Bitcoin miners suffered a massive 6.31% difficulty increase this week, pushing their rating to a whopping 155.97 trillion. Still, miners continued to rampage through hashrates past the 1,100 exahash per second (EH/s) mark, with block times close to the classic 10-minute cadence.

October revenues rose slightly, but Bitcoin miners face hardship

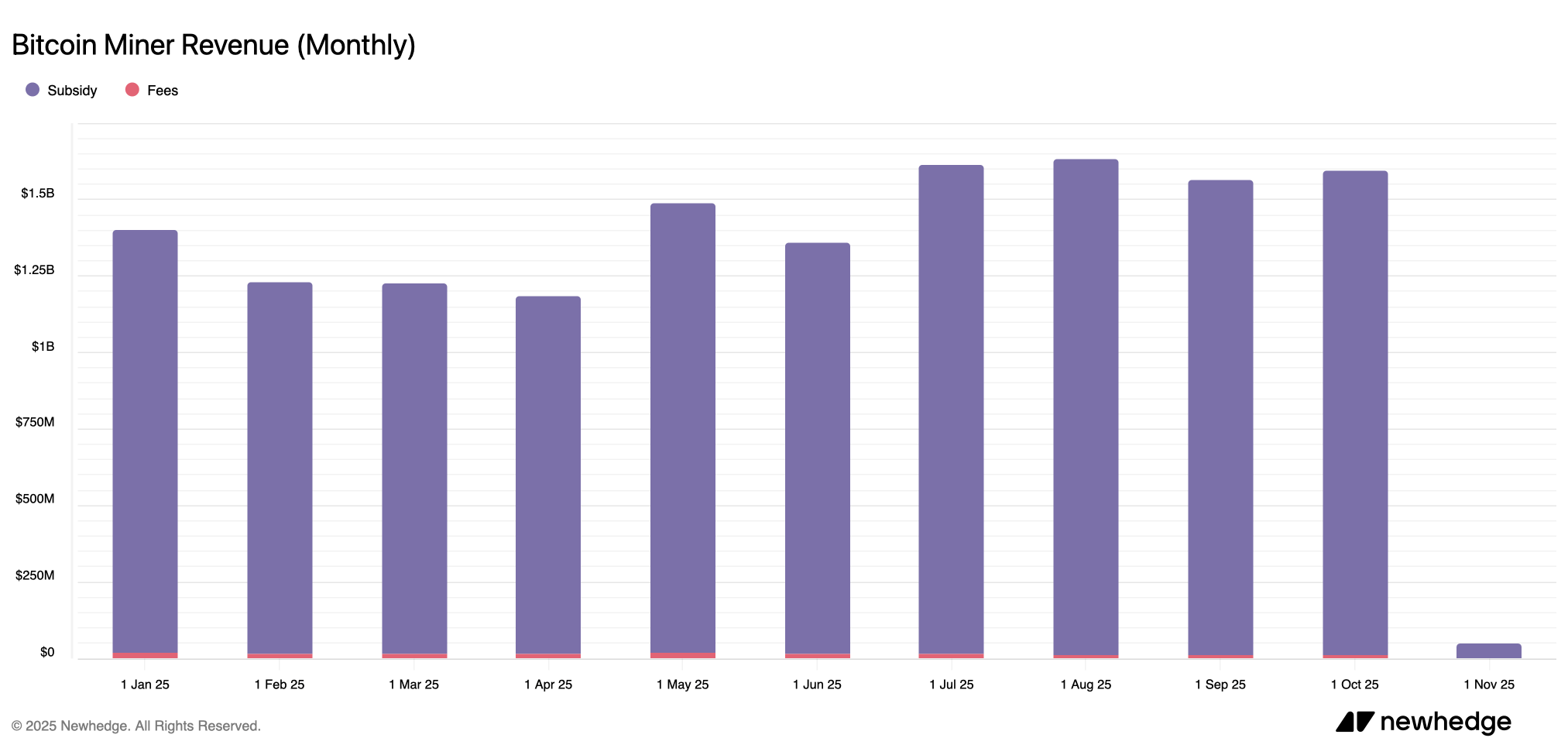

Bitcoin miners were treated a little better in October, with about $1.595 billion in revenue, of which about $1.584 billion came directly from block subsidies, according to numbers collected by newhedge.io.

This is a modest increase from September's $1.564 billion harvest and will leave miners smiling at an additional $31 million. Overall, the October salary looks fresh, increasing by 13.77% compared to January 2025 take-home pay.

As of Saturday, November 1st, hashrate is cruising at a refreshing speed of 1,110.86 EH/s after spiking to 1,164 EH/s on October 19th, according to network statistics from hashrateindex.com. That means around 54 EH/s has been cut since then, and miners are feeling the squeeze as Bitcoin's price has fallen and difficulty has increased by 6.31%.

This latest difficulty increase ranks as the third largest of the year, behind the July 12, 2025 and April 5, 2025 difficulty retargets. Meanwhile, the price of Bitcoin has fallen this week, and hashprice, the estimated value of one petahash per second (PH/s) of mining power, has lost some luster since last month.

30 days ago, the price of PH/S was around $50.66; it is now close to $44.67. Trading fees? Yet they continue with the unreliable side hustles we've seen from last year. On average, less than 1% of the value of each block reward goes to on-chain fees, or pennies in miner terms. The average fee for Saturday block rewards is equal to 0.75% of the net value of finding a block.

Miners are probably holding their heads high hoping that things will level out soon, with Bitcoin prices returning to more friendly levels and hash prices following suit. Ultimately, profitability depends on a delicate balance between difficulty, energy costs, and market value. Two of those three aren't playing well.

Once prices rebound and hash prices recover, miners will finally have some relief and be able to keep their rigs running without sweating every block. For miners, like traders staring at charts with sweaty palms, it's a waiting game. However, in mining, patience is not only nerve-wracking, but also consumes electricity and cash.

Frequently asked questions ❓

- What is the current mining difficulty for Bitcoin? Bitcoin mining difficulty recently increased by 6.31% to 155.97 trillion, the third largest increase in 2025.

- How much did Bitcoin miners earn in October 2025?Miners raised about $1.595 billion in October, almost all of which came from block grants.

- What is happening to the Bitcoin hash price?Hash price has fallen from about $50.66 per PH/month a month ago to about $44.67 currently.

- Why are the miners under pressure now?Increasing difficulty, falling Bitcoin prices, and low on-chain fees are squeezing miners' profits.