Despite a very strong start to the month, the historically bullish “Uptober” period did not go as expected for Bitcoin prices. After the market-wide decline on October 10th, this major cryptocurrency has not been able to clearly recover to its previous highs.

Indeed, Bitcoin price performance continues to struggle under sustained bearish pressure, dropping to a new low near $103,000 on Friday, October 18th. With uncertainty sweeping the market, investors are wondering if the bull market is over or if the downturn is just a small change.

According to recent outlooks, the current technical position of BTC price may provide insight into the next steps.

BTC at risk of further correction if loses $99,900 support

In an October 17th post on social media platform X, Glassnode proposed an interesting assessment of the current Bitcoin pricing. A prominent crypto analysis firm has revealed that the flagship cryptocurrency is currently located between two major support zones.

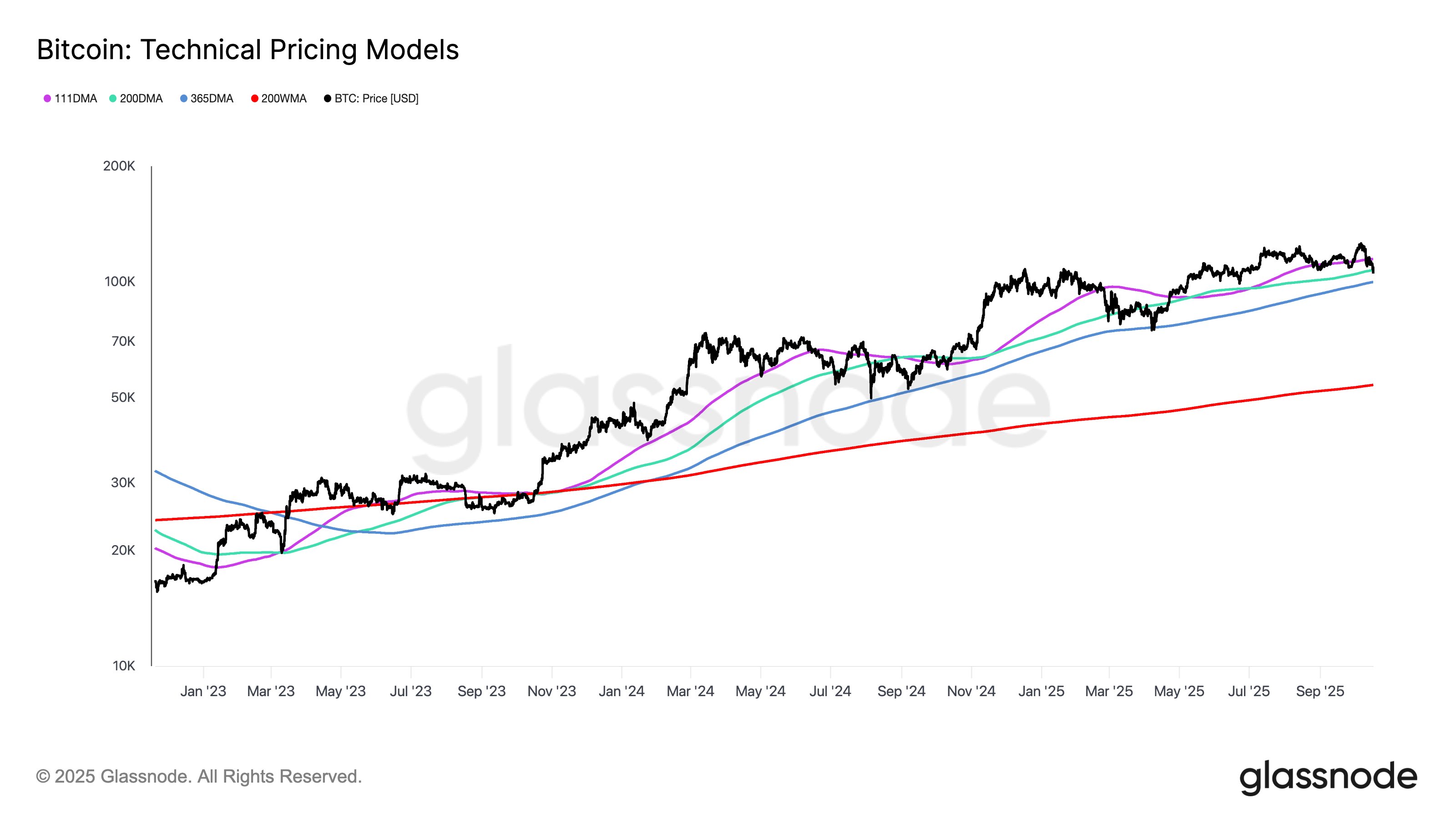

This analysis is based on the Glassnode technical price model, which is a chart that includes a number of technical indicators, including the Pi Cycle indicator, the Mayer Multiple, the annual moving average (MA), and the 200-week moving average.

According to Glassnode, Bitcoin price is currently wedged between the Mayer multiple ($107,400) and the annual MA ($99,900).

Source: @glassnode on X

The Mayer Multiple (200-day simple moving average) is a popular technical indicator often associated with transition points between bull and bear markets. The 365-day SMA, on the other hand, provides a long-standing baseline that indicates high timeframe market momentum.

Following the latest decline, Bitcoin price fell below its 200-day moving average, suggesting a possible transition from bullish to bearish market conditions. BTC is still above its 365-day moving average, but the best cryptocurrency needs to move above this level for the current trend to stabilize.

Ultimately, investors may want to keep an eye on BTC price, as a break below the $99,900 level could spell even bigger trouble for the world's largest cryptocurrency. It is worth noting that although there is price resistance near the 111-day moving average (currently $114,700), a return to levels above the Mayer multiple could be important for Bitcoin's development.

Bitcoin price overview

At the time of this writing, Bitcoin is worth approximately $106,427, reflecting a price decline of almost 2% over the past 24 hours.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

editing process for is focused on providing thoroughly researched, accurate, and unbiased content. We adhere to strict sourcing standards, and each page is carefully reviewed by our team of top technology experts and experienced editors. This process ensures the integrity, relevance, and value of your content to your readers.