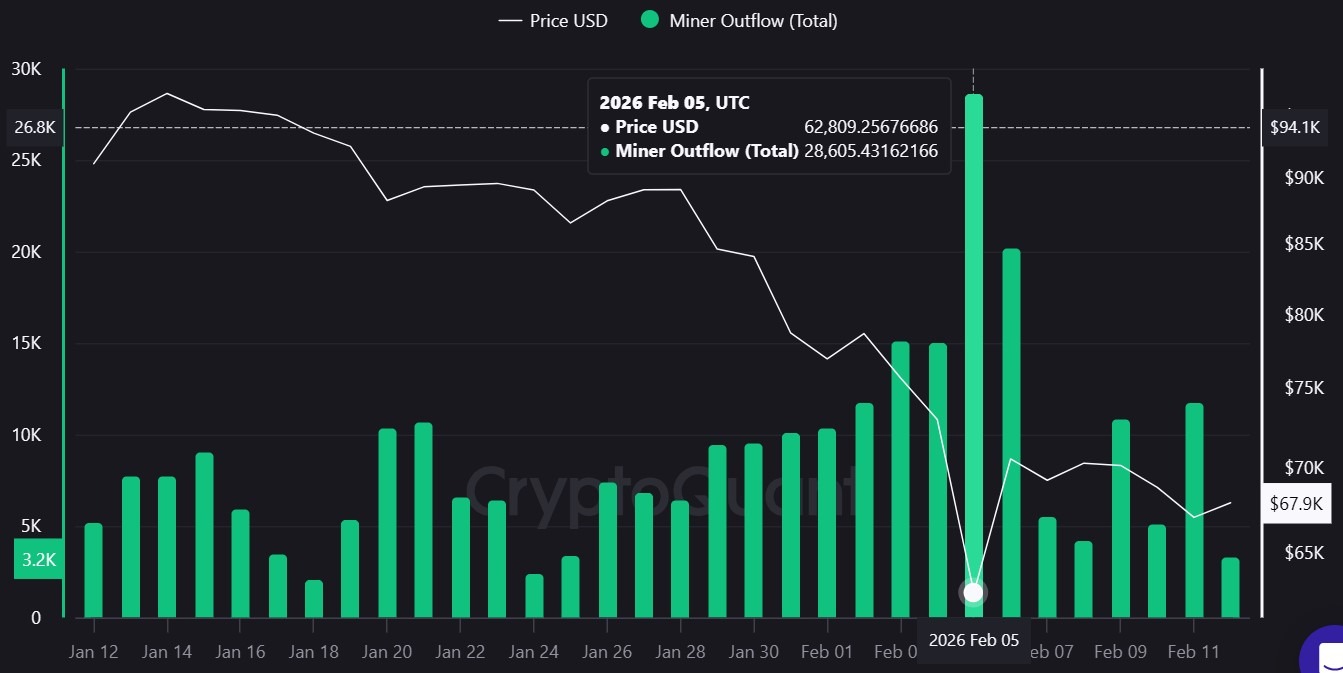

Number of Bitcoin miners leaked soars to 28,605 $BTCtransactions worth about $1.8 billion took place on February 5, making it the largest single-day transfer since November 2024 as prices soared during volatile trading.

An additional 20,169 Bitcoins ($BTCApproximately $1.4 billion worth of cryptocurrencies were leaked from wallets linked to miners on February 6, according to data from CryptoQuant. The last similar spike occurred on November 12, 2024, when the number of exodus reached 30,187. $BTC.

This spike coincides with rapid price movements; $BTC It traded at around $62,809 on February 5, but rebounded to $70,544 the next day. Large scale transfers of miner wallets during volatile sessions are often subject to scrutiny as they can indicate potential selling pressure.

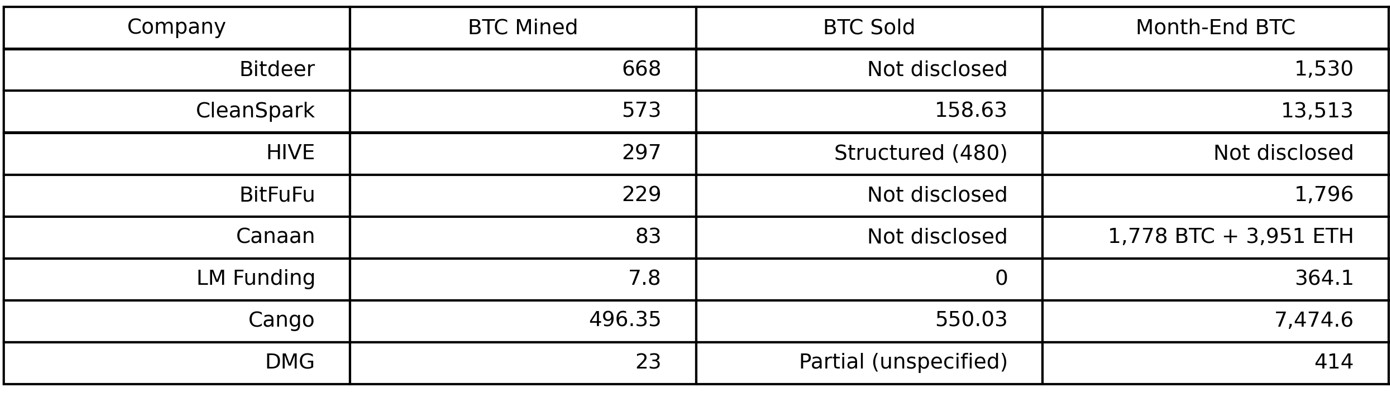

The eight miners that have disclosed January numbers so far are CleanSpark, Bitdeer, Hive Digital Technologies, BitFuFu, Canaan, LM Funding America, Cango, and DMG Blockchain Solutions. They reported a total production of approximately 2,377 pieces. $BTC During that month. This total is much lower than 28,605 cases. $BTC It was transferred in one day on February 5th.

Runoffs likely reflect broader ecosystem flows

The scale of the outflow on February 5th and February 6th exceeded the January output of publicly traded companies surveyed by Cointelegraph.

The combined January sales reported by CleanSpark, Cango, and DMG account for only a fraction of the 28,605 confirmed sales. $BTC It will be transferred in 1 day.

However, a miner exodus does not automatically lead to capitulation or immediate spot market sales.

According to CryptoQuant, miner outflows include transfers to exchanges as well as internal wallet movements and transfers to other entities, and this metric by itself does not confirm that the coins were sold on the open market.

Given the size of the move relative to disclosed public miner sales, the move may reflect activity beyond large publicly traded companies.

30-day chart of Bitcoin miner outflow. sauce: cryptoquant

Miners' public disclosures show various moves by the Treasury Department

CleanSpark reported mining 573 $BTC and sales 158.63 $BTC January ended at 13,513 $BTC It's on the balance sheet.

Kango mining 496.35 $BTC Disclose sale of 550.03 $BTCsaid it will continue selling newly mined Bitcoin to support the expansion of its artificial intelligence and inference platform.

On February 9, the company sold an additional 4,451 units. $BTC Approximately $305 million will be paid to partially repay a Bitcoin-backed loan and raise funds for AI projects.

Related: Bitcoin difficulty drops more than 11%, biggest drop since China's ban in 2021

Other companies took a different approach. canaan mining 83 $BTC Reserves increased to 1,778 $BTC and 3,951 ETH. LM Money Mining 7.8 $BTC No sales were reported and the financials rose to $364.1. $BTC.

Hive, on the other hand, used the structured pledge mechanism associated with 480. $BTC To maintain liquidity while maintaining operations.

Some miners consistently report monthly production performance, while others only report intermittently or have moved to quarterly disclosure.

January miner data compiled by Cointelegraph. Source: Cointelegraph

Related: Stock prices of Bitcoin mining companies IREN and CleanSpark plummet due to lack of revenue

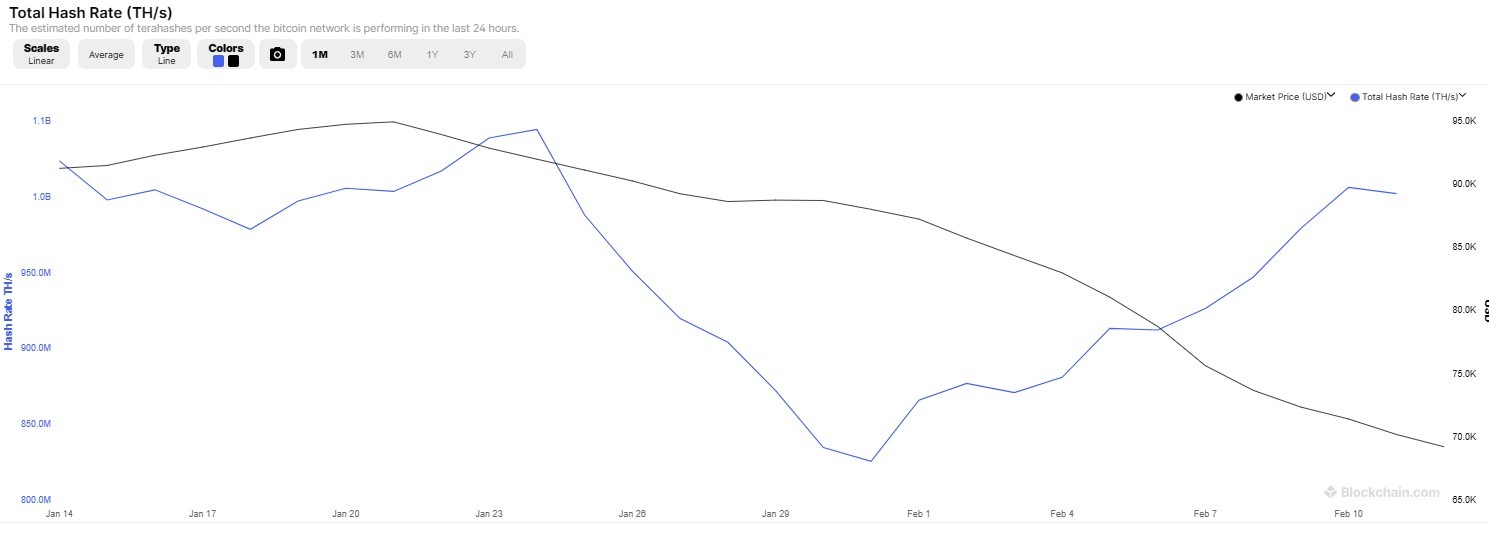

Winter storm impacts US miner hashrate

In late January, the network's hashrate also fluctuated rapidly as severe winter storms hit parts of the United States. On January 27th, Bitcoin's hashrate dropped to 663 exahashes per second in two days, a drop of more than 40%.

Total mining hashrate. sauce: Blockchain.com

The temporary decline came as miners scaled back operations to stabilize the region's power grid amid frigid temperatures and soaring energy demand. U.S.-based companies such as Marathon Digital Holdings and Airen have reported reduced operating hours, resulting in a significant short-term drop in daily production.

According to data from Blockchain.com, the hashrate dropped in the last week of January before recovering in early February.

magazine: The 6 strangest devices people used to mine Bitcoin and cryptocurrencies