On Friday, the market capitalization of Bitcoin mining stocks rose 9.43%, with all of the top 10 publicly traded miners by market capitalization closing in the green, including three stocks with double-digit gains. With one week left on the 2025 calendar, nearly the entire mining group, with the exception of two laggards, appears poised to end the year on a positive note.

Strong trading on Friday puts listed Bitcoin miners in for a noisy run into 2026

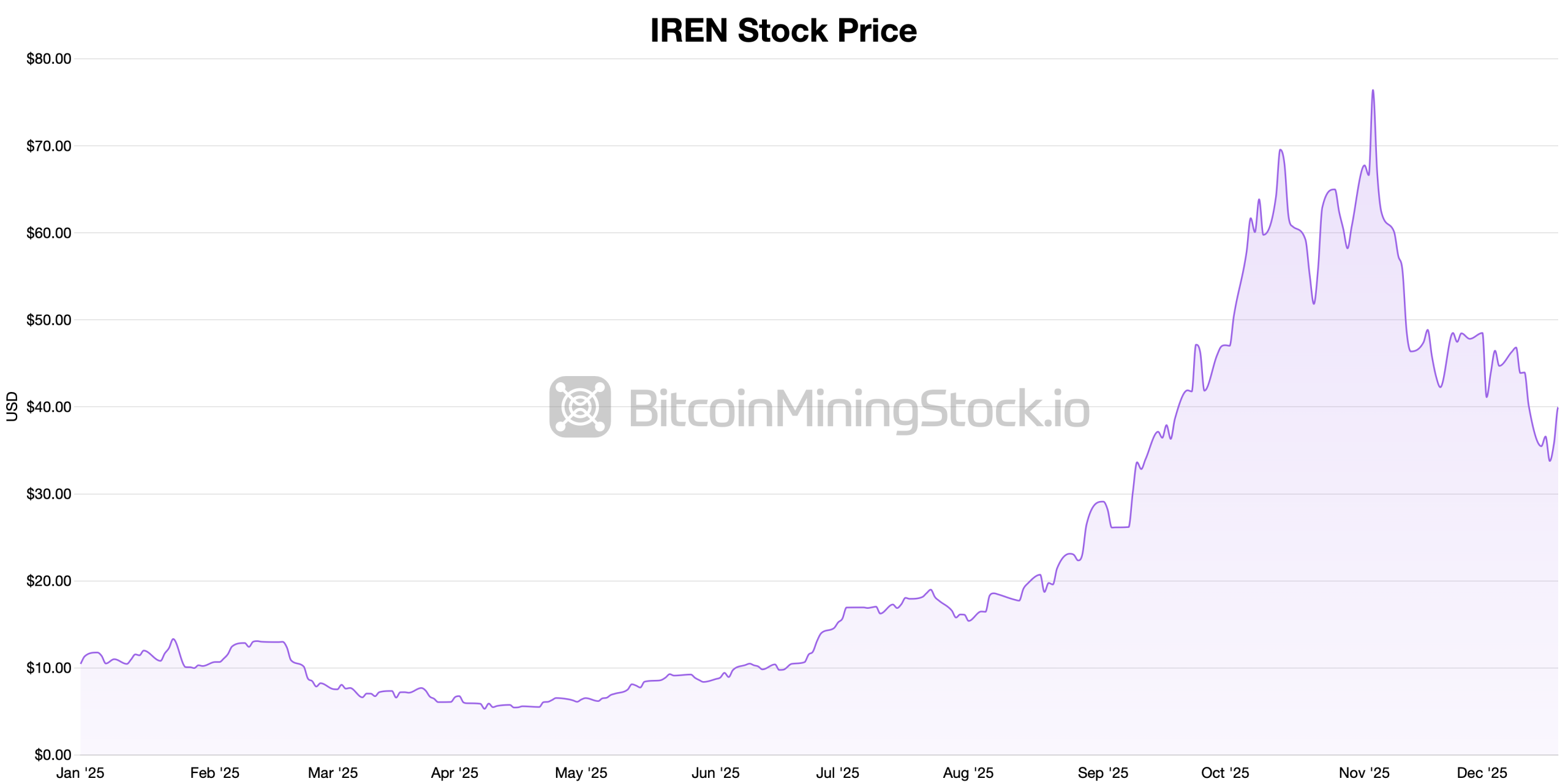

Bitcoin miners traded on U.S. exchanges were solid on Friday, keeping pace with major U.S. stock indexes. IREN Limited, the largest publicly traded Bitcoin miner with a market capitalization of $11.31 billion, rose 11.50% on the day to close at $39.92. Although the stock price has fallen by 0.52% in the past five business days, the overall picture is still attracting attention, with the stock price increasing 306.51% year-to-date (year-to-date).

Applied Digital rose 16.52% on Friday to close at $27.85. Still, the stock price remained largely unchanged over the five-day period, down just 0.03%. Zooming out, APLD is still having a great year, up 264.52% year-to-date, giving it a market cap of around $7.8 billion. Just below APLD, Cipher Mining closed at $16.21 on Friday, marking a 6.99% gain on the day.

IREN YTD statistics as of December 20, 2025.

This increase hasn't completely erased the recent impact, with the stock still down 4.92% over the past five sessions. Still, CIFR has a lot to be proud of over the long term, with its stock price up 249.35% year-to-date and its market cap hovering around $6.4 billion. Riot Platforms closed Friday's trading up 8.37% at $14.50. However, in 5 days, the stock price fell by 5.22%. On a year-to-date basis, RIOT still leads by 42.01%, with a valuation hovering around $5.39 Billion.

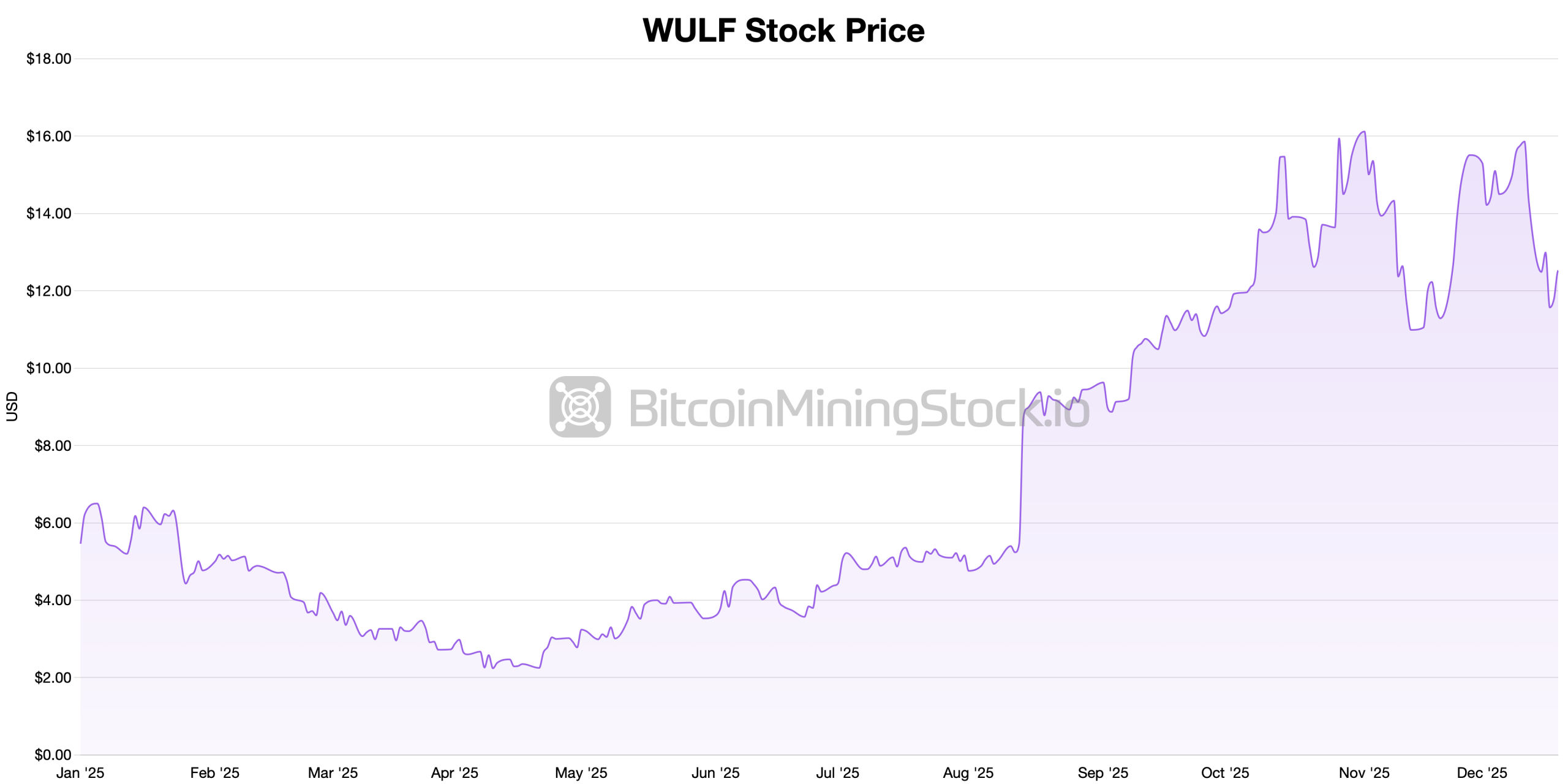

WULF YTD statistics as of December 20, 2025.

TerraWolf Inc. closed the week at $12.52, up 6.19% on Friday. Short-term trading has been tough, with the stock price down 12.63% over the past five days. Even after this decline, WULF is still up 121.20% year-to-date, with a market capitalization of approximately $4.89 billion as we approach the last week of December.

Also read: Bitcoin futures and options positioning signals a cautious reset ahead

Rounding out the top 10, Core Scientific ended the week at $15.60, up 7.14% on the day, increasing its year-to-date gain to 11.03% and giving it a market cap of approximately $4.84 billion. Hut 8 Corp. surged 14.33% to close at $44.12, giving it a year-to-date return of 115.32% and valuing the miner at approximately $4.77 billion.

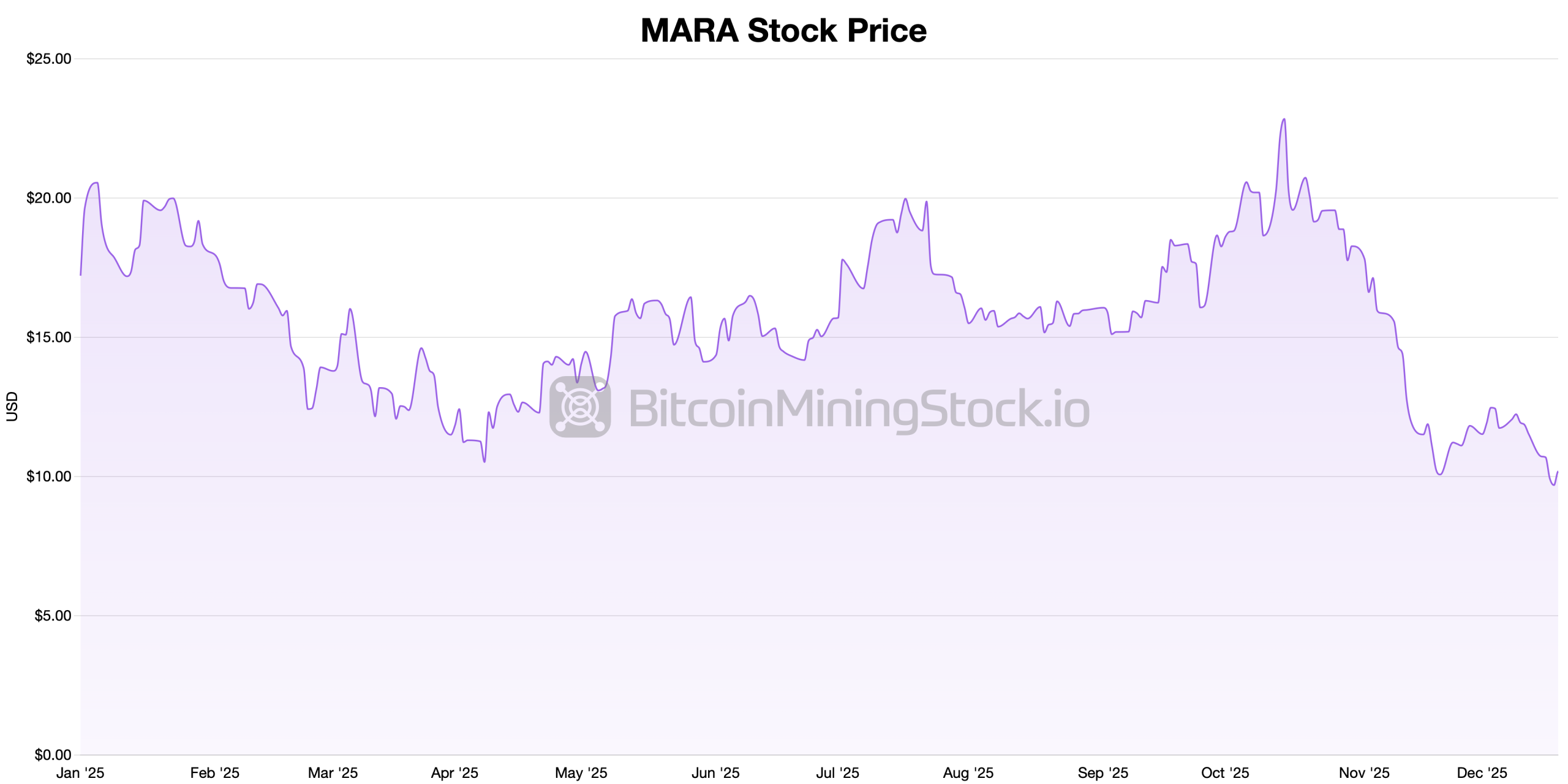

MARA year-to-date statistics as of December 20, 2025.

MARA Holdings rose 5.05% on the day to close at $10.18, but was still down 39.29% since January 1st, giving it a market cap of nearly $3.85 billion. Cleanspark Inc. rose 7.41% to end the year at $12.03, up 30.61% year-to-date. Meanwhile, Bitdeer Technologies Group closed at $11.01, up 9.99% for the day but down 49.19% for the year, giving it a market valuation of approximately $2.3 billion.

Friday's across-the-board rally ended the year neatly for publicly traded Bitcoin miners, and despite some short-term stumbles, most companies enter the final days of 2025 on solid footing. The contrast between volatile weekly trading and eye-catching year-to-date results shows that investors continue to focus on scale, execution, and balance sheet discipline as the calendar turns, even if not all miners make it to the finish line unscathed.

The final week of December is expected to remain constructive, but volatile, as investors keep their books on track and secure profits, while thin holiday trading will be exaggerated. As 2026 begins, attention will turn to balance sheets, expansion plans, and Bitcoin price trends, which should set the tone for which miners maintain momentum and which face a reset.

Frequently asked questions ⛏️

- Why did Bitcoin mining stocks rise on Friday?Most miners rose along with U.S. stock indexes as investors bid up stocks ahead of year-end positioning.

- Which Bitcoin Mining Stocks Led the Rise?Large miners such as IREN Limited, Applied Digital, and Hut 8 posted the strongest single-day gains.

- What should investors be watching for in the final week of December?If holiday liquidity is thin and settlement activity increases, overall price fluctuations in mining stocks may increase.

- What are the most important factors for Bitcoin miners heading into 2026?Balance sheets, expansion plans, and Bitcoin price trends are likely to determine performance early in the new year.