All three major inventory indices closed at record highs on Thursday afternoon, and Bitcoin is now suing lawsuits on Friday.

BTC rises sharply when stocks reach peak

Something strange happened on Thursday. Inflation has been slightly higher than expected after the Bureau of Labor Statistics reported a rise in the Consumer Price Index (CPI), but Big News says it's not inflation and yesterday's unemployed surge will seal trades next week due to interest rate cuts by the Federal Reserve. That sentiment sparked stock rally, where all three key indicators approached at record highs, and now Bitcoin is joining the party.

(Tyler Winklevoss, co-founder of Gemini, said during an interview Friday that Bitcoin will reach $1 million over a decade.)

The S&P 500 ended the day with 6,587.47, with the Nasdaq breaking 22,000 for the first time, and the Dow spiked above 46,000, reaching its highest nearer. Software giant Oracle (NYSE:ORCL) led its stock on Wednesday with a 36% surge. According to Oracle CEO Safra Catz, the company has ticked out several multi-billion dollar deals with multiple AI companies. With Oracle Stock's sudden appreciation, Larry Ellison, the company's co-founder and chairman, wobbled over $400 billion and earned a net worth, thrilling Tesla billionaire Elon Musk.

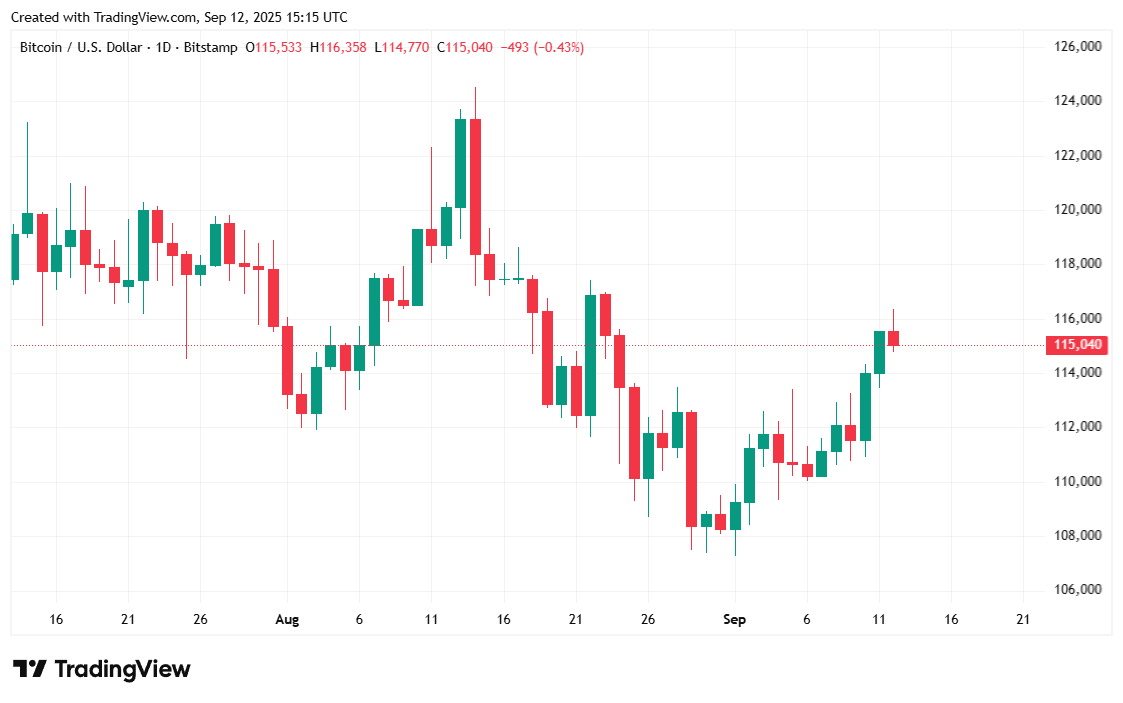

But in the crypto world, Bitcoin is a star, picking up where stocks left before settling down at around $115,000 on Friday morning, surpassing $116K in more than $100 million trades.

“If you mess with the money, you see Bitcoin trading for $1 million in Bitcoin, so that's still at the bottom of the first innings,” Gemini co-founder Tyler Winclevos said in an interview Friday. “I think it's ten times easier from here. It's still really early. And I think we're sitting here ten years from now and saying, 'Wow, today was really early.' ”

Market Metric Overview

Bitcoin was trading at $115,026.52 at the time of writing, according to data from CoinmarketCap. Cryptocurrency has moved between $114,030.39 and $116,317.21 since yesterday.

(Bitcoin Price/Trading View)

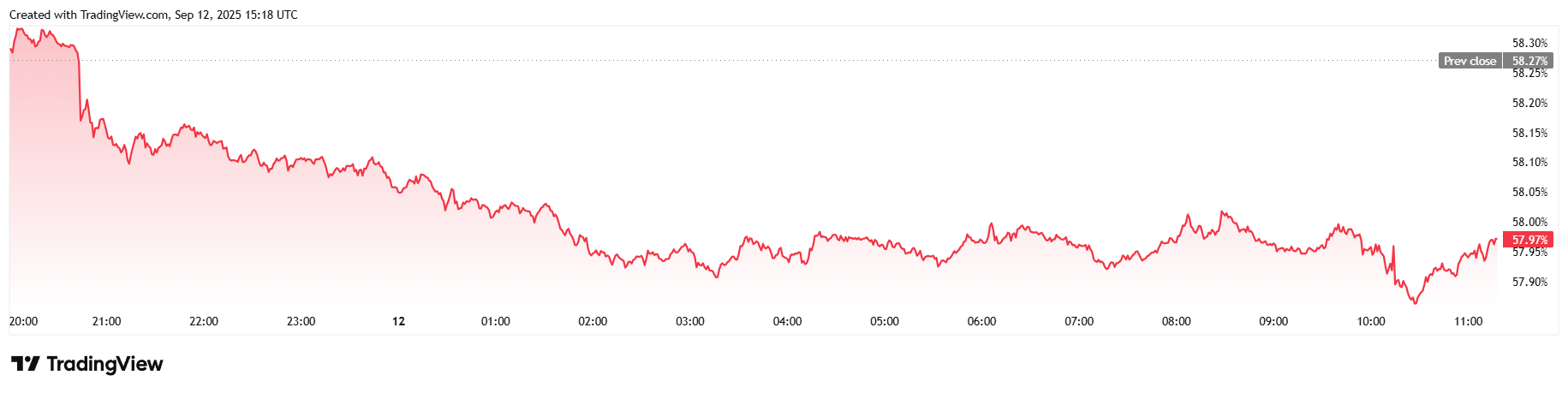

The 24-hour trading volume has been almost flat, down just 0.93% immersion since Thursday to $466.5 billion. Market capitalization rose 0.53% to $2.29 trillion, while Bitcoin's dominance fell 0.52% to 57.98% in 24 hours.

(Bitcoin control/trade view)

According to Coinglass data, total open gifts of Bitcoin futures were flat for the day, up 0.07% to $8500 billion. However, due to the Bitcoin accommodation rally, the liquidation of $688 million from yesterday and yesterday jumped to $608.58 million yesterday. The Longs got much fewer hits, significantly lowering $6.68 million in liquidation.