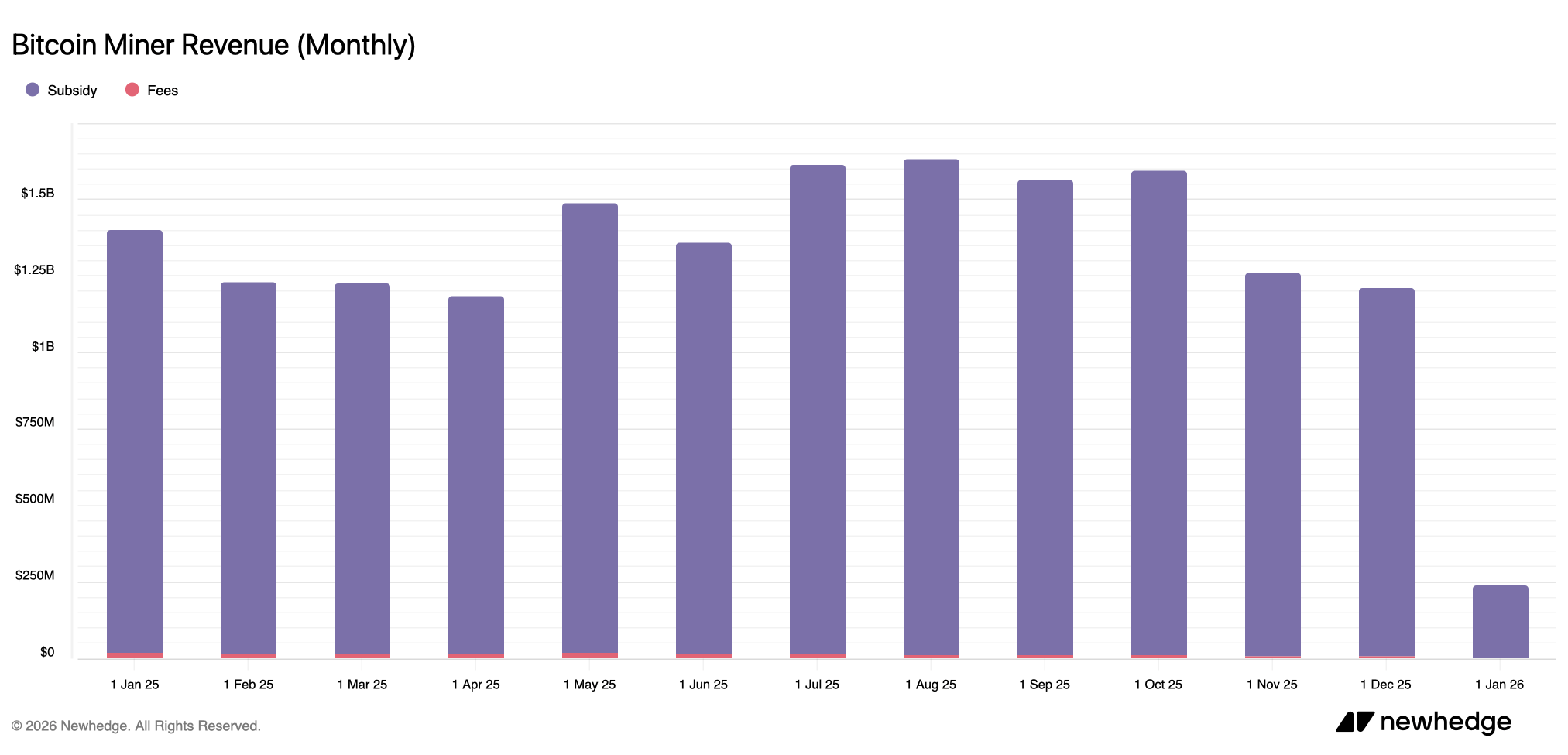

After a lackluster November, Bitcoin miners collected even more modest revenue in the final month of 2025, with revenue reaching around $1.21 billion, the second weakest monthly performance of the year.

December has been painful for Bitcoin miners, but the worst may be over

Although the situation for Bitcoin miners will improve in 2026, December profits will still be That ranks as the second-weakest month of 2025, behind April's $1.18 billion cumulative total, according to newhedge.io statistics. Miner revenue in November was $1.26 million, down 4.13% from $1.21 billion in December.

December 18, 2025 was the weakest day of the month for HashPrice, the estimated spot price assigned to sin.At this point, the current rate of 1 PH/s was $36.25, one of the lowest hash price levels recorded in recent years.

Despite the revenue squeeze, the network's hashrate did not exceed the 1,000 exahash/second (EH/s) or 1 zetahash/second (ZH/s) threshold until the end of December. At the end of the first week of January 2026, the hashrate will remain at 1,046 EH/s and a new difficulty epoch will arrive within two days.

Also read: Wall Street powerhouse Morgan Stanley files for Bitcoin and Solana ETFs

Block times will be slightly longer on average at 10 minutes and 8 seconds, and current forecasts suggest difficulty may ease by 1.4%, although that outlook could change over the next two days.

A slight increase in block times and a possible downward adjustment of difficulty suggest a modest mechanical relaxation, but not a fundamental reset. The moderate average block time and strong hashrate are both primarily due to improved revenue, with the current hash price level sitting at $40.26 per PH/sec.

Spot hash prices have risen 11% since December 18th lows. However, on-chain fees still account for less than 1% of total block rewards, and Bitcoin miners rely heavily on BTC price appreciation to increase the value of their subsidies.

If BTC price continues to hold strong and hash price maintains its recent gains, it could find more stable footing in early 2026. Until then, the mining economy will be a test of efficiency, balance sheet strength and patience.

Frequently asked questions ⛏️

- Why did Bitcoin miners struggle in December 2025?Revenue fell to $1.21 billion as hash prices fell to multi-year lows and transaction fees remained minimal.

- What has changed for Bitcoin miners heading into 2026?Hashprice has recovered 11% from its December 18th low, and network hashrate and revenue metrics have started to improve.

- How strong is the Bitcoin network despite declining miner income? The hashrate remained above 1 zettahash per second until late December, indicating continued participation in mining.

- What will miners rely on to improve profitability in early 2026?Miners are still heavily dependent on rising BTC prices, and on-chain fees remain less than 1% of block rewards.