Despite the recent big moves towards upside down, futures traders are betting that the current Bitcoin (BTC) rally will continue.

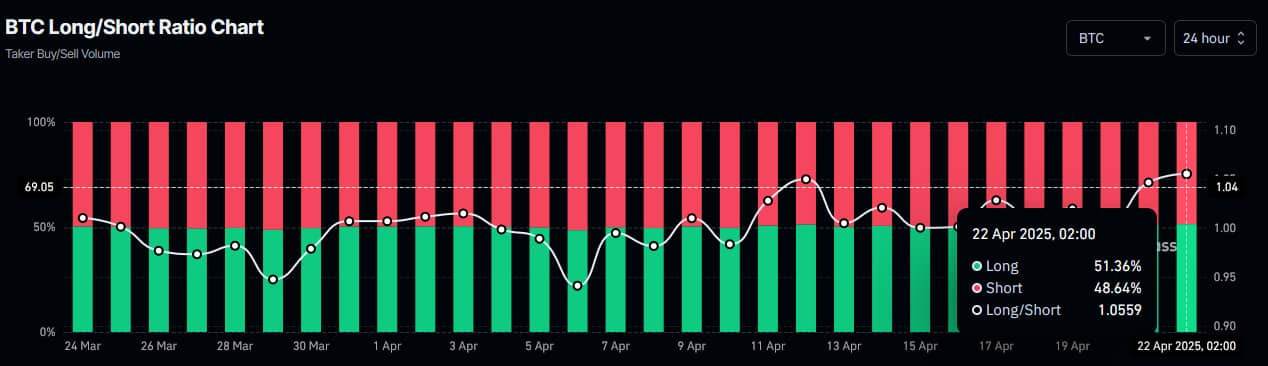

That is, Bitcoin's long/short ratio has reached a monthly high of 1.0559, indicating that 51.36% of the derivatives open in the last 24 hours are bullish, indicating that they are bullish on each data Finbold has obtained from the Cryptocurrency futures trading and information platform. Coinglass April 22nd.

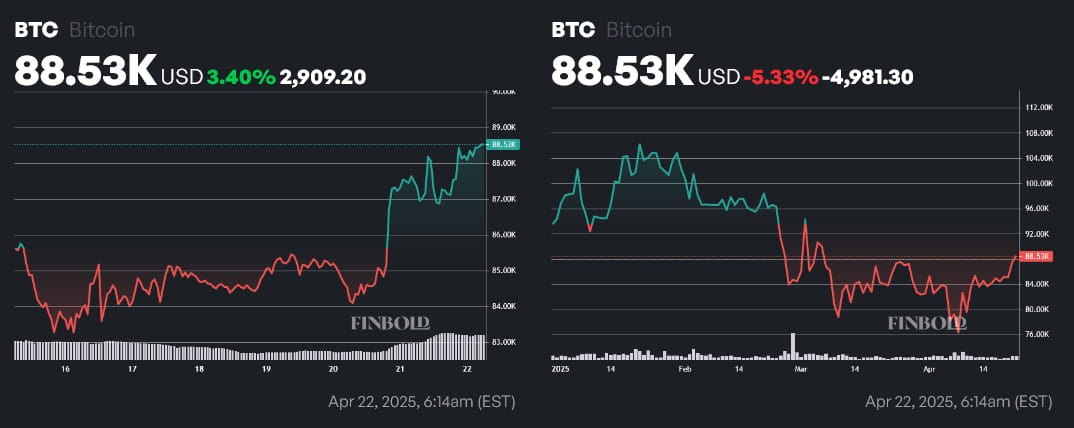

Bitcoin (BTC) surged from $85,000 to $87,000 during closing time on Sunday, April 20th. By press time on April 22nd, major cryptocurrencies had changed hands at a price of $88,530. It marked a profit of 3.40% on the weekly chart, which reduced its weekly (YTD) loss to 5.33%.

Is the Bitcoin Long/Short Ratio a reliable signal?

The second Bitcoin long/short ratio in the last 30 days was 1.05, which was seen on April 12, which represents 51.23% of the position. At the time, flagship digital assets were trading at $82,944.

However, traders should always be wary of excessive optimism. Metrics are useful because they provide clear insight into the sentiment of futures traders, but at the end of the day, this is just one part of the puzzle.

Some, like Tom Lee from Fundstrat, have denounced the Bitcoin issue earlier this year. And we believe that cryptocurrencies could even coincide with the upcoming rise of gold meteors. Meanwhile, Harry Dent, founder of HS Dent Investment Management, believes BTC will lead the “Everything Bubble” crash later this year.

While it is clear that market-wide dynamics and macro concerns will be the main drivers of impacting BTC's future price actions, at least in the short term, major digital assets are beginning to show signs of resilience.

Featured Images via ShutterStock