Bitcoin prices were trading around $89,700, largely flat on the day and down about 2% over the past week. On the surface, price trends appear weak. Inside, something even more interesting is happening.

Large Bitcoin holders are quietly retreating. Whale support is waning, and on-chain data shows a sustained distribution over the past few weeks. But despite this, Bitcoin failed to collapse. This resiliency is important because despite the whales’ indifference, another on-chain signal suggests that selling pressure may be dissipating.

Whales are selling, but overall pressure may be nearing depletion

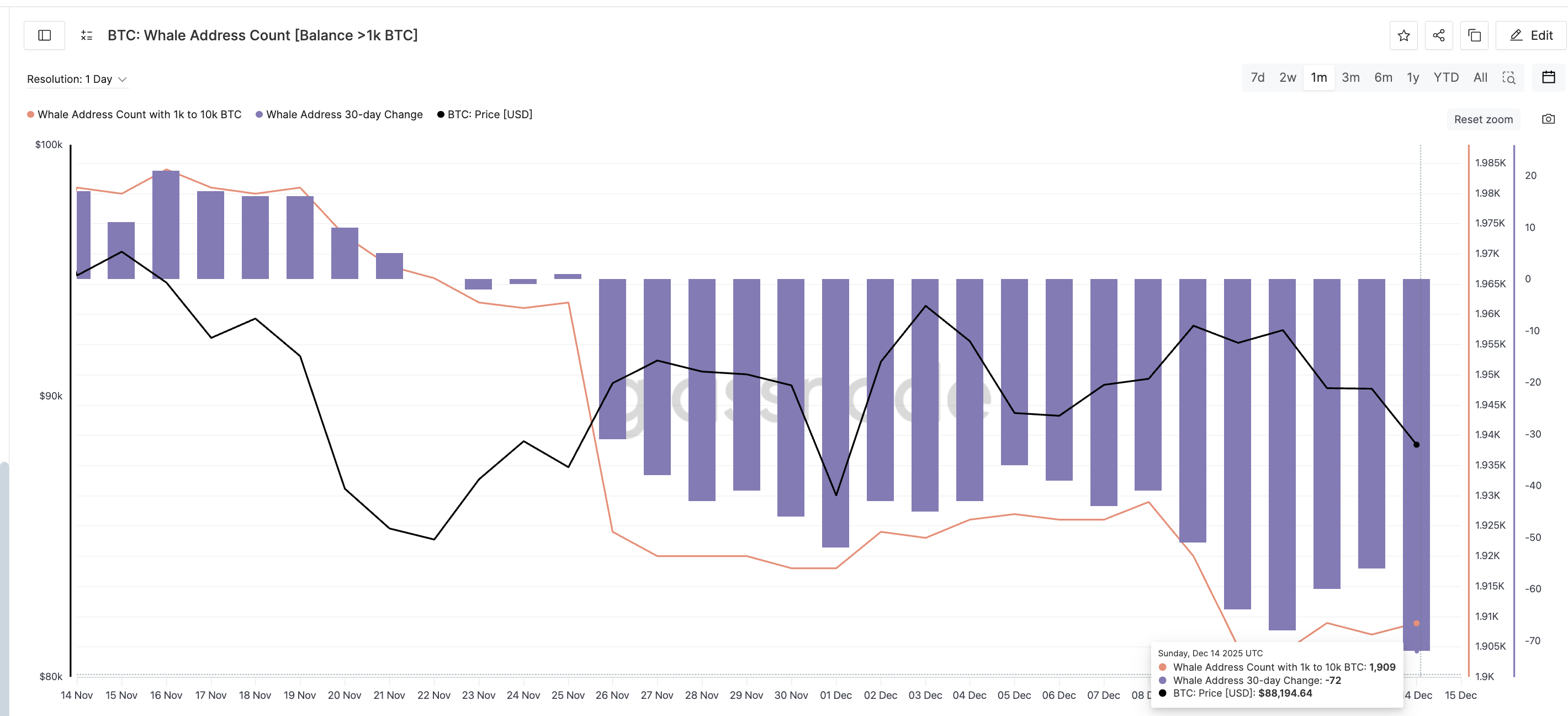

Bitcoin whale address data shows clear weaknesses. The 30-day change in whale addresses holding 1,000 to 10,000 BTC fell to -72, the lowest level since late November. The total number of whales is also near monthly lows. This confirms that large holders are reducing their exposure rather than accumulating it.

Whale Reduction Position: Glassnode

Want more token insights like this? Sign up for editor Harsh Notariya's daily crypto newsletter here.

Note that most of these whales are moving to ETH. This shows more optimism for the second-largest cryptocurrency.

🚨 Whale rotation accelerates

The big whale has just been replaced.

🔹 502.8 $BTC → 14,500 $ETH

🔹 ~$45.24 millionThis was not a one-off.

The same wallet was converted:

🔹 1,969 $BTC

🔹 to 58,149 $ETHIt's not panic selling.

That is the rotation of capital.When the whale rotates,

They… pic.twitter.com/59goN9BeKb— BMNR Bullz (@BMNRBullz) December 15, 2025

Usually such actions lead to deeper regression. That wasn't the case this time.

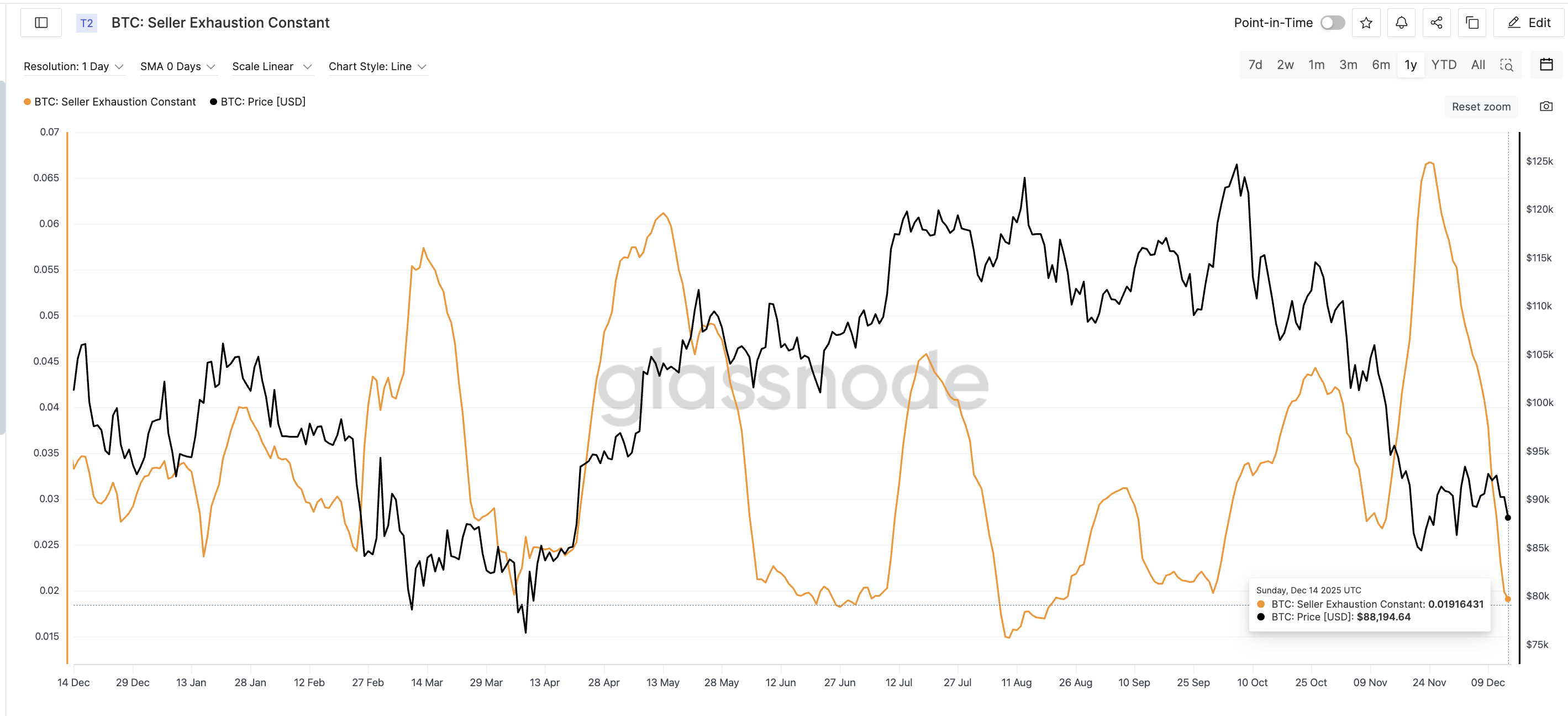

One reason could be the Bitcoin Seller Exhaustion Constant, a Glassnode indicator that combines loss-taking behavior and price volatility. This highlights a period where volatility remains low despite many sellers being underwater. Historically, this combination is considered to be near the bottom of the local BTC price with low risk.

The indicator is currently hovering around 0.019, a level last seen around April 5, when Bitcoin traded around $83,500. Over the next six weeks, the price rose more than 33% to a high of nearly $111,600. Today's readings are slightly lower and are firmly within the same historical depletion zone.

BTC sellers may be tired: Glassnode

This does not guarantee a backlash. This suggests that downside risk is shrinking.

Bitcoin price levels that will determine the next move

Despite the whale selling, Bitcoin remains above the key support zone of $89,250. As long as these daily closing prices persist, the bears will have a hard time gaining control.

Momentum will quickly improve if Bitcoin regains $91,320. This opens the door to $94,660, where previous supply exists. A complete breakout here would shift the market structure back in favor of the bulls.

Bitcoin Price Analysis: TradingView

The invalidity is obvious. A daily close below $89,250 would weaken the depletion theory and expose downside potential towards $87,570 and $85,900.

The post Bitcoin loses whale support? Yet History Shows the Price Can Still Rise appeared first on BeInCrypto.