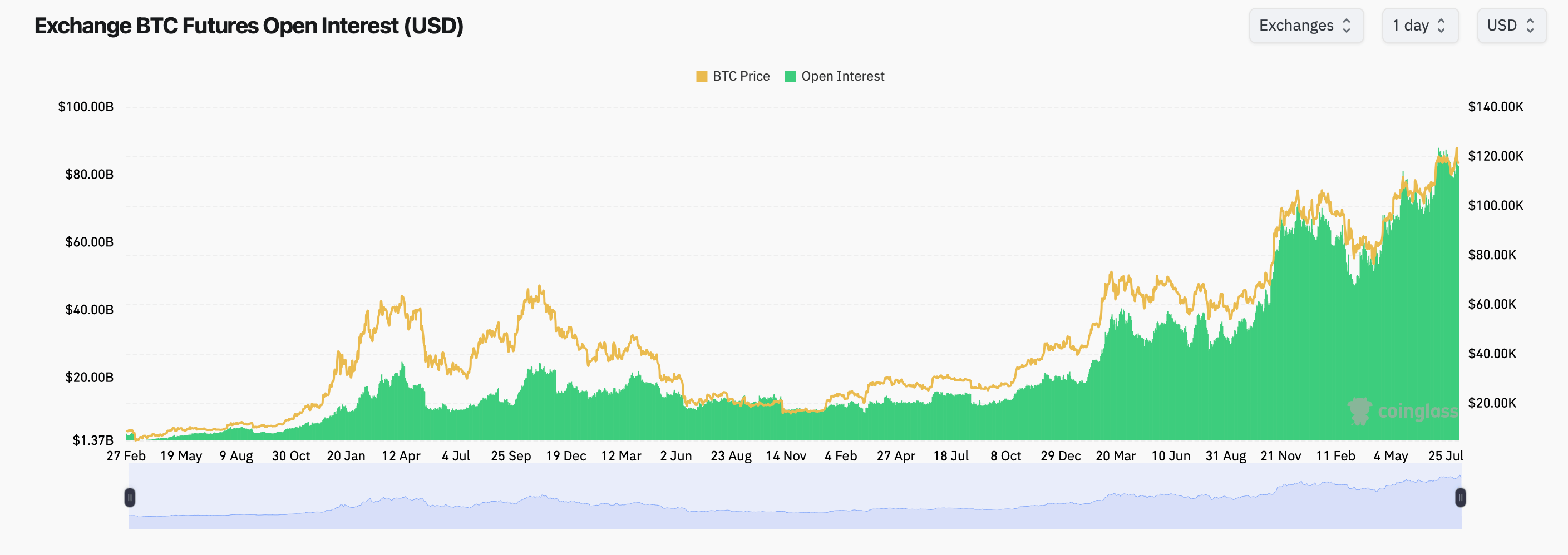

Bitcoin derivatives market behavior showed strong involvement this weekend as open interest on futures rose above $82 billion, while options activity reflects a slight bullish slope.

The Bitcoin derivatives market will expand as spot prices consolidate

During the morning trading session, Bitcoin was trading at $117,860 on the spot market. Futures activity was the focus of derivative trading, with open interest (OI) totaling 699,620 BTC, or an estimated value of around $82.44 billion.

Bitcoin futures are of interest, according to coinglass.com statistics on August 16, 2025.

The CME Group continues to lead the market with $17.1 billion of public interest, accounting for 20.7% of total positioning. Binance held $15.07 billion and Bybit held $9.66 billion. Among the notable changes, open interest in Gate's futures has risen sharply in the past day, rising over 21%, while Binance and Okx saw a 2.4% and 4.5% decline, respectively.

The broader trends show steady growth in futures exposure, with Coinglass data showing a strong correlation between spot prices in Bitcoin and rising levels of open interest. The current trajectory places gross activities near the highest ever high, highlighting an increase in participation from both institutional traders and retailers.

On the options side, Delibit remained the dominant venue in December 2025 with the largest open interest concentration. The only biggest position was the $140,000 call that expired on December 26th, with over 10,800 BTCs surpassing BTC on open contracts. Other high profits include $200,000 phone calls and $95,000 puts.

Overall, the option was 407,278 BTC, with a call representing 61.4% of issued contracts, compared to 38.6% of PUTS. However, trading volumes have been slightly bearish over the past 24 hours, accounting for 53.9% of activity. Differences suggest that investors are positioned for potential long-term benefits, but heading near terminal risk.