Bitcoin is over $115,000 to recover from recent weaknesses. Crypto King is currently testing this level as support and is about to break out of the two-month downward trend.

Positive chain signals suggest seller fatigue. This could provide higher support for the next leg.

Bitcoin shows signs of a potential recovery

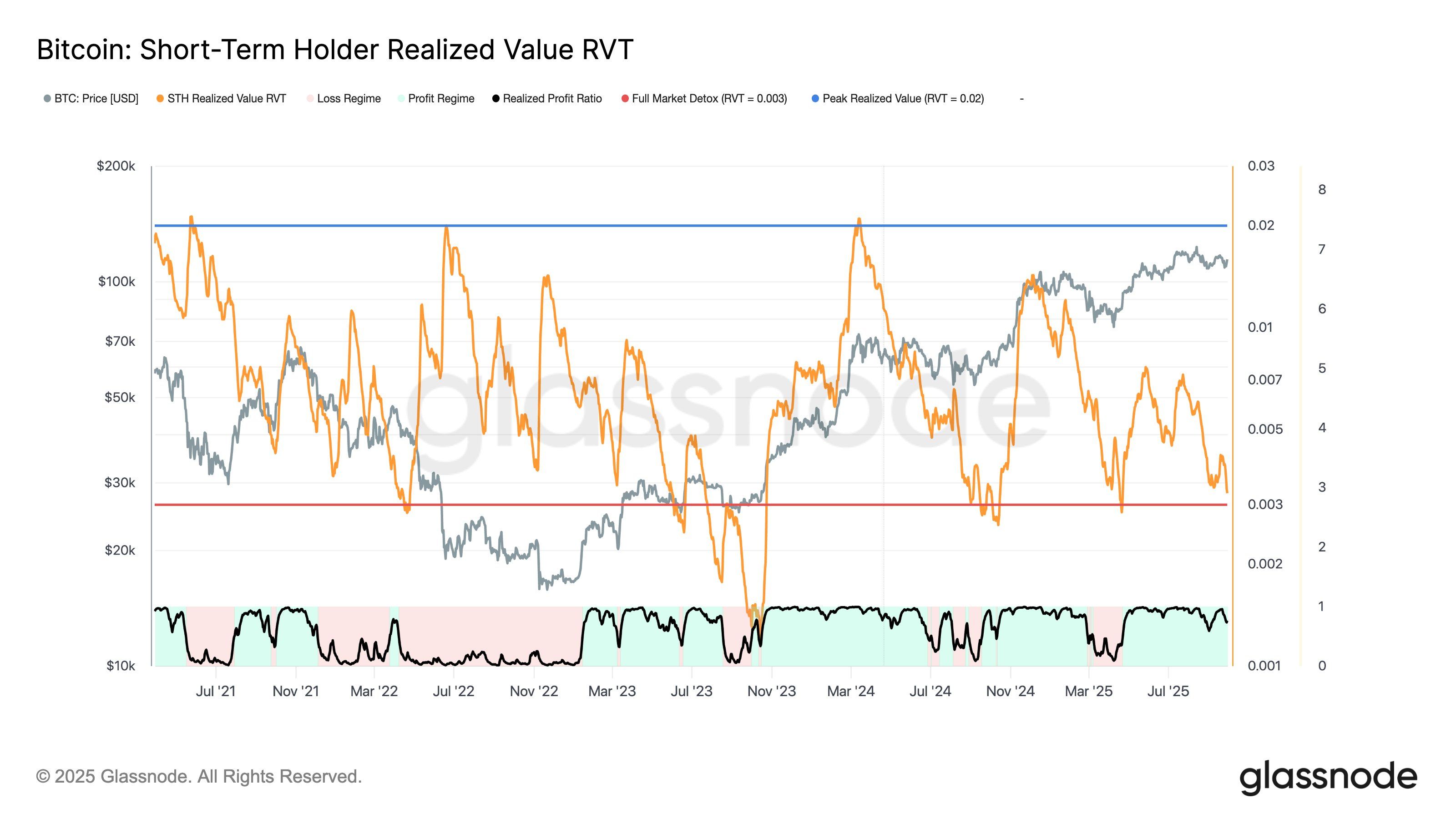

Short-term holders have achieved value from the transaction volume (STH RVT) ratio value. This shows that realised profits remained sluggish compared to Bitcoin's network valuation. Historically, these resets often occur during market detoxes, laying the foundation for healthier, longer-term price recovery.

This pattern suggests that investors' activities are cooled down and reduce the intensity of speculative trading. When realised profits fall, it often indicates that market participants are waiting for more favorable terms.

Want more token insights like this? Sign up for Editor Harsh Notariya's daily crypto newsletter.

Bitcoin Sth Rvt. Source: GlassNode

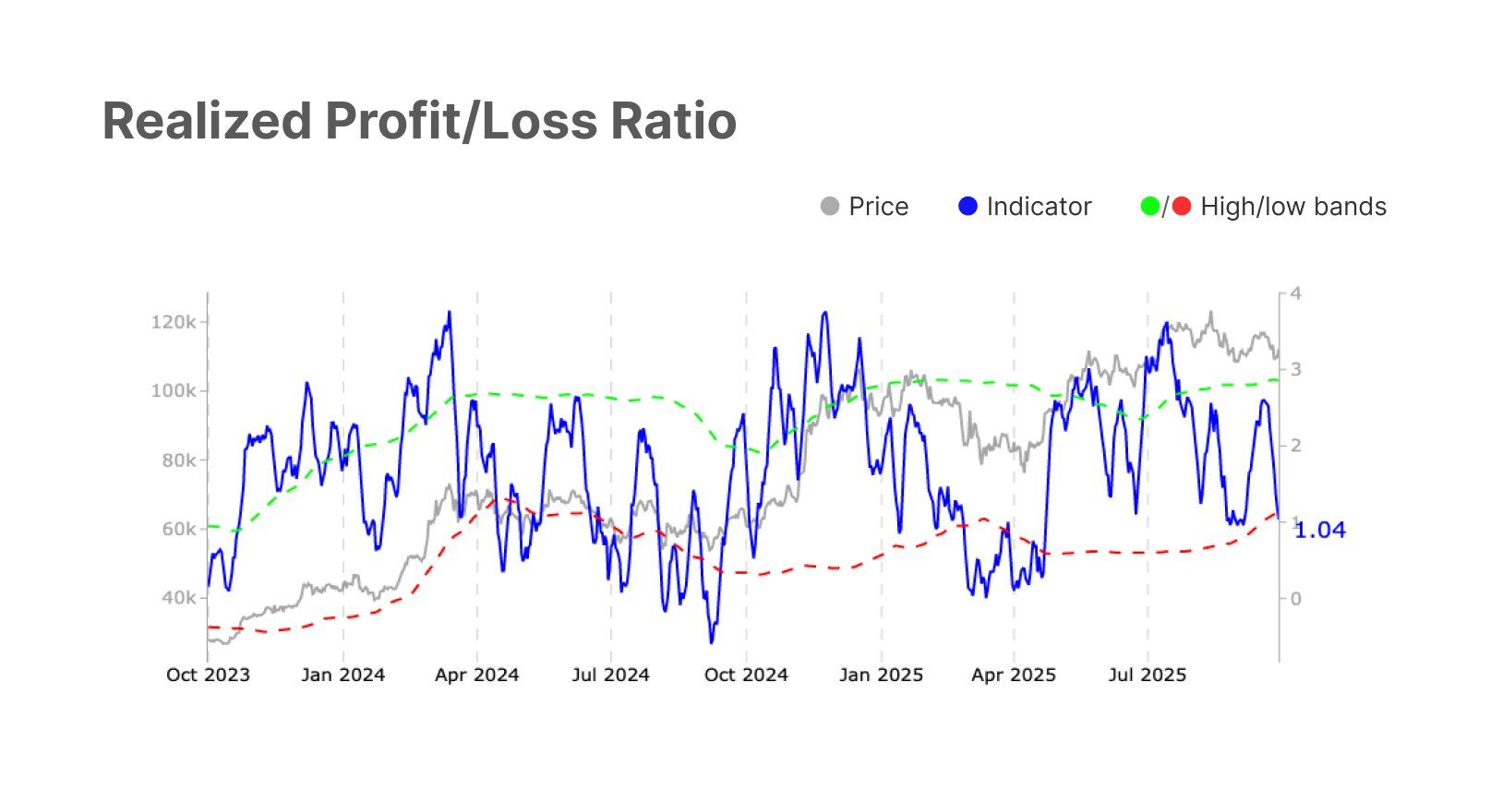

The macro signal is also tailored to this story. GlassNode data shows that the realized profit/loss ratio has dropped from 2.2 to 1.0, reaching a lower band. This adjustment supports RVT reset and illustrates the balance between realised profits and realised losses in Bitcoin's current trading environment.

Bitcoin appears to be in the neutral stage as it has gained profits and the losses are more evenly matched. Historically, such equilibrium suggests a seller fatigue as sales pressure declines and buyers begin to recover control.

Bitcoin achieved profit/loss rates. Source: GlassNode

BTC prices could break out soon

Bitcoin is trading at $115,151 and is about to hold a new support level of $115,000. It is essential to ensure this area as cryptocurrencies also function to break out of the two-month downtrend, which has been holding back the upward momentum since midsummer.

If conditions improve, Bitcoin can gather above $116,096 and approach $117,261. Violating this level will result in a door of $120,000. This will strengthen optimism among traders and institutions predicting further growth in the Crypto King's valuation.

Bitcoin price analysis. Source: TradingView

However, if you can't maintain your current level, your bullish outlook will be invalidated. Bitcoin could potentially extend the Bearran back to $112,500, or even $110,000. Such a move has weakened emotions and has updated the vulnerability of the world's largest cryptocurrency.

The bullish image of seller fatigue painting first appeared on Beincrypto, which led to the price of post-Bitcoin rising to $120,000.