Since August 25th, Bitcoin has been tackling resistance close to the $112,000 level. Every time I tried to stabilize it above the threshold, I ran into repeated sales.

But despite these struggles, confidence among some investors remains the same. Instead of retreating, these holders continue to accumulate BTC and strengthen their optimism about the short-term recovery of their assets.

Two chain clues show that the Bitcoin bull still has the advantage

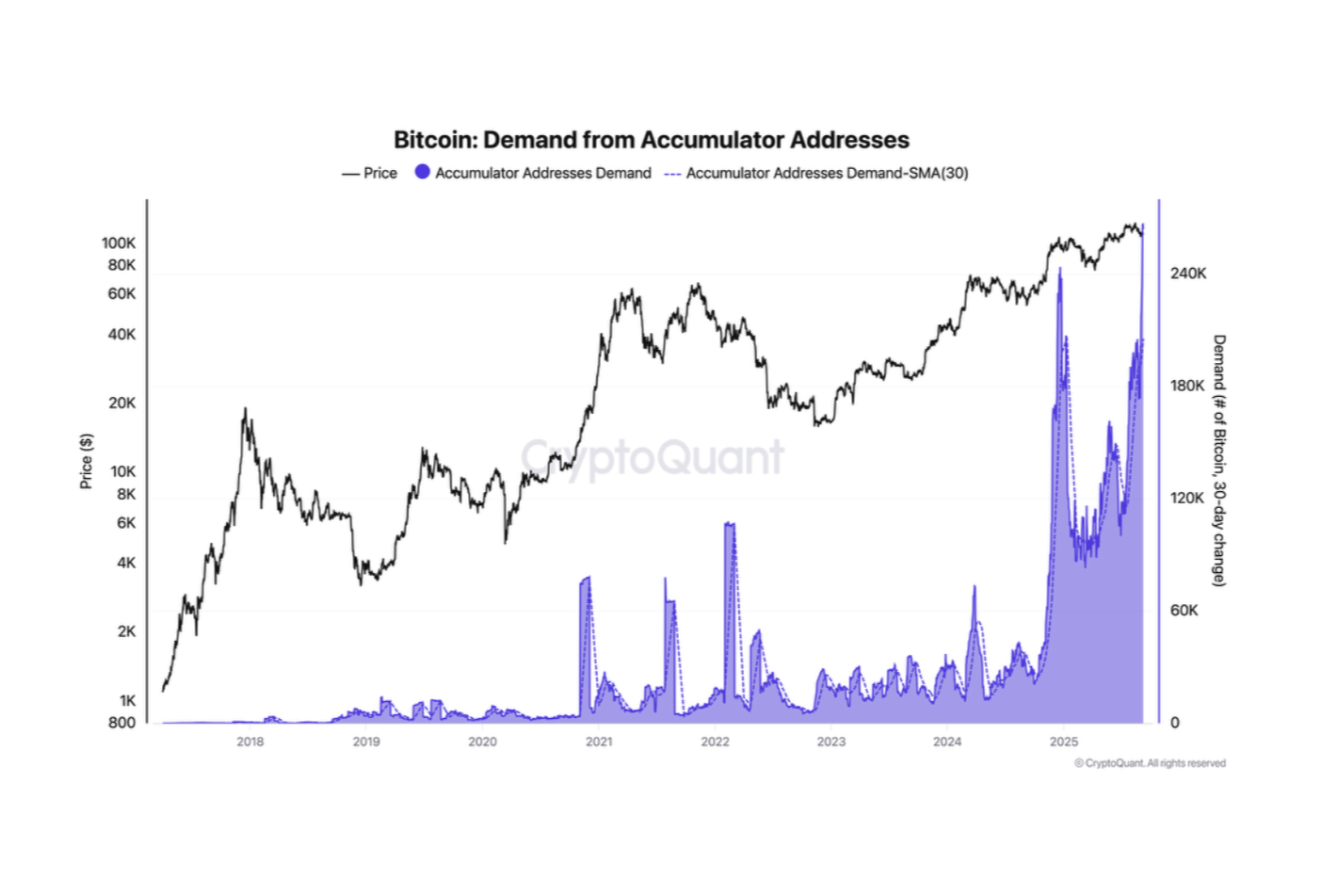

Demand from BTC accumulator addresses is “surged,” according to a new report by pseudonym encryption analyst DarkFost.

These are wallet addresses created at least two transactions with minimal amount of BTC without performing a single sales transaction. They are now setting a new all-time high to hold.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya's daily crypto newsletter.

Bitcoin accumulators deal with demand. Source: Cryptoquant

“Therefore, this type of address can be linked to long-term holder behavior. With the era of the corporate Treasury, increasing adoption and Bitcoin being perceived as an increasingly valuable store, it appears that many BTCs are accumulated with the explicit intention of being held for the long term,” Darkfost said.

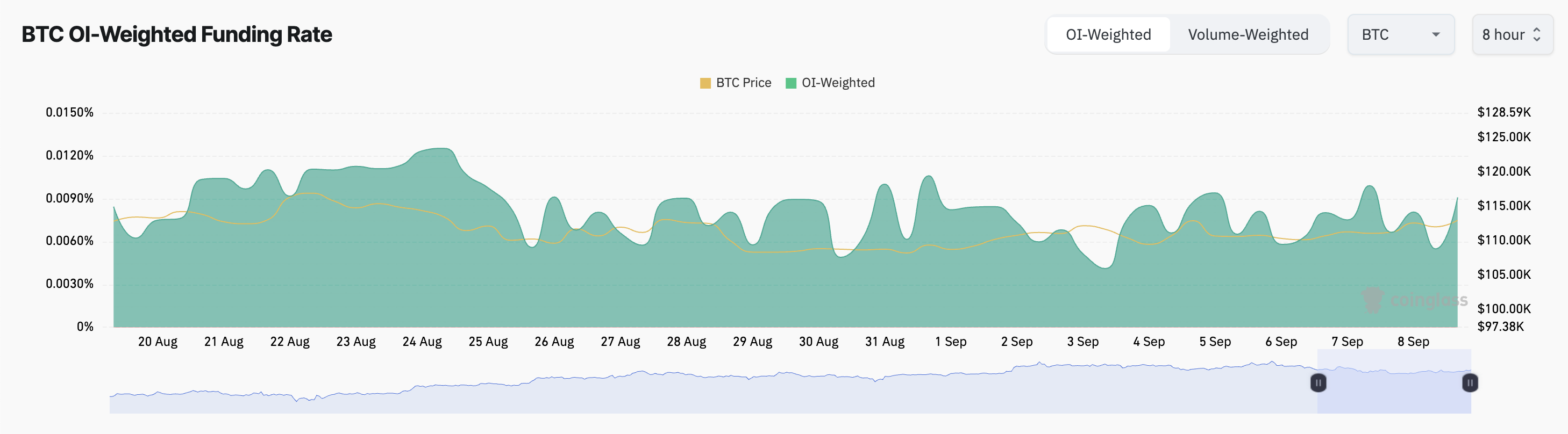

Beyond the surge in long-term accumulation, the funding rate of BTC in major exchanges remains firmly positive despite recent lack of performance. For each Coinglass, this is currently 0.0091%.

BTC funding rate. Source: Coinglass

Funding rates are used in perpetual futures contracts to maintain prices in line with BTC spot prices. This represents the recurring fee paid between traders who hold long positions (betting on price increases) and short positions (betting on reductions).

If the asset's funding rate is positive, it means that long traders are paying short traders, indicating that most traders are bullish and betting on continuous gatherings.

This means that BTC traders are willing to consistently pay premiums and maintain long positions, examining the trends seen in accumulator addresses.

BTC Bulls maintain hope, but Bears aims to break down $110,000

Together, these signals highlight that despite the repeated struggles of BTC at $112,000, both retail and derivatives market participants continue to bullish, suggesting that upward momentum is only a matter of time.

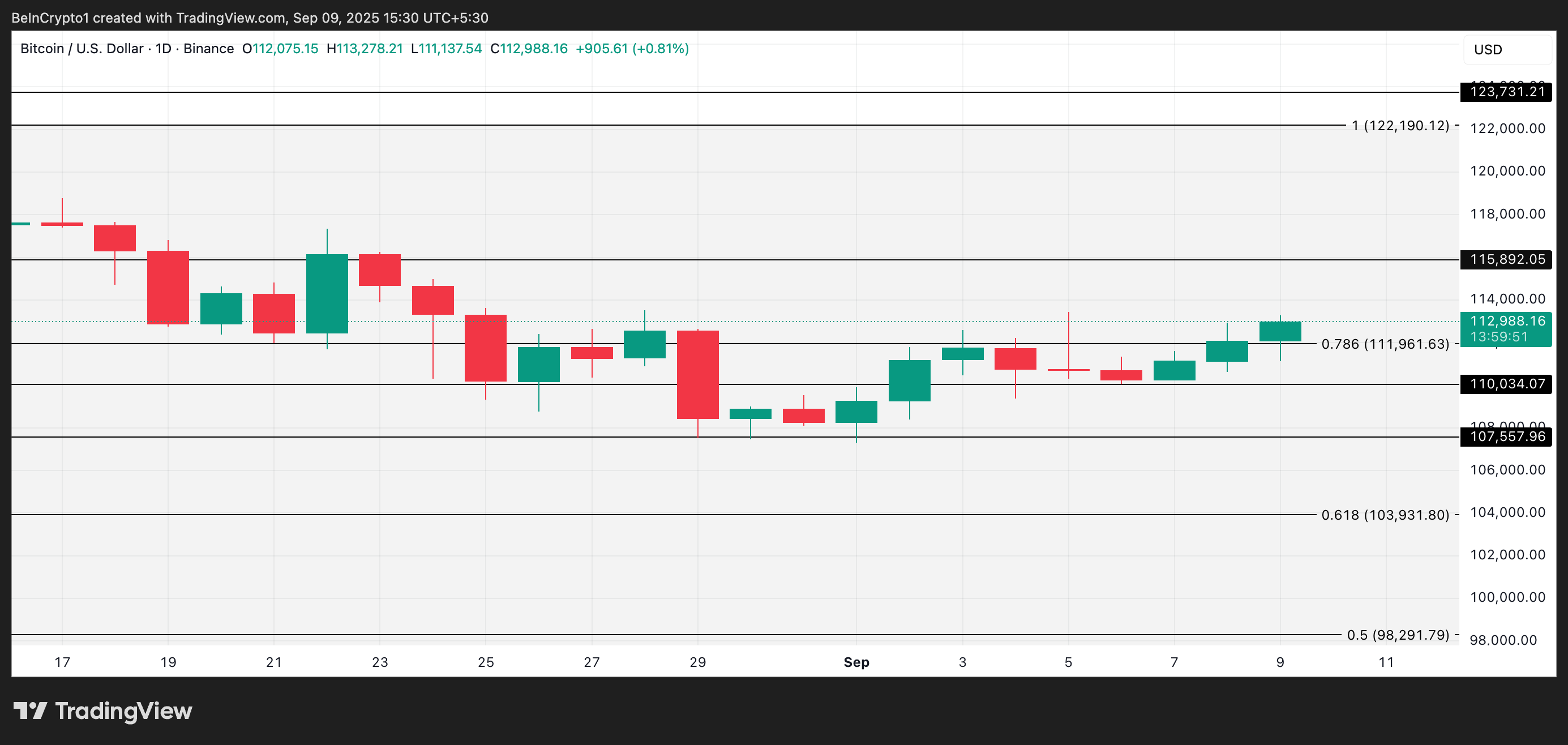

As demand continues to increase, the coin's price could rise to $115,892.

BTC price analysis. Source: TradingView

Meanwhile, when Selloffs resumes, BTC tends to be below $111,961, and at $110,034.

Post-Bitcoin is struggling at $112,000, but two signals indicate that the bull has not appeared in Beincrypto first.