 51.55, recovering from oversold, suggesting a positive momentum from neutral to positive.

BTC Price Chart | Source: crypto.news

Nevertheless, it will need to overcome a major resistance of $114,800 to allow BTC to test $118,500 or revisit its current high of $124,475. Meanwhile, $110,000 and $107,500 are important support levels. The drop below may open Bitcoin for additional fixes.

Although the current photo is optimistic, the decline in the futures market and whale involvement show that the continued bullish trend depends on new institutional demand. Without that, BTC may continue to be sideways for the next few days.

You might like it too: The XRP Rally accelerates when the price exceeds $3