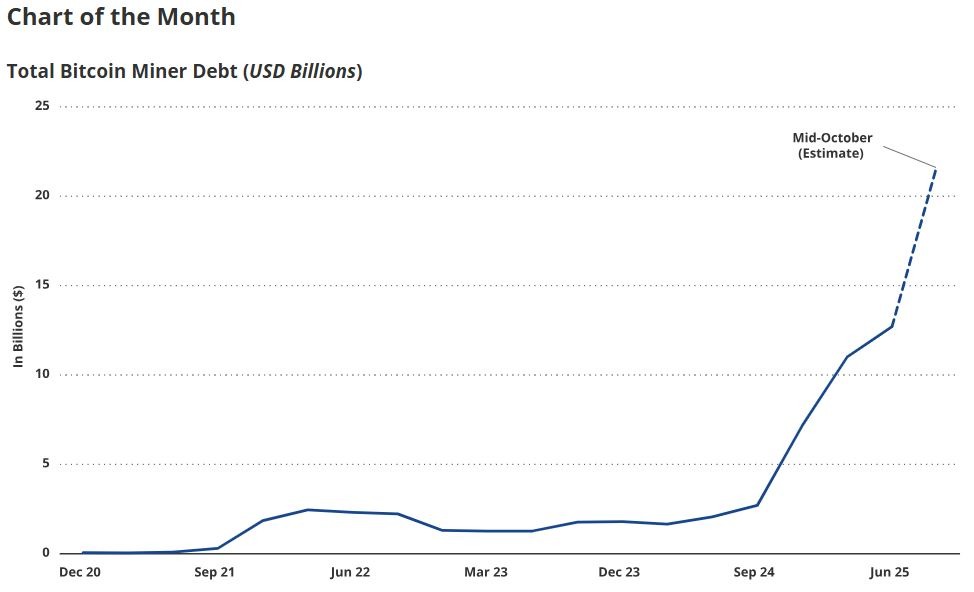

Bitcoin miners' debt rose from $2.1 billion to $12.7 billion in just 12 months as they race to meet the demands of artificial intelligence and Bitcoin production, according to investment giant VanEck.

Without continued investment in modern machines, miners' share of the global hashrate will decline, resulting in a decline in the share of Bitcoin (BTC) granted each day, VanEck analyst Nathan Frankowitz and head of digital asset research Matthew Siegel said Wednesday in their October Bitcoin Chaincheck report.

“We call this movement the ice-thaw problem. Historically, miners relied on the stock market rather than debt to cover these high capital investment costs.”

“This is due to the fact that miners' income is almost entirely dependent on the speculative price of Bitcoin, making them difficult to underwrite. Importantly, equity tends to be a more expensive form of capital than debt,” Frankowitz and Siegel added.

Bitcoin miners' debt has increased from $2.1 billion to $12.7 billion in the past 12 months. sauce: Van Eck

Industry publication The Miner Mag estimates combined debt and convertible bond issuance from 15 public miners to be $4.6 billion in the fourth quarter of 2024, $200 million in early 2025, and $1.5 billion in the second quarter of 2025.

Crypto miners move into AI

Since the halving in April 2024, when mining rewards will be reduced to 3.125 Bitcoins, more Bitcoin miners are diversifying their income sources by shifting energy capacity to AI and HPC hosting services, hurting overall profitability.

“In doing so, miners now have more predictable cash flow backed by multi-year contracts,” Frankowitz and Siegel said.

“The relative predictability of these cash flows allows miners to take advantage of the bond market, diversifying their income from Bitcoin’s speculative and cyclical prices and lowering their overall cost of capital.”

In October, BitFarms completed a $588 million convertible debt offering, with proceeds going toward HPC and AI infrastructure development in North America.

Fellow mining company TeraWulf also announced a $3.2 billion senior secured debt offering to partially fund a data center expansion at its Lake Mariner campus in Barker, New York.

sauce: terra wolf

Meanwhile, IREN also completed a $1 billion convertible debt offering in October, with some funds designated for general corporate purposes and working capital.

AI pivot is not a threat to the Bitcoin network

Miners are the backbone of the Bitcoin network. Validate every Bitcoin transaction and record it in a new block. The more miners that participate, the higher the hashrate, which helps make the network more secure.

Related: Mining Bitcoin just got easier, but it didn't last long as the hashrate went wild again

Frankowitz and Siegel said miners shifting their focus to AI and HPC hosting is not a threat to the network's hashrate, as “AI's prioritization of electronics is a net benefit for Bitcoin.”

“Bitcoin mining is an easy way to quickly monetize surplus power in remote and developing energy markets, and can effectively subsidize the development of data centers designed with AI and HPC transformability in mind,” they said.

“Furthermore, AI inference experiences cyclical demands throughout the day based on human activity.”

Miners looking for ways to cut costs

At the same time, several miners they spoke to for this report said they are looking for ways to monetize excess power capacity at a time when demand for AI services is low.

Frankowitz and Siegel said this could allow miners to offset or eliminate expensive backup power sources such as diesel generators.

“Although this is still conceptual, we believe it represents a logical next step in the unique synergy between Bitcoin and AI that will lead to greater efficiency in the use of both financial and electrical capital.”

magazine: Binance shakes up Morgan Stanley’s security tokens in South Korea, Japan: Asia Express