Bitcoin prices are just above $108,000, but most markets monitor one number. $110,000. And while Bitcoin prices have tried to touch on its elusive levels over the past week, the setup shows signs of substance.

Not all systems are green yet, but one clean breakout can turn everything upside down.

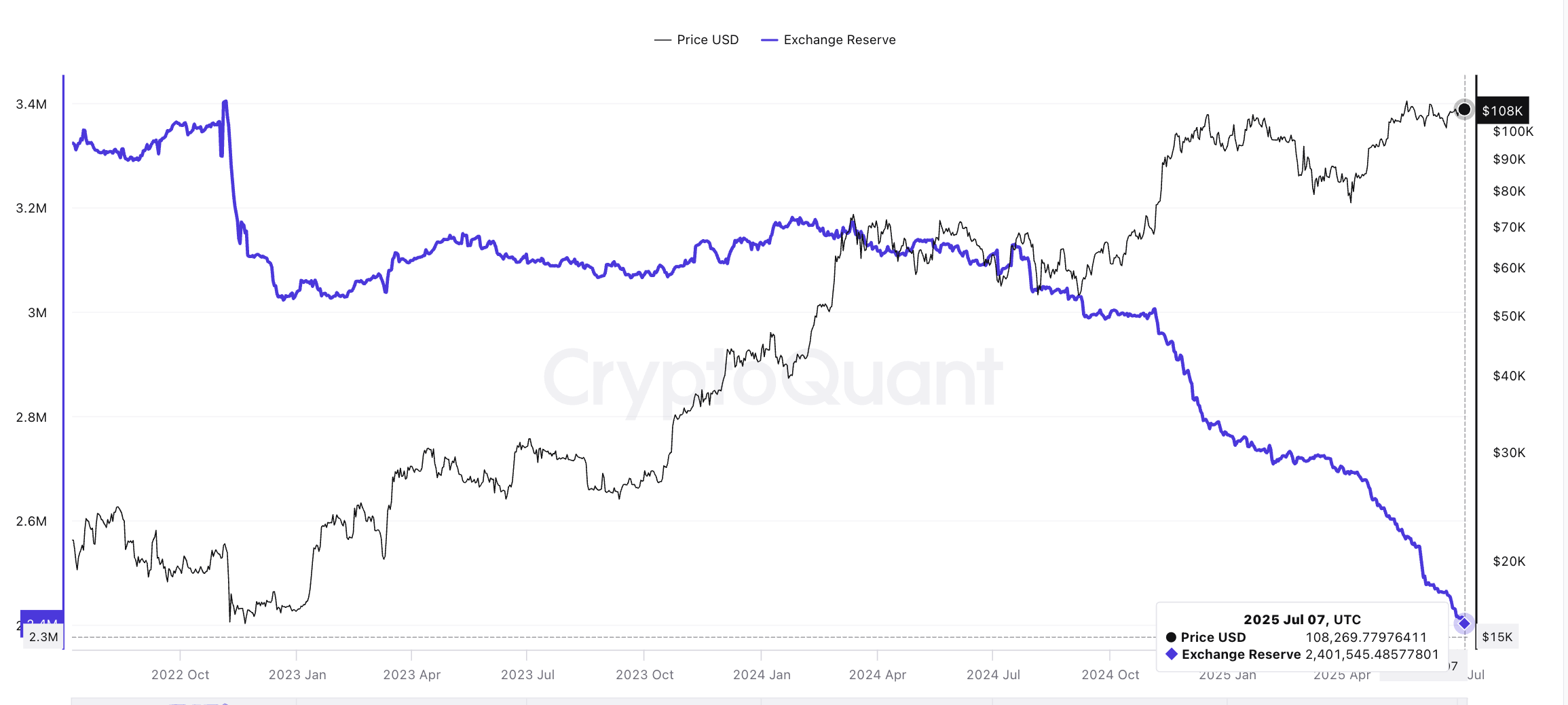

The BTC reserve continues to decline, and it is bullish

The clearest bull indicator right now is how fast Bitcoin is falling on the exchange. As of July 7th, there is 2.4 million BTC remaining on the entire centralized platform, the lowest in over three years. Historically, reserves indicate that investors are pulling coins into cold wallets and reducing the supply they can sell.

Bitcoin Price and Drop Exchange Reserve: Encryption

This setup often reaches a major price when the float is tightened, and there is little room for sellers to respond to sudden surges in demand. When this supply aperture couples with photoresistance levels, even modest volumes can drive large-caliber movements.

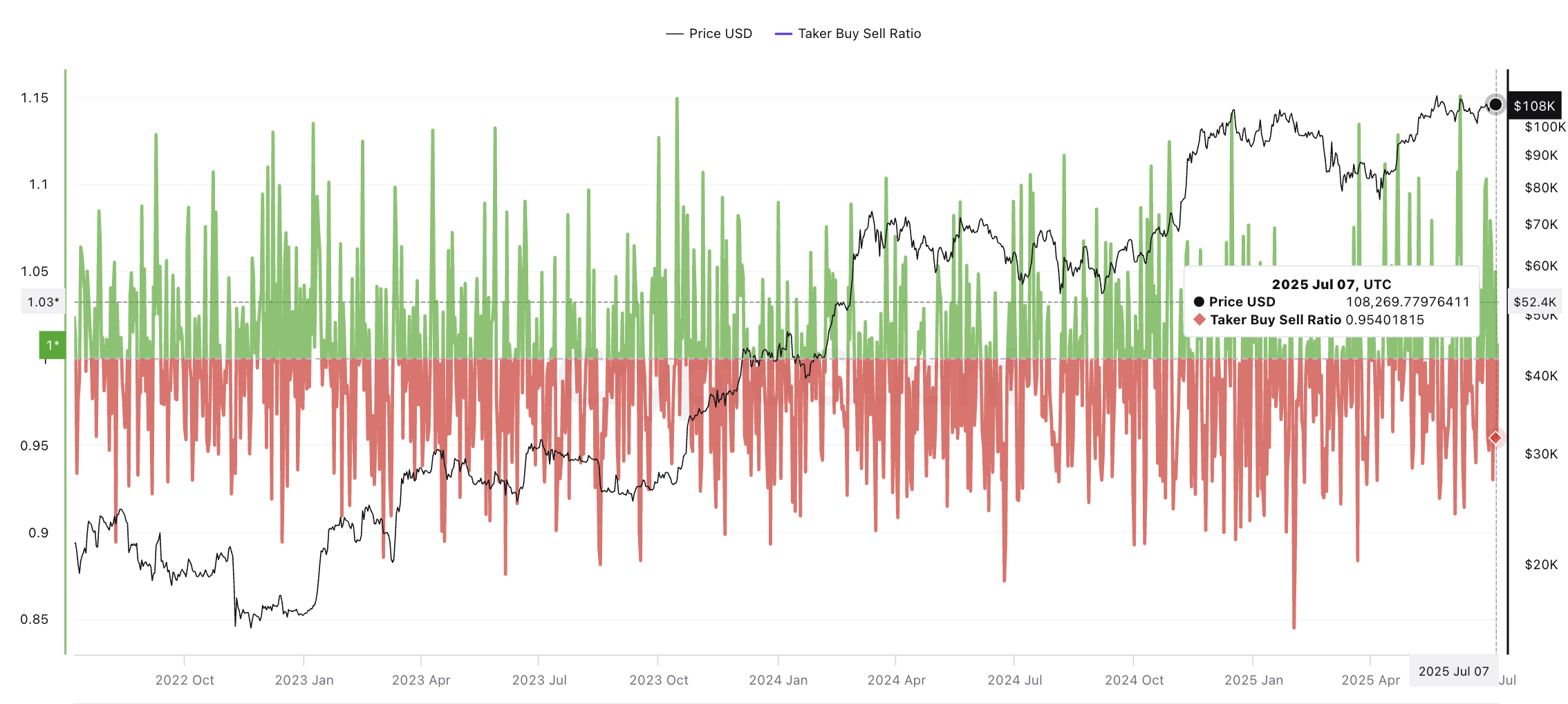

The buy and sell ratio for takers less than 1 is approaching

A metric worth looking at carefully is the buy and sell ratio of Taker. This measures how Bitcoin buyers are actively lifting offers compared to sellers who hit their bids. Currently, the ratio is sitting at 0.95. So, BTC sellers are still slightly controlled, but just.

Bitcoin Taker's buying and selling ratio is seller bias: encryption

If this exceeds 1, it tends to indicate that BTC buyers are convicted and intervening. Every time it happens in the last six months, a short ascent is triggered. Seeing this ratio etched high over the next few days could potentially serve as the final push you need to surpass the $110,000 barrier.

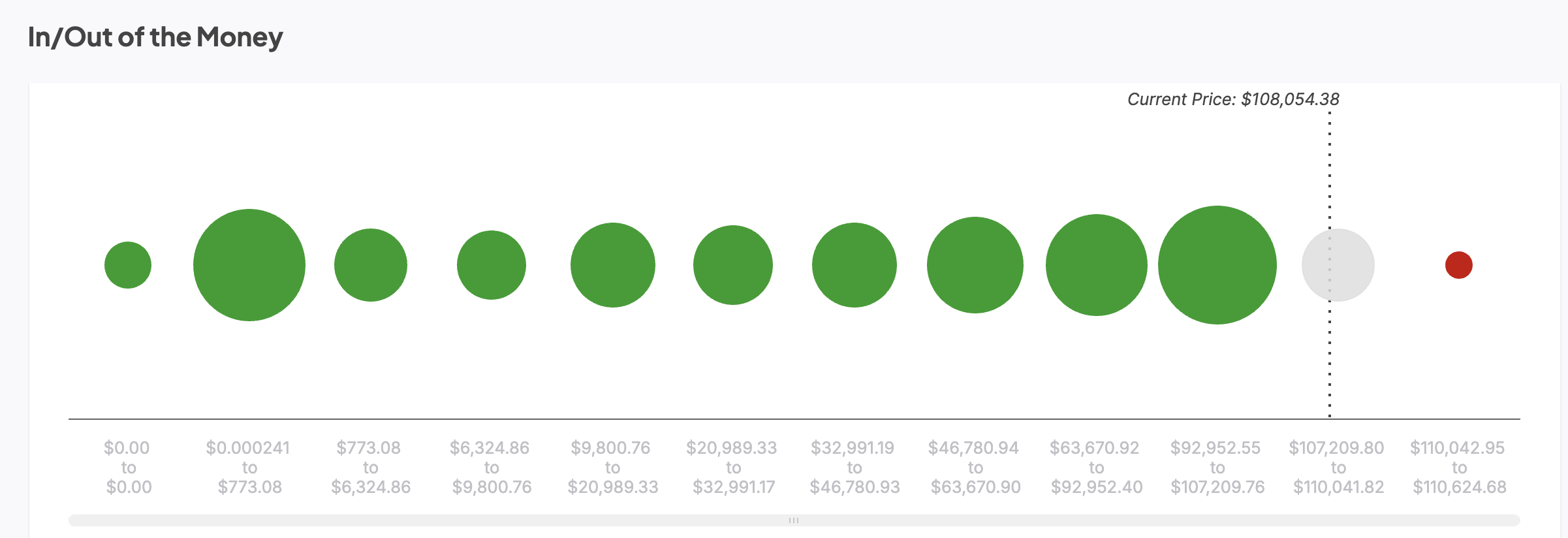

Strong support zones confirmed by IOMAP clusters

The in/out indicator map for Price (IOMAP) maps wallet addresses where you purchased Bitcoin at various price levels. Clusters of wallets “in the money” (current profits) support zones, and they form resistance “out of money” (now lost).

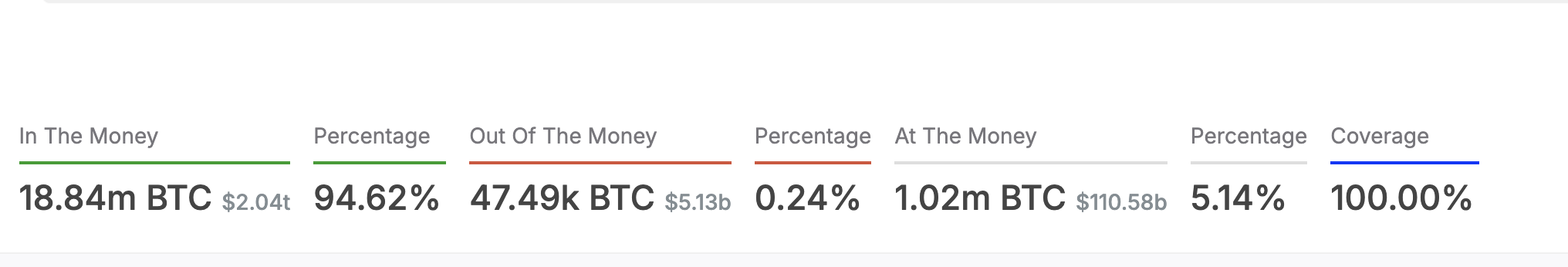

In/out of the money stats into theblock

According to the latest IOMAP snapshot, 94.61% of all BTC addresses are currently profitable. It's an important cushion. Historically, high profitability tends to reduce selling pressure as owners are less likely to leave early.

The data also shows a very strong support zone between $107,209 and $110,041. There, many wallets acquired BTC. A lower price creates a strong buying barrier.

In/Out of the Money shows a strong level of support: into theblock

Meanwhile, the resistance zone between $110,042 and $110,624 is thin. There are very few wallets here. This means that if BTC breaks beyond $110,000, there is a minimal overhead supply to block the upward movement. Its integrity, strong support, and light resistance sets a potentially explosive movement if momentum returns.

Bitcoin price levels match on-chain signals

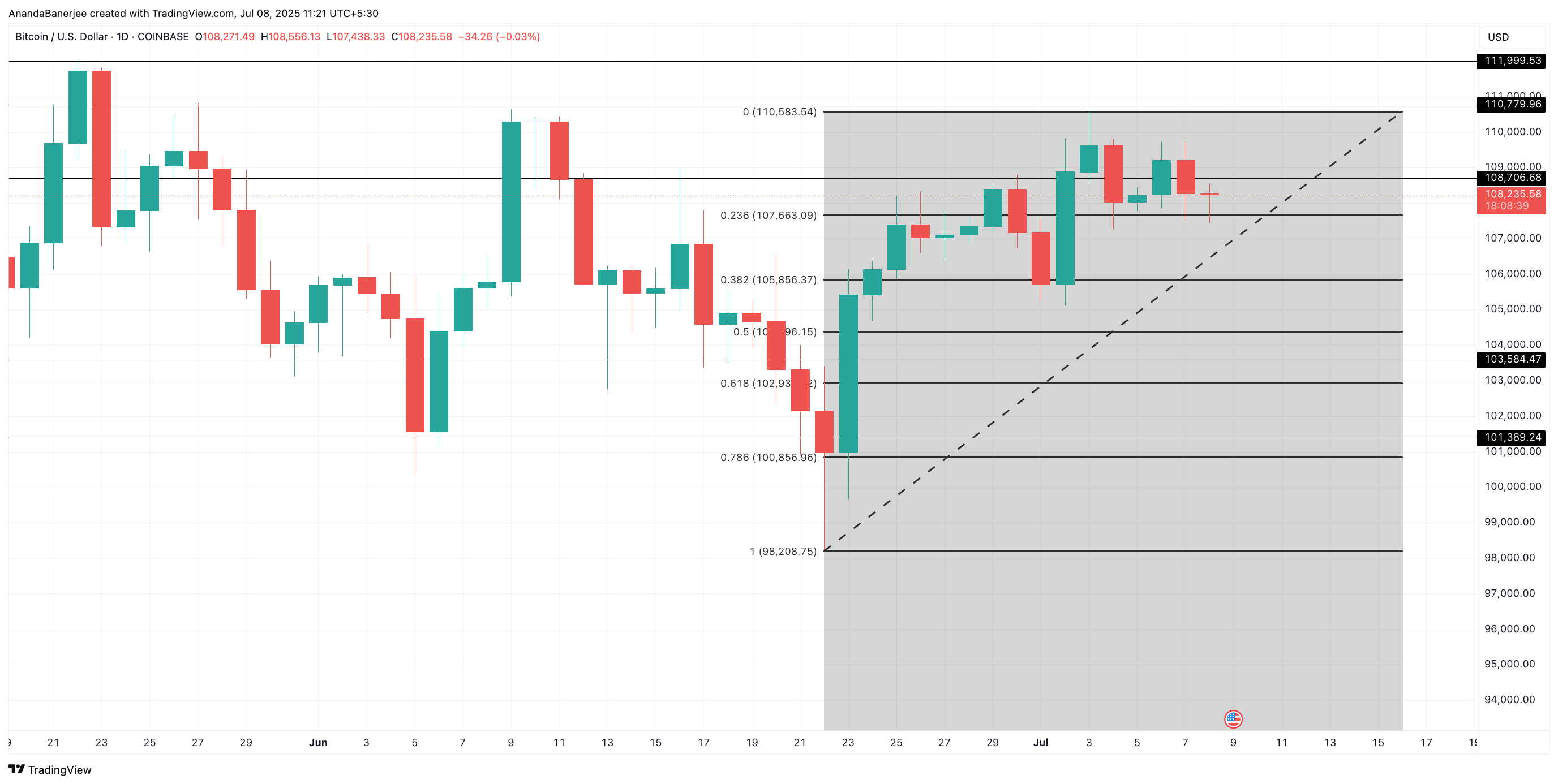

Both the Fibonacci retracement chart and the horizontal resistance line confirmed that on-chain metrics were signaling. Bitcoin is closely located just below the breakout zone.

Currently trading at $108,235, BTC is slightly above the retracement level of the 0.236 Fibonacci, which has been drawn from high to high from the recent swing. This level serves as a magnet for price integration and now forms a soft, short-term base.

Bitcoin Price Analysis: TradingView

Looking up, the horizontal resistance level between $110,583 and $110,779 represents the final hurdle before a potential surge. Enhance this technical drawing is the perfect alignment with the on-chain IOMAP cluster.

As highlighted previously, Money Indicator's In/Out shows that most BTC holders are profiting and have compact wallet support ranging from $107,209 to $110,041. On the downside, the keyfallback support levels remain the same at $103,584 and $101,389. But as things stand, the charts check on-chain stories. Bitcoin is primed and one clean break above $110,779 could be the signal the market has been waiting for.

However, when Bitcoin fails to hold its support band between $107,209 and $110,041 and falls below $103,584, the bullish paper unleashes. This suggests fatigue for buyers at the top, increasing the risk of retesting the $101,389 zone.

When Bitcoin prices exceed $110,000 in volume, its structure is due to its high rapid legs. There's minimal resistance to psychological history with a hit of $111,970 just a few weeks ago. It remains the final ceiling. At least for now!