Today's Ethereum Price: $2,460

- Ethereum recorded a 1% decline in the last 24 hours as the Bulls eased purchasing pressure.

- Bitcoin Miner from BIT Digital has announced plans to switch to its ETH financial strategy.

- ETH should recover to a $2,500 level to prevent validation of bearish flag patterns.

Ethereum (ETH) has fallen 1% in the last 24 hours, following the announcement of Bitcoin (BTC) Miner Bit Digital (BTBT) on Wednesday.

ETH loses steam despite digital pivots despite Ethereum financial strategy

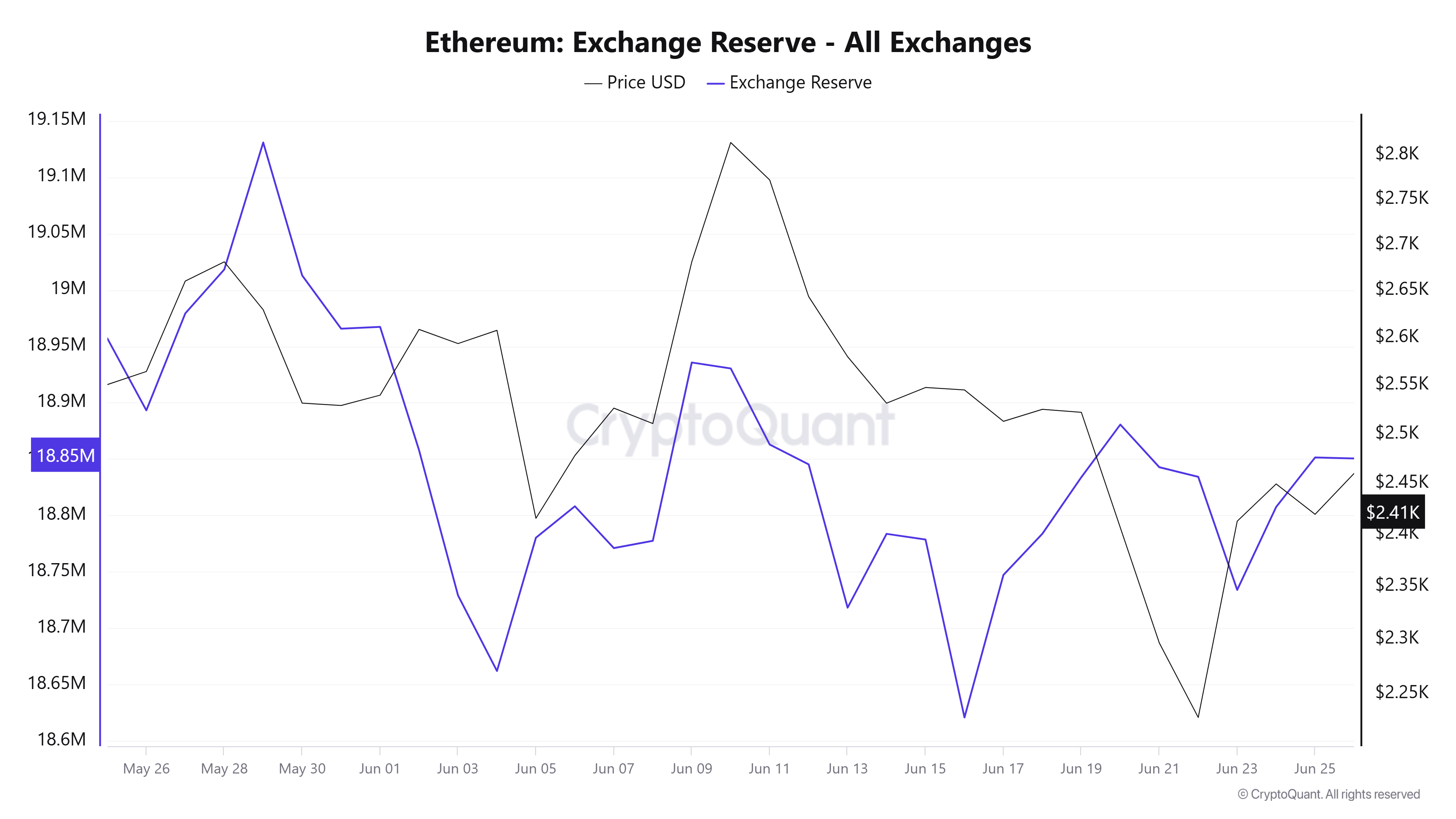

The Bulls lost steam after recording profits for two consecutive days following the Israeli-Iran ceasefire as Ethereum recorded a 1% decline. This decline is spurred by an increase in Ethereum's exchange reserves, indicating low demand and slight increases in sell-side pressure.

Eth Exchange Reserve. Source: Cryptoquant

Despite its calmness, NASDAQ-listed Bitcoin Miner Bit Digital has revealed a critical shift towards becoming a Treasury-focused company in ETH staking, so the company entities continue to allocate funds to ETH.press release on wednesday.

The company announced plans to abolish Bitcoin mining operations, redirecting revenues and expanding Ethereum staking activities. BIT Digital claimed that it began building Ethereum location and staking infrastructure in 2022, gradually expanding its ETH holdings.

Bit digital tooannouncement The launch of a public offering for the underwriting of common stock, in which all shares are issued and sold directly by the company. The company said revenue from sales will be used to expand its Ethereum holdings and will strengthen its strategic shift to becoming the ETH Treasury Ministry and staking platform. However, the scale or timing of the offering has not been disclosed.

BIT Digital has revealed that it has held 24,434.2 ETH and 417.6 BTC as of March 31.

The move is in line with growth trends among crypto companies, as it adopts a financial model that provides exposure to Ethereum and other cryptocurrencies. This includes Sharplink Gaming (SBET). This includes the Ethereum Treasury Department, the largest public company. The company holds a total of 188,478 ETH, worth approximately $457 million based on current prices.

NASDAQ-registered BTCS also acquired 1,000 ETH last Friday, increasing its Treasury holdings to 14,600 ETH.

Ethereum price forecast: ETH should recover $2,500 to prevent bear flag verification

According to Coinglas data, Ethereum has experienced a $49.49 million futures liquidation in the last 24 hours. The total amounts of long and short liquidations are $30.09 million and $19.4 million, respectively.

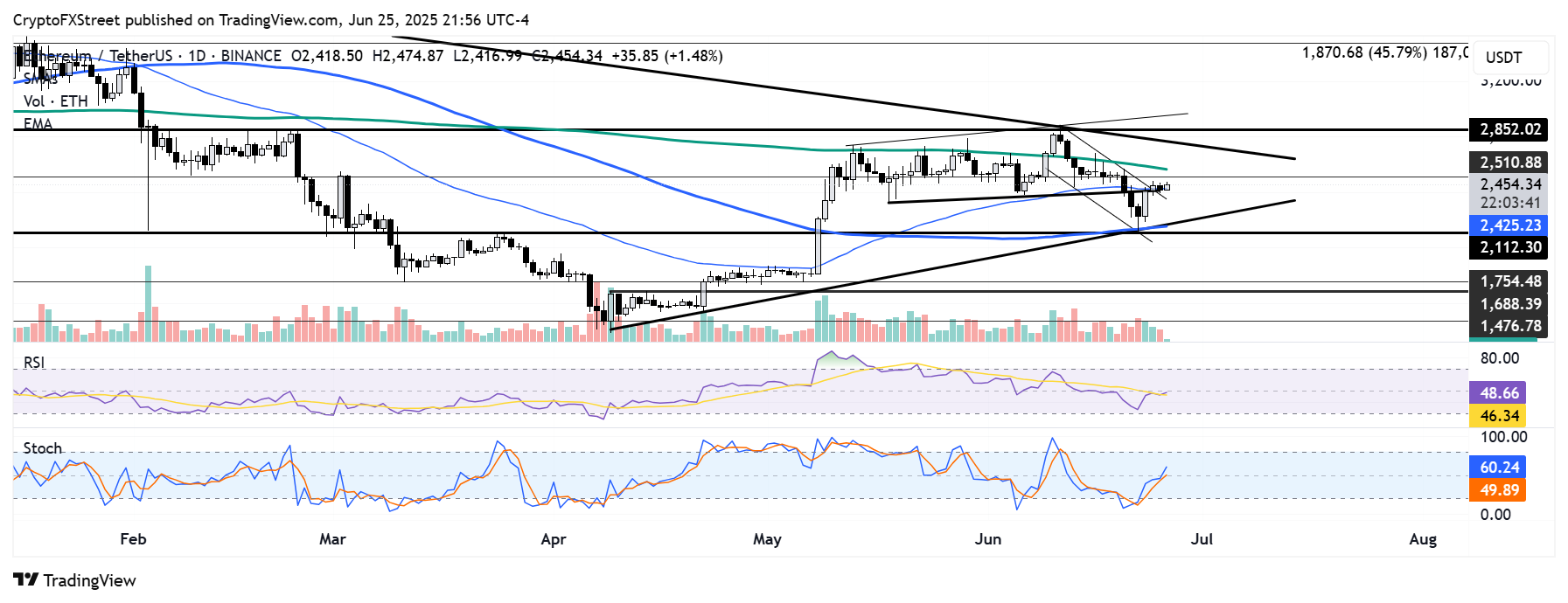

Ethereum was rejected just below the $2,500 key level after being temporarily broken down on the upper descent channel limit and the 50-day exponential moving average (EMA) over the last 24 hours.

ETH/USDT Daily Chart

If ETH fails to recover to a $2,500 level and loses the channel's cap support, the bearish flag pattern is verified. Such a movement could send the price to under $2,100 if it cannot retain the lower boundary support of the symmetrical triangle pattern.

The advantage is that ETH should clear the $2,500 and 200-day Simple Moving Average (SMA) resistance to test the upper limit of the symmetrical triangle and potentially the key level of $2,850.

Relative Strength Index (RSI) and Stoch oscillators (Stoch) test their neutral levels. Rejection can cause a resumption of bearish momentum, but crossovers accelerate bullish pressure.

Related News

- Ethereum price forecast: Powell's hawkish tone as a ceasefire between Israel and Iran ignores Powell's hawkish tone to burn bullish emotions

- Ethereum price forecast: ETH's eyes recovery as Israeli-Iran conflict leaks to US military bases

- Coinbase Eyes Record close, Call Company “Amazon of Crypto” as analysts raise their price target to $510

Share: