Bitcoin has been experiencing extremely difficulties over the $85,000 mark this week, with its prices stagnating below this important resistance.

Bitcoin enthusiasts are increasingly frustrated as cryptocurrencies struggle to maintain their upward momentum. In addition to this price stagnation, there was a significant decline in open interest and ETF outflows, reflecting increasing market uncertainty.

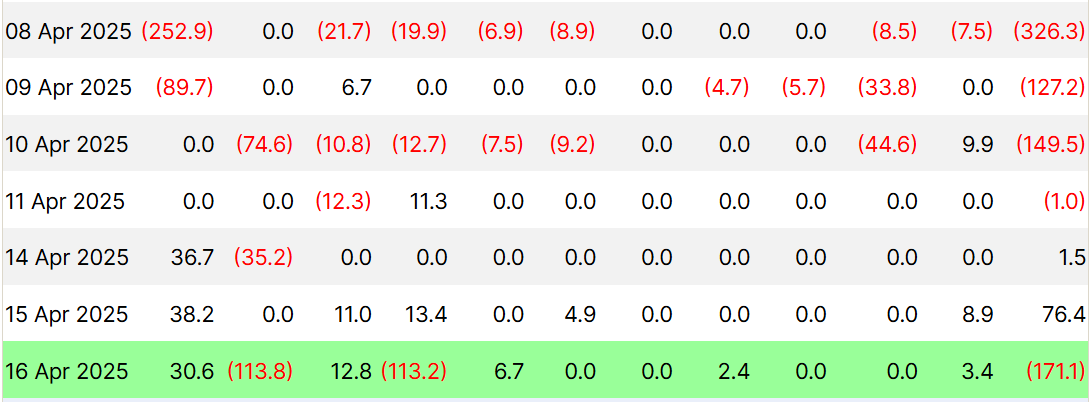

Bitcoin Spot ETF Flow is a concern

The Spot Bitcoin ETF recently recorded a $171.1 million spill on Wednesday, April 16 alone, with a weekly high of $171.1 million spill. This shift curbs investors' trust in Bitcoin as the market situation remains bearish. As more investors withdraw funds, it highlights a decline in confidence in Bitcoin's short-term outlook.

Bitcoin Spot ETF Flow. Source: Farside

The ongoing leak suggests that broader market sentiment is sour to Bitcoin. The fierce moves in funds away from the Bitcoin ETF show investors being cautious as Bitcoin failed to gain footing above $85,000. This lack of price growth has led to uncertainty and hesitation among traders.

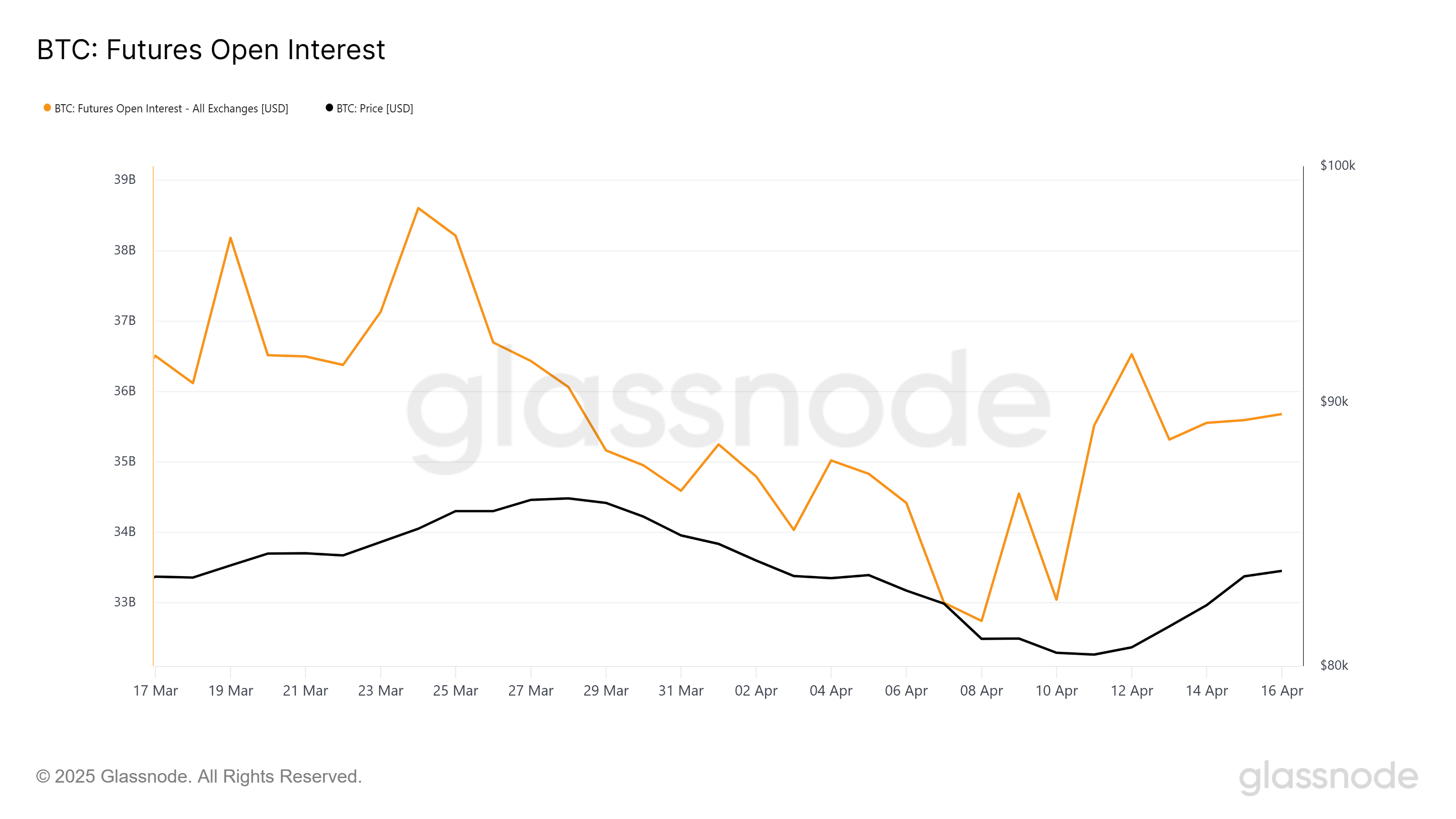

Open interest requires a push

Open interest in Bitcoin remains below $36 billion. This is an indication that traders are skeptical about the immediate future of Bitcoin. Despite early optimism this year, the lack of recovery and significant price movements continues to stagnate open interest.

Bitcoin open interest. Source: GlassNode

This flatness of open interest indicates that Bitcoin faces a period of indecisiveness in the market. Traders seem hesitant to bet aggressively in either direction given stagnant prices and wider market conditions. Without increasing open interest, Bitcoin may have a hard time breaking out of its current range.

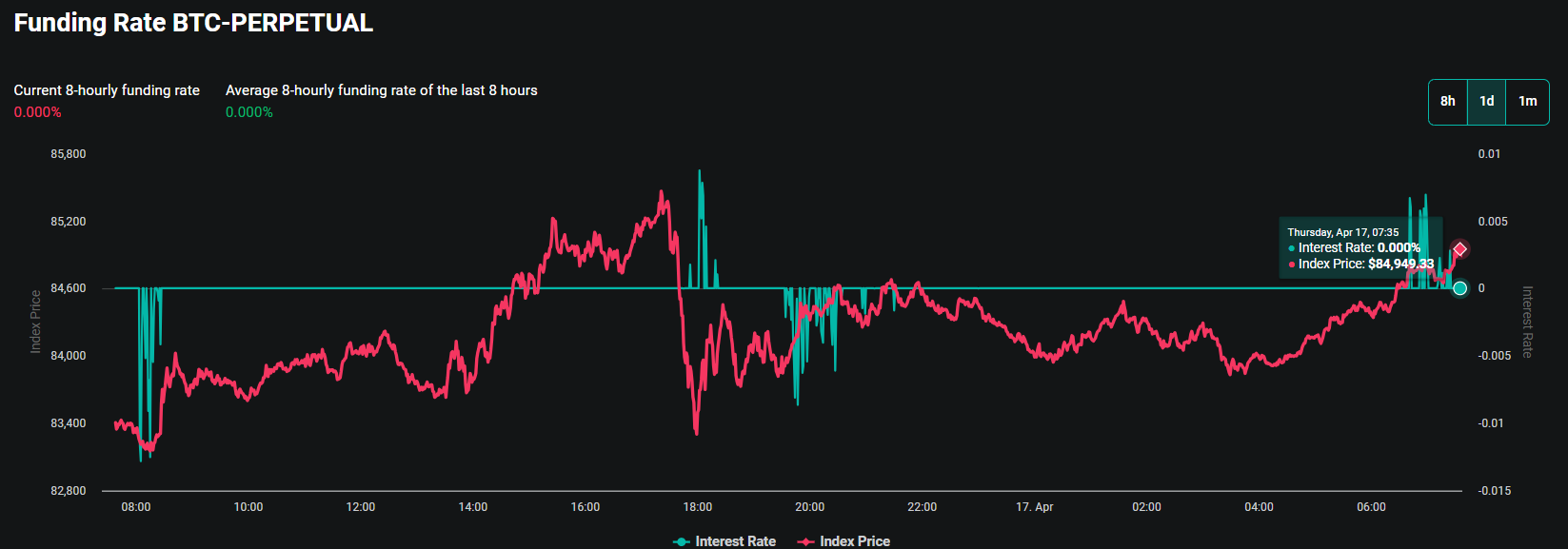

Funding rates will recover

Despite skepticism, Bitcoin's funding rate has been changing recently. After being negative for a while, it has become positive over the past few hours, reflecting a slight increase in market optimism.

Bitcoin funding rate. Source: Deribit

The positive funding rate shows a new optimism, but it is still too early to determine whether this sentiment will continue to raise price action. A sustained positive funding rate could suggest that Bitcoin could see more significant rebounds if broader market conditions improve.

Phone number. Put

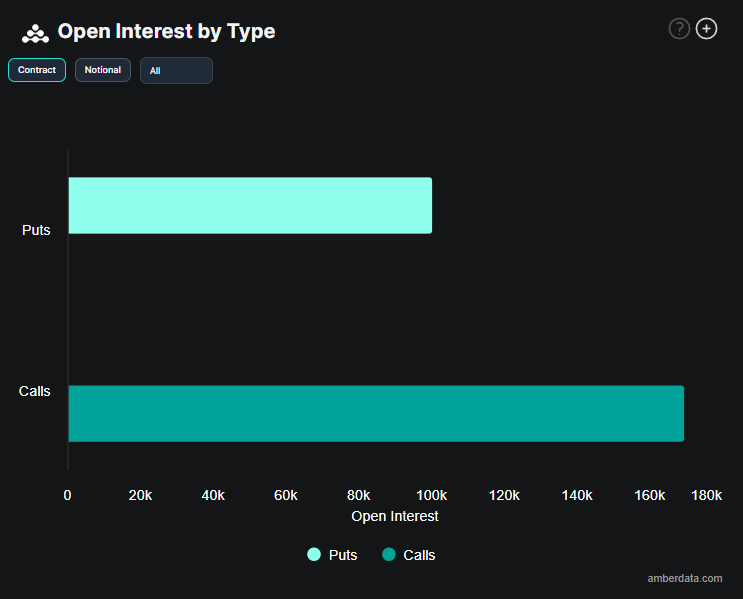

Open interest data further supports this optimistic change as call options currently dominate the market, with over 169,760 call contracts in place.

Open interest for each BTC option type. Source: Deribit

Call's advantage over Puts suggests that market participants expect bullish moves. This is despite the recent advances in Bitcoin prices. Whether this optimism is realized will depend on broader market trends and Bitcoin's ability to surpass the $85,000 barrier.